A budgeting app is a software application that helps you track your income, expenses, and savings. These apps can be used on your smartphone, tablet, or computer, and they offer a variety of features to help you manage your finances more effectively. It can be hard to decide which ones are the best budgeting apps 2024. But we are here to clarify the options you can choose from.

In this guide will help you navigate through the options and select the best budgeting apps 2024 to suit your financial goals.

Understanding Your Financial Needs

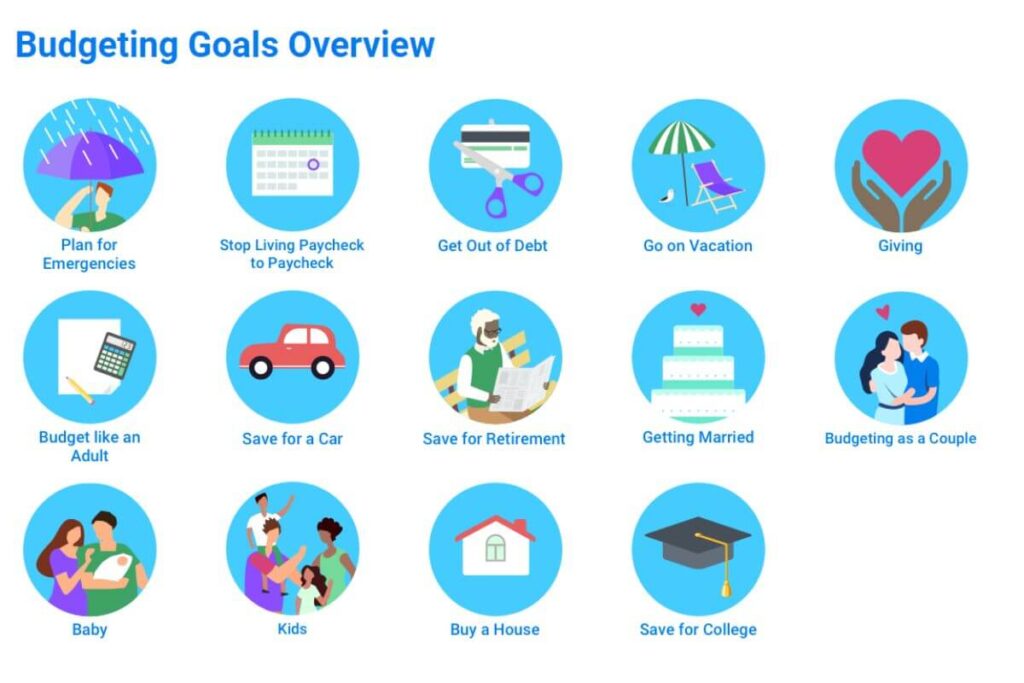

Before you dive in to the list of the best budgeting apps 2024, it’s essential to assess your financial situation.

Considering the following questions can help you to decide more accurately what option is the best to choose:

- What is your primary financial goal? Are you looking to save for a down payment, pay off debt, or simply track your spending?

- How comfortable are you with technology? Some apps offer complex features, while others prioritize simplicity.

- Do you prefer a hands-on or automated approach? Some apps require manual data entry, while others automatically sync with your bank accounts.

- Do you need to collaborate with a partner? Some apps offer features for joint accounts and budgeting.

List of Best Budgeting Apps 2024

Here’s a breakdown of some of the best budgeting apps 2024, along with their key features and target users:

