European stocks are entering Q1 2026 in a calmer but more demanding environment. The easy gains from falling inflation and post-crisis rebounds are largely behind us. Valuations across the region are now close to fair value, which means stock selection matters more than ever.

This is not a market built for chasing momentum. Instead, it favors quality businesses, stable cash flows, and realistic growth expectations.

Big Picture: Why Europe Still Matters in Early 2026

European equities are supported by several structural factors, according to Morningstar:

- Slower but steady economic growth

- Gradual interest rate cuts, not aggressive easing

- More clarity on trade policy after a volatile 2025

- Improving corporate balance sheets

At the same time, risks remain. Inflation has not fully disappeared, consumer demand is uneven, and geopolitical headlines still influence sentiment. This creates a market where some sectors look expensive, while others are quietly becoming attractive again.

Where Value Is Starting to Reappear

Communications Services: From Avoided to Attractive

Telecom stocks were deeply out of favor for much of the past two years. Heavy investment needs, regulation, and low growth kept investors away. Now, the setup looks different.

What has changed:

- Valuations are low compared with history

- Cash flows are stabilizing

- Consolidation talks are resurfacing in several countries

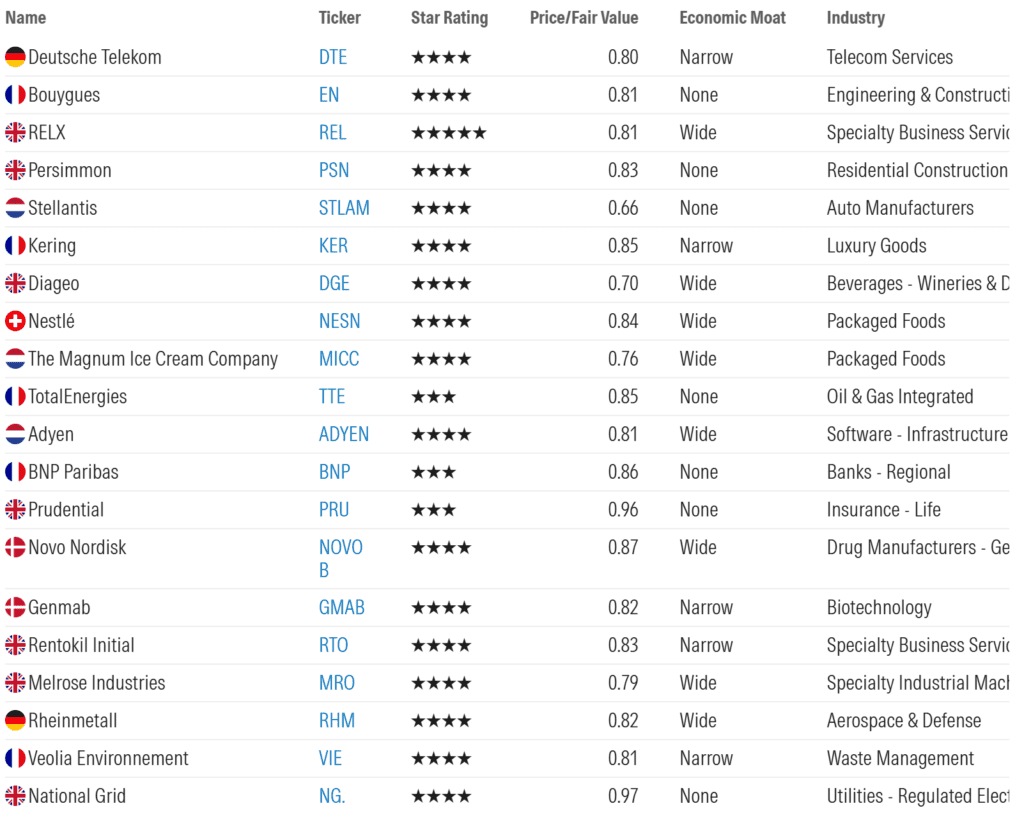

Companies like Deutsche Telekom benefit from US exposure and operational improvements, while Bouygues offers a mix of telecom stability and infrastructure upside.

This is not a fast-growth trade, but it is a re-rating opportunity if sentiment improves.

Technology: Focus on Software, Not Services

European tech is often misunderstood as one group. In reality, there is a clear split:

- IT services remain pressured by weak European corporate spending

- Software and data businesses are more resilient

Software companies benefit from recurring revenue, pricing power, and AI-driven efficiency gains. RELX stands out as a steady compounder, benefiting from analytics, digital publishing, and data demand without relying on aggressive IT budgets.

Consumer Stocks: Recovery, but at a Slower Pace

Luxury and Autos: Much of the Good News Is Priced In

Luxury stocks rallied strongly late in 2025 as US demand improved and Chinese conditions stabilized. While fundamentals are better, valuations now reflect that optimism.

Key points:

- Demand recovery is real, but not explosive

- Investors broadly share the same positive view

- Upside is more limited than a year ago

This means luxury is no longer cheap. Selectivity matters.

Consumer Defensive: Quietly Getting Interesting

Food and beverage companies struggled last year as investors debated whether slowing demand was cyclical or structural. Long-term trends, however, remain intact.

Supportive factors include:

- Strong global brands

- Pricing power over time

- Growth in emerging markets

Companies like Nestlé and Diageo may not shine immediately, but they offer defensive stability and potential upside later in 2026.

Energy: Discipline Over Excitement

Oil markets are shifting from supply risk to oversupply concerns. Prices are expected to trend lower, which changes the investment case.

What works in this environment:

- Strong balance sheets

- Capital discipline

- Diversified energy exposure

TotalEnergies benefits from its integrated model, while SLB stands out due to offshore exposure, which is more stable than US shale activity.

Financials: Strong, but No Longer Cheap

European banks had an excellent 2025 as higher rates boosted earnings. That tailwind is fading.

Key takeaways:

- Profits remain solid

- Valuations are closer to fair value

- Growth will likely moderate

Banks like BNP Paribas offer diversified income streams, while payments leader Adyen remains attractive for long-term growth despite short-term noise.

Healthcare and Industrials: Long-Term Structural Winners

Healthcare continues to offer structural growth despite policy uncertainty. Obesity treatments, oncology, and biologics remain powerful themes.

- Novo Nordisk still trades below long-term potential

- Genmab offers pipeline-driven upside

In industrials, defense and business services stand out. Rising military spending and regulatory requirements support names like Rheinmetall and Rentokil Initial.

Utilities: Stability Over Growth

Utilities are no longer uniformly cheap. Some rallied too far on hopes of demand recovery.

More attractive are:

- Regulated networks

- Predictable cash flows

- Inflation-linked returns

National Grid and SSE fit this profile.

For Q1 2026

European stocks enter Q1 2026 on firmer ground, but the easy gains are behind us. Valuations are close to fair value, meaning returns will depend significantly on stock selection rather than broad market momentum. Sectors with stable cash flows, structural demand, and disciplined management, such as healthcare, selected industrials, communications, and parts of the energy sector, offer the most compelling opportunities. Meanwhile, areas that surged in 2025, like financials and luxury, now appear more fully priced. For investors, the message is simple: this is a market that rewards patience, quality, and realism rather than speed or speculation.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: European stocks retreat as early-2026 rally pauses on retail and tech weakness

European Stocks Slide as Fed Cut Hopes Fade and Tech Valuations Come Under Pressure

Why European Stocks Are Beating S&P 500 in 2025?