Wall Street enters the week riding fresh record highs, with big bank earnings and key inflation data set to dominate investor attention. Together, they will shape expectations for what the Federal Reserve does next and whether the market’s strong start to the year can hold.

Markets start 2026 on a solid footing

US stocks closed last week higher, led by technology shares, capping the first full trading week of the year with gains across all major indexes.

Both the Dow Jones Industrial Average and the S&P 500 finished Friday at record highs. For the week, the Dow gained more than 2%, the Nasdaq Composite rose just under 2%, and the S&P 500 added about 1.6%.

Energy markets were also active. Oil prices climbed as investors digested geopolitical developments following the US military’s capture of Venezuela’s president Nicolás Maduro and the Trump administration’s seizure of the country’s oil industry.

Brent crude rose more than 3.7% on the week, while US benchmark West Texas Intermediate gained roughly 2.6%.

Inflation data could shape Fed expectations

The macro focus now turns to inflation.

Consumer price data is due Tuesday, followed by producer prices and retail sales on Wednesday. Traders are watching closely for any signal that could influence the Fed’s policy decision later this month.

Markets are currently pricing in roughly a 95% chance that the Fed keeps interest rates unchanged. Any upside surprise in inflation could push expectations for the next rate cut further into the future.

Banks take the earnings spotlight

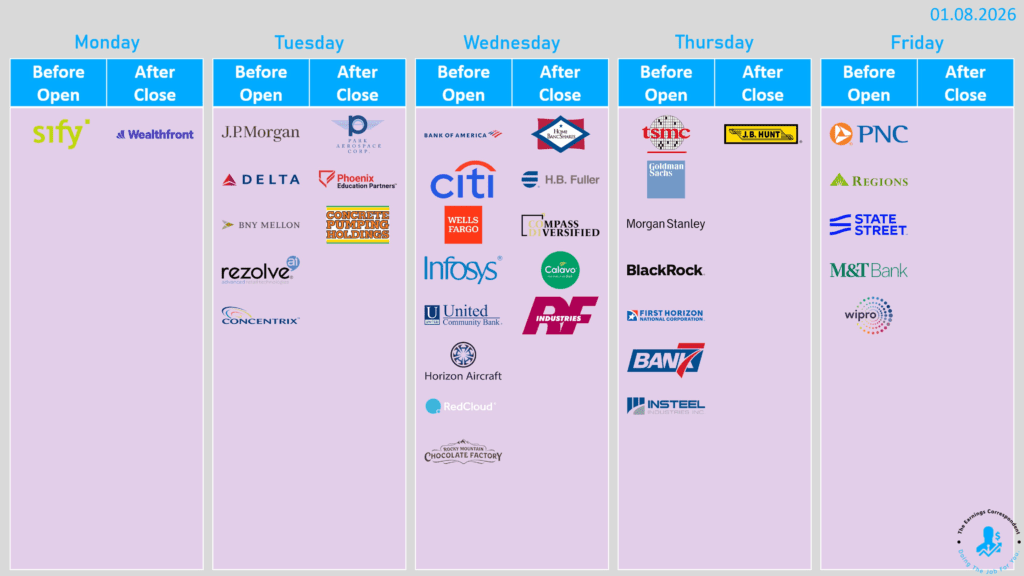

Earnings season officially begins this week, led by the country’s largest banks.

JPMorgan Chase and BNY Mellon report Tuesday. On Wednesday, results follow from Bank of America, Wells Fargo, and Citigroup.

Later in the week, investors will hear from Goldman Sachs and Morgan Stanley, alongside semiconductor heavyweight Taiwan Semiconductor Manufacturing Company.

Expectations are high. According to FactSet data, S&P 500 companies are forecast to post 8.3% earnings growth for the fourth quarter, marking the tenth consecutive quarter of year-on-year profit growth.

A labor market that is cooling, not cracking

Last week’s December jobs report completed the US labor market picture for 2025 and revealed a notable slowdown.

The economy added just 584,000 jobs last year, the weakest annual gain outside a recession since 2003. Still, economists stressed that conditions are cooling rather than collapsing.

The unemployment rate stood at 4.4% in December, its lowest level in four months. However, cracks are visible beneath the surface.

Unemployment among workers aged 16 to 24 rose to 10.4%, up from 9% a year earlier. Long-term unemployment is also climbing, with nearly 2 million people now out of work for more than 27 weeks.

Some analysts describe the labor market as frozen, with low hiring and low firing limiting opportunities for new entrants and career switchers.

What investors are really watching

Beyond individual data points, investors are trying to answer two big questions.

First, will inflation continue cooling enough to allow the Fed to cut rates later this year? Second, can corporate earnings keep growing fast enough to justify already elevated stock valuations?

Wall Street strategists remain broadly bullish for 2026, betting that expanding profit margins will turn modest revenue growth into strong earnings gains. Whether valuations can stay stretched is a debate that will play out day by day.

This week’s mix of inflation data, bank earnings, and macro signals may not settle that debate. But it will set the tone for markets as earnings season gets underway and the Fed’s next move comes into sharper focus.

| Day | Economic Data | Earnings |

|---|---|---|

| Monday | No notable economic data | Wealthfront (WLTH) |

| Tuesday | CPI MoM Dec +0.3% exp • Core CPI MoM +0.3% exp • CPI YoY +2.7% exp (2.7% prev) • Core CPI YoY +2.7% exp (2.6% prev) • Real avg hourly earnings YoY +0.8% prev • New home sales Oct 714k exp | JPMorgan Chase (JPM) • BNY Mellon (BK) • Delta Air Lines (DAL) • Concentrix (CNXC) • Phoenix Education Partners (PXED) |

| Wednesday | MBA mortgage apps w/e Jan 9 +0.3% prev • Retail sales MoM Nov +0.4% exp (0.0% prev) • Retail sales ex auto & gas +0.3% exp (+0.5% prev) • PPI MoM Nov +0.3% exp • Core PPI MoM +0.2% exp • Existing home sales Dec 4.23M exp (4.13M prev) • Business inventories Oct +0.2% prev | Bank of America (BAC) • Wells Fargo (WFC) • Citigroup (C) • Infosys (INFY) • Bitmine Immersion Technologies (BMNR) • Home Bancshares (HOMB) • Platinum Group Metals (PLG) |

| Thursday | Initial jobless claims w/e Jan 10 208k prev • Continuing claims w/e Jan 3 1.91M prev • Import prices MoM Nov -0.2% exp • Empire State mfg Jan 1 exp (-3.9 prev) • Philly Fed outlook Jan -2.9 exp (-10.2 prev) | Taiwan Semiconductor Manufacturing Company (TSM) • Goldman Sachs (GS) • Morgan Stanley (MS) • BlackRock (BLK) • JB Hunt Transport Services (JBHT) • First Horizon Corporation (FHN) |

| Friday | NY Fed Services Activity Jan -20.0 prev • Industrial production MoM Dec +0.2% exp (+0.2% prev) • Manufacturing production Dec 0.0% prev • NAHB Housing Index Jan 39 prev | PNC Financial (PNC) • State Street (STT) • M&T Bank (MTB) • Wipro (WIT) • Regions Financial (RF) • BOK Financial (BOKF) |

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Best European Stocks for Q1 2026: Our Top Picks by Sector