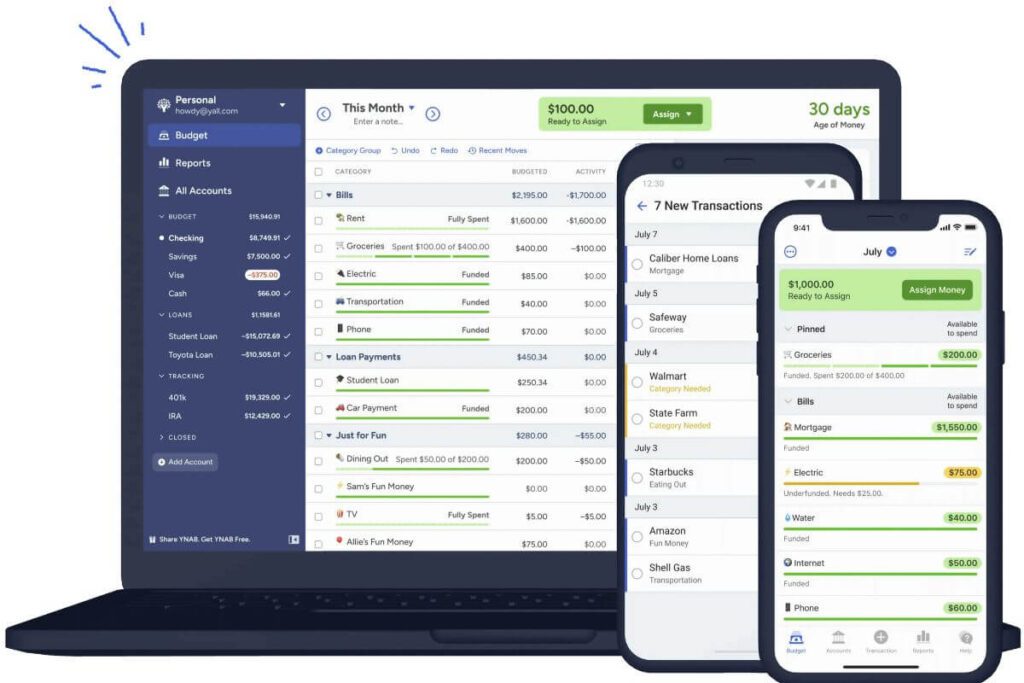

1. YNAB (You Need a Budget)

Overview: YNAB remains one of the most popular and best budgeting apps 2024, particularly for users who want to gain control over their finances through proactive budgeting. The app encourages users to “give every dollar a job,” which means assigning every income dollar to a specific category, be it rent, groceries, or savings.

Key Features:

- Proactive Budgeting: YNAB’s philosophy revolves around planning for future expenses rather than just tracking past spending.

- Goal Tracking: Users can set specific financial goals, and YNAB will help track progress towards them.

- Bank Syncing: Seamlessly sync your bank accounts to track transactions in real time.

- Reports and Insights: YNAB offers detailed reports that help you understand your spending patterns and identify areas for improvement.

Pros:

- Highly educational, and great for learning how to budget effectively.

- Encourages proactive financial planning.

- Excellent customer support and educational resources.

Cons:

- Paid subscription ($14.99/month or $98.99/year).

- Requires consistent user input to get the most out of the app.

