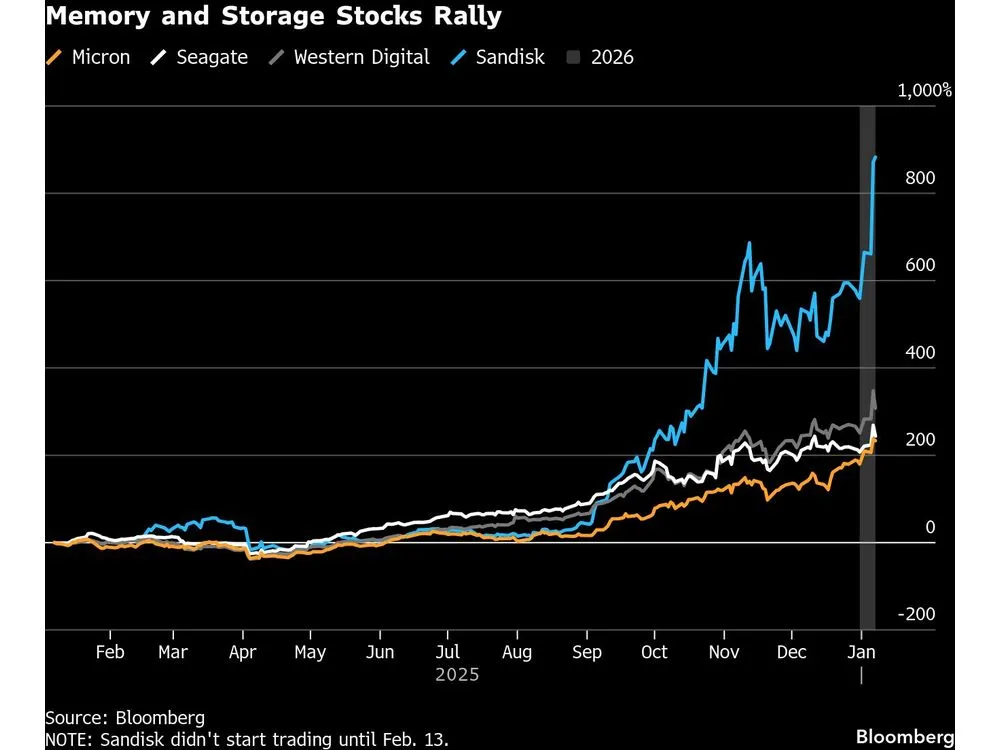

The stock market’s best-performing theme of 2025 is still running in early 2026: memory and storage names, lifted by the AI infrastructure spending boom, are again sitting near the top of the leaderboard.

What’s driving it: Investors have been chasing the “pick-and-shovel” layer of AI: rising demand for memory and storage components as data-center buildouts expand.

The rally has spread into parts of tech that are usually seen as more cyclical and less flashy.

The moves (all the key numbers)

- SanDisk jumped 16% on the first trading day of 2026, then surged 28% on Tuesday after Nvidia CEO Jensen Huang highlighted growing memory and storage needs in the AI ecosystem.

- The stock rose 1.1% on Wednesday and is up 49% so far in 2026.

- Early Thursday, SanDisk was down 1.4%, while Seagate fell 2.1%, Western Digital dropped 2.6%, and Micron slipped 1.0%.

- In 2025, SanDisk soared 559% to lead the S&P 500, with Western Digital, Micron, and Seagate also among the index’s top gainers.

A separate market write-up in late 2025 also highlighted SanDisk as the S&P 500’s top performer, putting the annual gain at roughly the high-500% range.

Why some investors are getting nervous

Marquette Associates strategist Jessica Noviskis warned that forecasting these companies is tough while a “transformation technology” is evolving quickly, and that some retail buyers may be “desperate” not to miss the rally.

Peter Andersen of Andersen Capital Management said the strength fits the AI data-center narrative, but he worries demand is being projected too far forward, with the usual risks of over-capacity and pricing pressure.

Technical caution signals are flashing: the 14-day RSI for SanDisk and Micron is above 70, a level many traders interpret as overbought.

Valuations look cheaper than Big Tech, but that is not the whole story

- Micron trades at about 10x estimated earnings.

- SanDisk is around 20x.

- Seagate and Western Digital are below 25x (around where the Nasdaq 100 sits), while the Bloomberg “Magnificent Seven” basket is closer to 29x.

- The concern is not just valuation, but whether AI capex momentum stays strong.

What could keep the rally going

Bulls argue the spending is still real: big AI buyers like Microsoft, Amazon, Alphabet, and Meta have reiterated aggressive capex plans in recent results.

Bank of America analyst Wamsi Mohan said expanding multimodal AI should create far more data, boosting demand for low-cost storage (helping Seagate and Western Digital), while more storage needs on edge devices plus faster access requirements can lift NAND demand (helping SanDisk).

The key risk from here: If the market decides AI infrastructure is being overbuilt, one clear sign could flip sentiment fast: any major AI spender signaling they are slowing investment. Andersen’s view was blunt: if that happens, it could “open the floodgates” for selling.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: How Big Tech Created the 2025 AI Boom on Debt

Stocks Split as Jobs Data and Trump’s Venezuela Oil Deal Take Spotlight