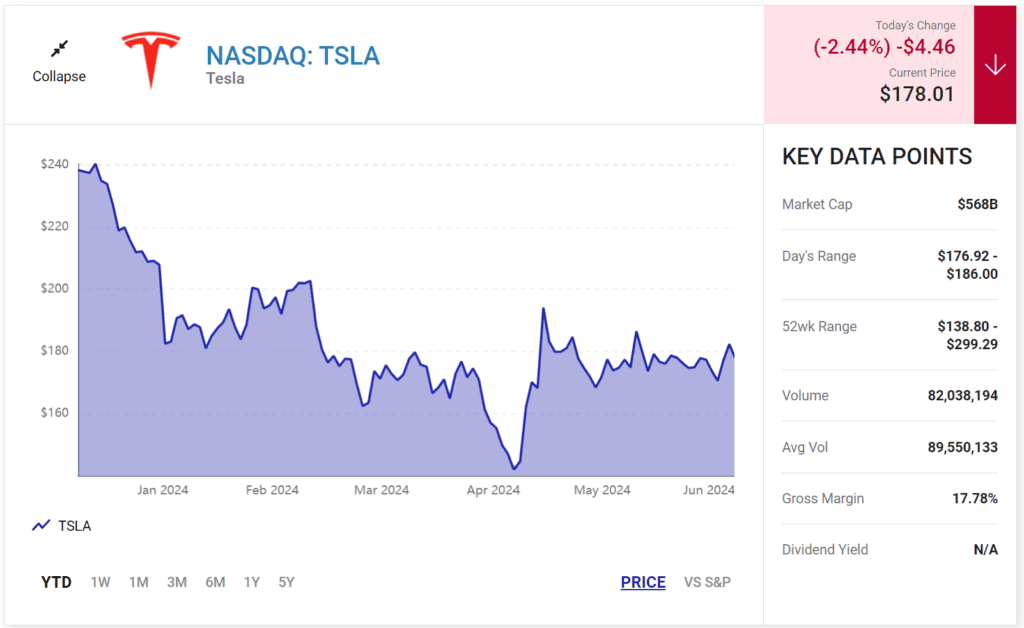

Ark Investment Management has updated its financial forecasts for Tesla, predicting the EV giant’s stock could reach $2,600 by 2029, a potential 1,366% increase from its current price. This ambitious target hinges on the success of Tesla’s full self-driving (FSD) software and the Cybercab (robotaxi) platform set to launch in August.

Key Points:

- Short-term Challenges: Tesla delivered 1.8 million EVs in 2023 but had to cut prices by 25.1% to boost demand. The company faces increased competition, particularly from lower-priced models in China, and analysts predict a slower growth rate for 2024.

- Ark’s Long-term Vision: Ark anticipates EV sales will constitute just 26% of Tesla’s revenue by 2029, with FSD technology becoming the primary revenue source. Tesla’s FSD has driven over 300 billion miles, proving significantly safer than human drivers.

- Potential Revenue Streams: Tesla could monetize FSD through subscriptions, licensing to other car manufacturers, and an autonomous ride-hailing network, with significant earnings from Cybercab deployments.

Despite these optimistic projections, Tesla’s current P/E ratio of 70.9 is more than twice the Nasdaq-100 technology index average, making its high valuation challenging to justify. Additionally, achieving Ark’s revenue forecast would require Tesla to grow by 64.8% annually from 2025 to 2029, a formidable task given current growth struggles.

Elon Musk’s View: While Musk believes Ark’s targets are achievable, he acknowledges the significant challenges ahead, including regulatory approval and consumer adoption of FSD and robotaxi technologies.

In summary, while Ark’s projection of $2,600 for Tesla stock by 2029 is ambitious, it hinges on flawless execution and widespread adoption of Tesla’s advanced technologies.