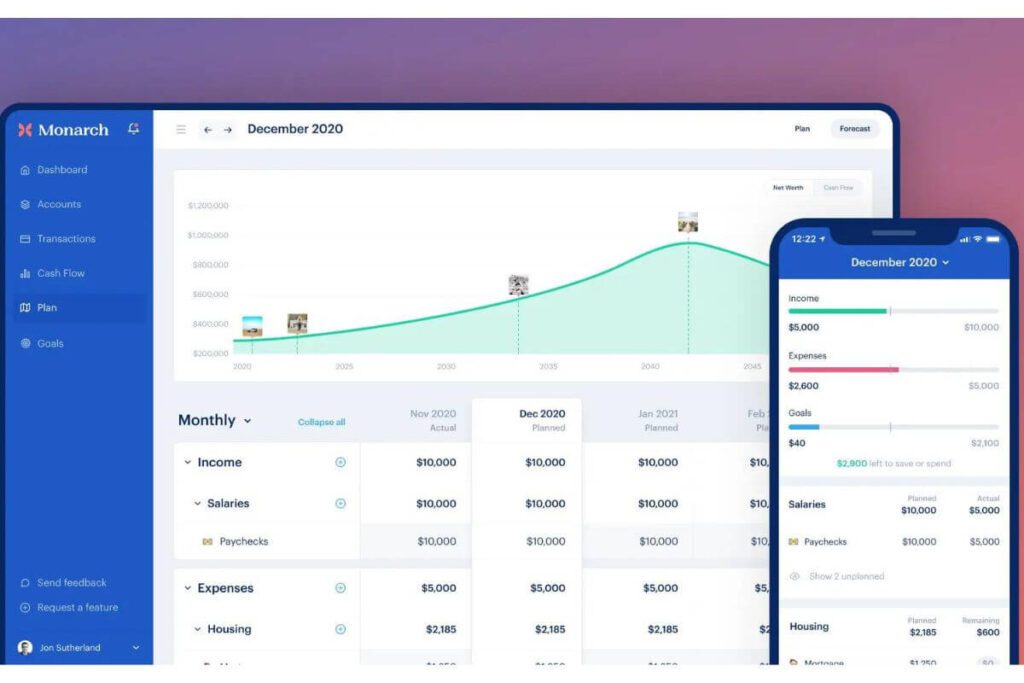

2. Monarch Money

Overview: Monarch Money is a premium financial management app that has gained significant popularity, earning high ratings on both Android and iOS platforms. It’s designed for users who want a robust and customizable tool for managing their finances. Monarch Money offers a suite of features that help users track spending, set financial goals, and collaborate with partners or financial advisors.

Key Features:

- Collaborative Financial Management: Share your financial data with a partner or collaborate with a financial advisor.

- Unlimited, Customizable Goals: Set and track an unlimited number of financial goals tailored to your specific needs.

- Automated Tracking: Sync your bank accounts, credit cards, and other financial data for seamless tracking of your finances.

Pros:

- High level of customization, allowing for personalized financial management.

- Strong collaboration tools for partners and advisors.

Cons:

- No free version is available, with costs starting at $14.99/month or $99.99/year after a 7-day trial.

- Lacks a bill payment feature and a bill-lowering tool, which is available in some other apps.

