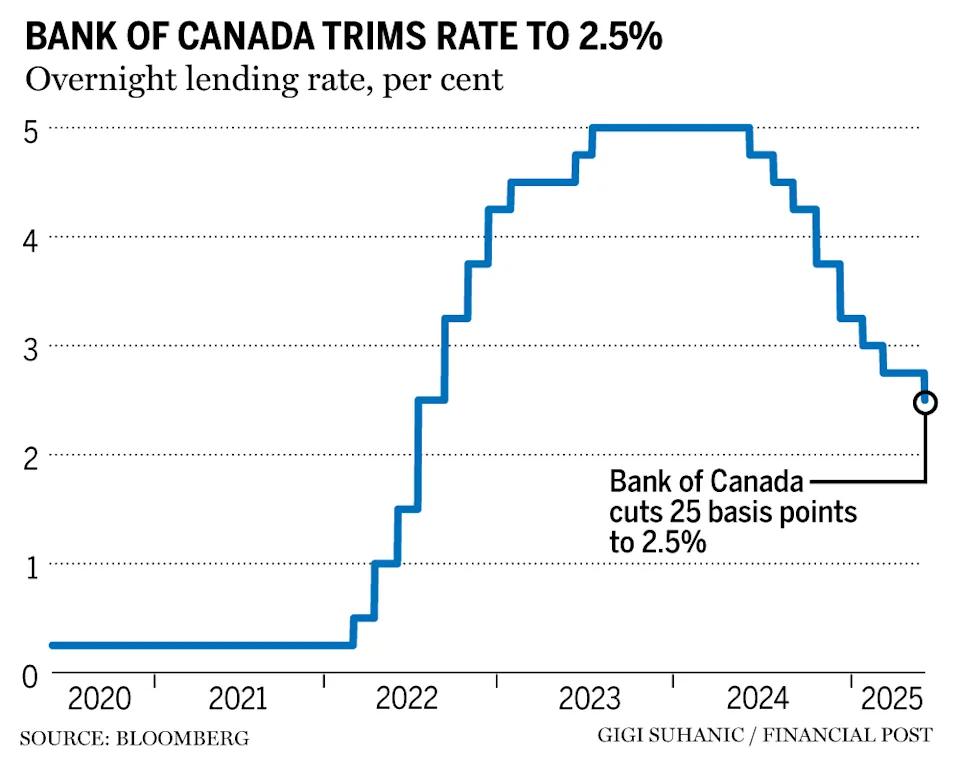

The Bank of Canada (BoC) announced a 25 basis point cut to its policy rate today, lowering it from 2.75% to 2.50%—its first reduction since March. The decision reflects a weaker domestic economy, declining job growth, and reduced inflation pressure, according to Governor Tiff Macklem.

Key Drivers of the Decision

The economy contracted in Q2, and the job market lost about 100,000 jobs in July and August. The unemployment rate rose to 7.1%.

Inflation in August stood at 1.9% year over year. Core inflation measures have been near 3%, but monthly upward momentum is easing.

Recent removal of retaliatory tariffs on U.S. goods has reduced upward risk to prices. Meanwhile, trade disputes, especially with the U.S. and China, continue to weigh on business investment and trade-sensitive sectors.

Tariffs have struck industries like auto, steel, aluminum, copper, softwood lumber, and also impacted canola exports.

Business investment is contracting, in part due to uncertainty over trade policy. Household spending shows some resilience, but labour market weakness and slow population growth are expected to weigh on demand going forward.

Central Bank’s Message & Forward Guidance

Governor Macklem said that while considerable uncertainty remains, the balance of risks—between inflation and economic activity—now favors easing. Policymakers reportedly reached clear consensus this time to deliver the cut.

However, the central bank declined to commit to a firm path beyond this move. Forward guidance was notably absent in the statement, as officials stressed they will remain data-dependent and monitor how inflation and trade pressures evolve.

What It Means for Canadian Economies & Consumers

Lower interest rates could help stimulate housing activity, particularly in high-price regions like Ontario and British Columbia, where mortgage costs remain a major barrier.

For households with variable-rate debt, monthly payments may drop modestly (estimates suggest around CAD $15 less per $100,000 borrowed). Fixed rates, however, are unlikely to fall significantly in the short term.

The timing of purchases, home closings, or major borrowing decisions may become strategic: many experts suggest waiting until after the BoC’s next rate decision in October for potential further cuts.

Market Reaction & Expectations

- Economists widely expected the cut, considering the recent labour data and disinflationary signs.

- Some analysts, including at CIBC, believe another 25 bps cut is probable at the October meeting. Others anticipate a full easing cycle through the rest of the year.

- Investors have reacted positively: rate-sensitive sectors like housing and consumer credit are beneficiaries, while banks and insurers may face pressure from narrower interest spreads.

Risks and Challenges Ahead

- There is still risk that trade disruptions—tariffs from abroad or retaliatory measures—could reintroduce inflation pressures.

- If global commodity prices rise or supply chain shocks return, they may force the BoC to shift back toward a more restrictive stance.

- The path forward depends heavily on how weak the labour market becomes, and whether inflation continues to ease steadily.

The BoC’s cut to 2.5% signals a shift in tone: policymakers believe Canada’s economy is soft enough and inflation risk low enough to warrant easing. But this is likely just the first of multiple potential rate cuts if labour market weakness persists and inflation continues to moderate. For consumers and markets, this decision offers relief, but one that comes with caution over what comes next.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Federal Reserve Explained: How It Shapes Stock Market and Economy