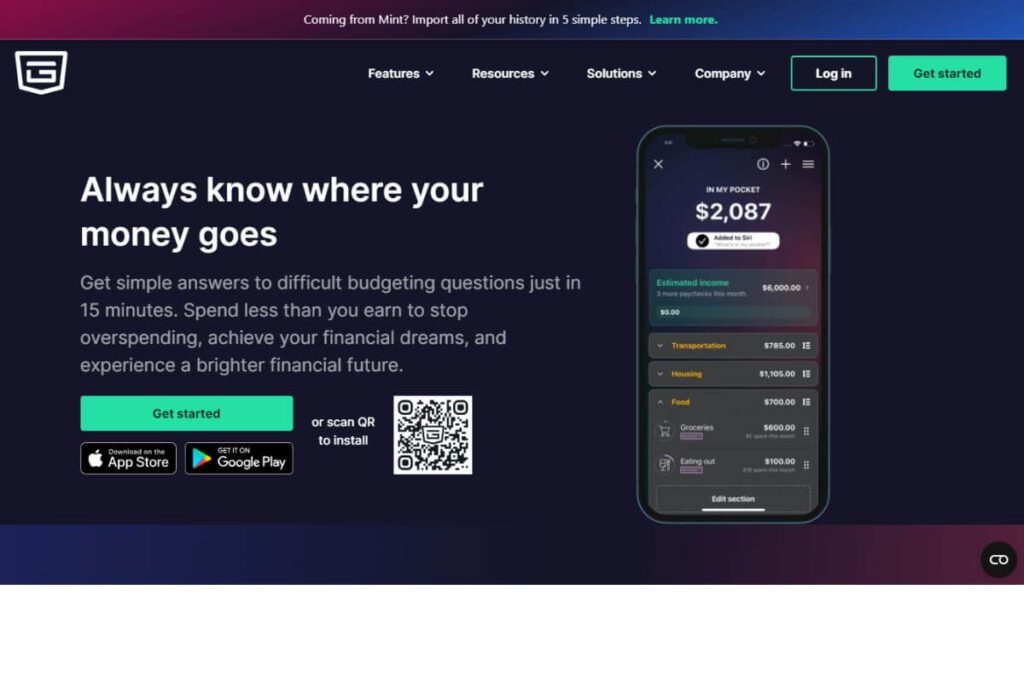

3. PocketGuard

Overview: PocketGuard is perfect for those who want a straightforward, no-nonsense approach to budgeting. The app’s main selling point is its simplicity—it focuses on helping you determine how much money you have left to spend after accounting for bills, savings, and essentials.

Key Features:

- In My Pocket: This feature shows how much disposable income you have after setting aside money for bills, goals, and necessities.

- Expense Tracking: Sync with your bank accounts to automatically track and categorize expenses.

- Bill Negotiation: PocketGuard can help you find better deals on your bills to save money.

- Spending Limits: Set limits on different spending categories to avoid overspending.

Pros:

- Simple, user-friendly interface.

- Great for those who want a quick snapshot of their disposable income.

- Useful bill negotiation feature.

Cons:

- Limited in-depth financial planning tools.

- The free version has fewer features compared to the paid version ($12.99/month or $74.99/year).

4. Goodbudget

Overview: Goodbudget is a digital version of the envelope budgeting system, where you allocate cash (in virtual envelopes) to different spending categories. It’s ideal for users who prefer a hands-on approach to managing their money.

Key Features:

- Envelope Budgeting: Allocate money into different envelopes for categories like groceries, entertainment, and savings.

- Debt Management: Track your debt payments and see progress over time.

- Cross-Platform Support: Sync your budget across multiple devices, making it easy to manage your finances from anywhere.

- Sharing: Share your budget with a partner or family members to manage household finances together.

Pros:

- Emphasizes conscious spending.

- Ideal for couples or families sharing a budget.

- Free version is available with basic features.

Cons:

- Manual input can be time-consuming.

- Limited bank account syncing options.

5. Empower Personal Dashboard

Overview: While primarily an investment tracking tool, Empower Personal Dashboard offers robust budgeting features that are perfect for those who want to manage both their daily expenses and investments in one place.

Key Features:

- Investment Tracking: Monitor your investment accounts and get advice on how to optimize your portfolio.

- Net Worth Calculator: Track your net worth by linking all your financial accounts, including assets and liabilities.

- Budgeting Tools: Set budgets, track spending, and manage cash flow easily.

- Retirement Planning: Use Personal Capital’s retirement planner to see if you’re on track to meet your retirement goals.

Pros:

- Comprehensive financial overview, including investments.

- Excellent for those with a focus on long-term financial planning.

- Free to use.

Cons:

- Less focus on day-to-day budgeting compared to other apps.

- Investment features may be overwhelming for beginners.

Choosing the Best Budgeting Apps 2024 for You

To select some of the best budgeting apps 2024, consider your financial goals, tech-savviness, and preferred budgeting method. Here are some additional tips:

- Try before you buy: Many apps offer free trials or basic plans.

- Sync your accounts: Ensure the app can connect to your bank accounts and credit cards.

- Set realistic goals: Start with achievable goals and gradually increase your savings or debt reduction efforts.

- Track your progress: Regularly review your budget to stay on track.

- Be patient: Building good financial habits takes time.

Additional Budgeting Tips You Should Consider

Even though using the best budgeting apps 2024 is a really good financial decision, you should still consider these tips for financial success:

- Create a realistic budget: Allocate funds for essential expenses, savings, and discretionary spending.

- Automate savings: Set up automatic transfers to savings accounts.

- Reduce debt: Prioritize high-interest debt and create a repayment plan.

- Build an emergency fund: Aim to save 3-6 months’ worth of living expenses.

- Invest for the future: Consider retirement savings and long-term goals.

Sources: