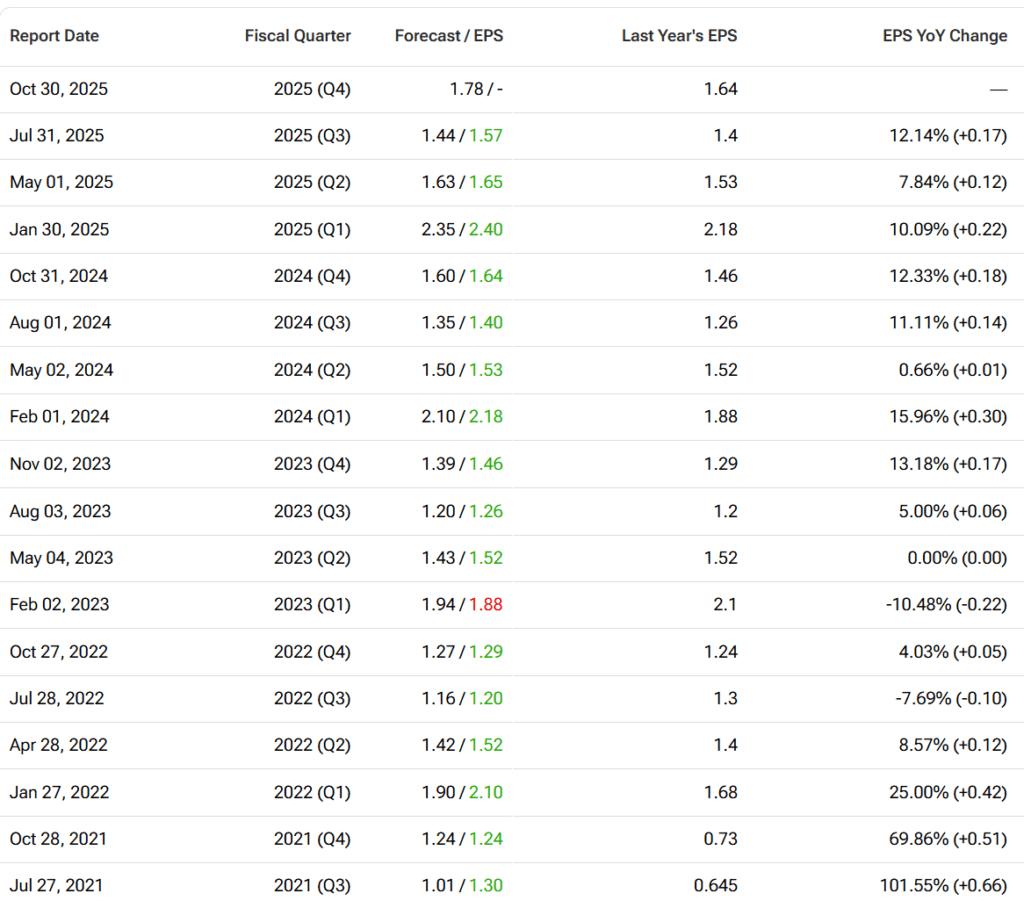

Apple (AAPL) reports fiscal Q4 2025 after the bell today (Oct 30), capping a pivotal launch quarter for the iPhone 17 and setting the tone for the holiday stretch. With Services on track to top $100B+ annually and China iPhone trends stabilizing, the bar is modest—but guidance and margin tone will steer the stock’s next move.

Street Forecast

Wall Street expects a solid print near the high end of Apple’s implied setup.

| Metric | Consensus Range | YoY Growth |

|---|---|---|

| Revenue | $101–$102.5B | ~+6–8% |

| EPS (diluted)** | $1.73–$1.79 | ~+5–8% |

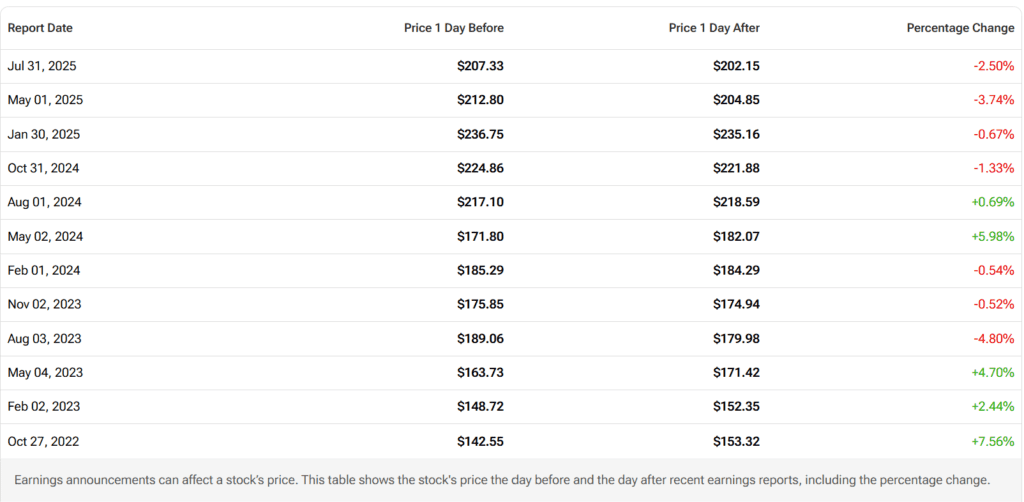

Analyst roundups (LSEG/FactSet/Zacks, major financial press) cluster around ~$102B revenue and ~$1.77 EPS. Options markets imply a ~3–4% post-earnings move. Key swing factors: iPhone sell-through, Services acceleration, gross-margin mix, and holiday guide.

Context: In Q3 (June), Apple posted $94.0B revenue (+10% YoY) and guided Q4 gross margin to 46–47%, above street—establishing a supportive margin base heading into today.

Prediction: Slight beat on EPS; guide/tone determines the stock reaction.

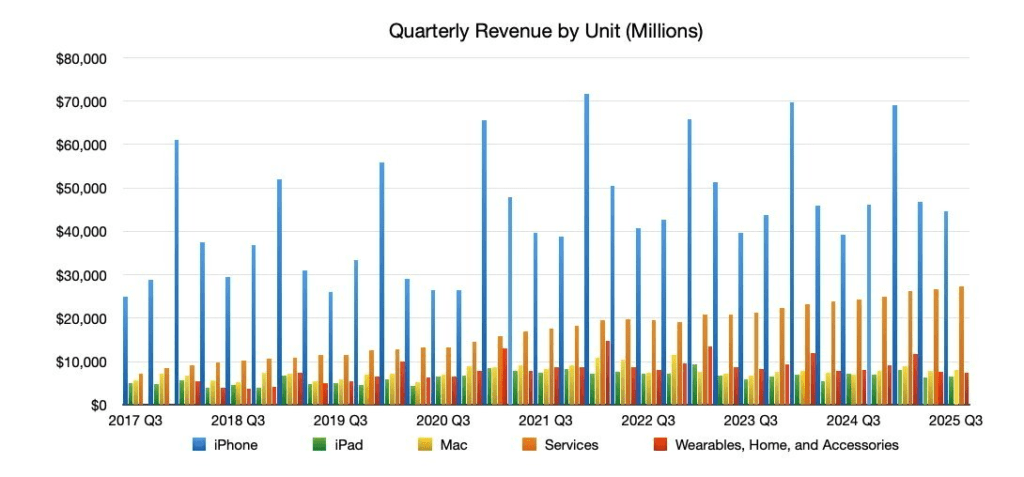

iPhone: Early 17 Series Strength, China Stabilization

- Launch traction: Early sell-through signals are constructive—Counterpoint tracked the iPhone 17 running ~+14% versus iPhone 16 in its first 10 days across China and the US, skewing to higher-end models (ASP tailwind)

- China pulse: Despite a soft market, Apple’s Q3 China shipments rose 0.6% YoY to 10.8M units (share 15.8%), one of the few top brands to grow. Value-oriented 17 base model helped. A firmer China underpins Q4 iPhone revenue.

Prediction: iPhone revenue up ~8–10% YoY with mix-driven margin help; watch any color on Pro/Pro Max supply and China demand into November.

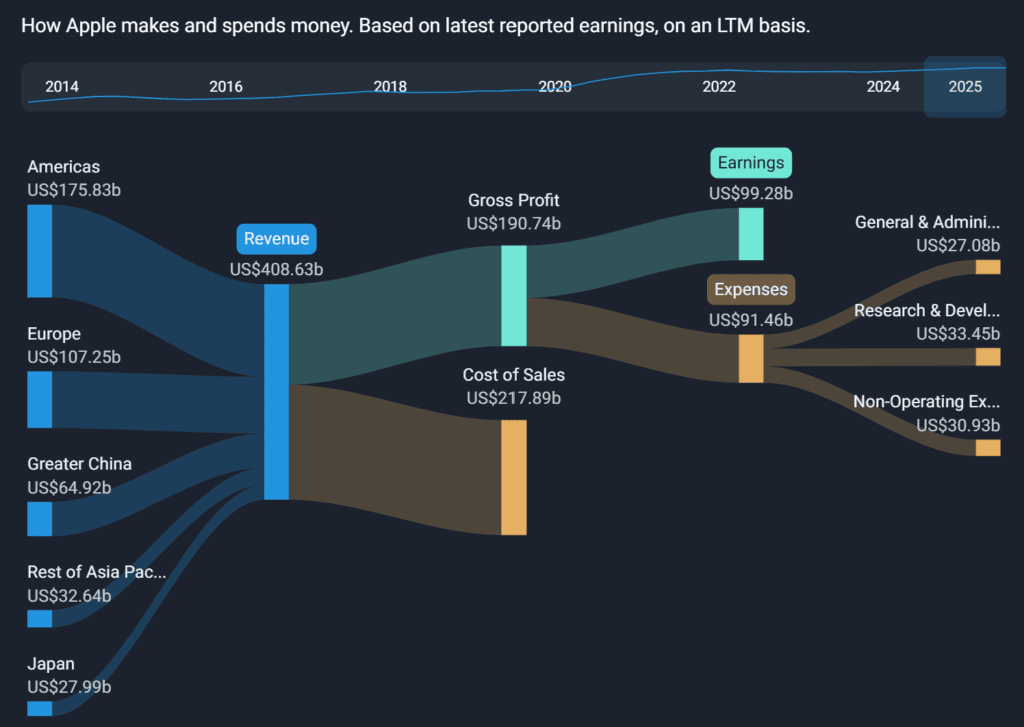

Services: Margin Anchor, Secular Upside

Services is set to clear $100B+ annual run rate (Visible Alpha est. ~$108.6B, +13% YoY), representing ~25% of sales and up to ~50% of profit given ~70–75% gross margins. For Q4, consensus implies low-teens growth.

Prediction: Beat/inline on Services with continued margin leverage; investors will parse any commentary on App Store, subscriptions churn, and search-licensing durability.

Mac & iPad: Mac Rebound, iPad Mixed

PC data points flagged a Mac recovery into the fall, while iPad remains cyclical with longer refresh intervals. Q3 prints: Mac up double-digits; iPad down mid-single to high-single digits—setting expectations for Q4 to be Mac up, iPad flat/down.

Prediction: Mac modestly +10% YoY; iPad flat to slightly negative.

Wearables, Home & Accessories: Incremental

Apple Watch refresh helps, but the bucket is expected flat to slightly down YoY this quarter; Vision Pro remains niche. Any upside likely comes from Watch mix rather than u

nit volume. (Street framing from previews.)

Prediction: Near inline; not a primary swing factor tonight.

Apple Intelligence & On-Device AI: Narrative > Numbers (for now)

Apple’s on-device AI push (Apple Intelligence) emphasizes privacy and edge performance; near-term financial impact is limited, but upgrade intent and ecosystem stickiness matter. The street wants timetable clarity (e.g., Siri revamp cadence) and evidence of AI-led device demand.

Prediction: No revenue breakout yet; constructive roadmap talk could aid multiple.

Margins, Capex & Mix: Holding the High Ground

Q3 gross margin 46.5% topped estimates; Q4 guide 46–47% implies stable mix benefits (Pro iPhones, Services) absorbing tariff/FX noise. Watch opex growth and any tariff commentary in the Q&A.

Prediction: GM near the top half of the 46–47% band; mix and Services offset costs.

Competitive Landscape: Premium Share Intact, China Duel

Samsung leads global units; in China’s premium tier Apple is effectively neck-and-neck with Huawei (both ~15–16% share), highlighting a competitive but stable setup into holidays.

Prediction: Competitive intensity persists, but no decisive share shock in Q4.

Macro & FX: Manageable Headwinds

Global smartphones improved modestly into Q4; FX and tariff lines remain watch-points, but not thesis-breaking tonight. Implied-move math (±~3–4%) signals the market expects execution > macro to drive the print.

Regulatory & Legal: Ever-Present Overhang, Services Still Scales

Services growth arrives alongside heightened legal scrutiny (App Store, UK/EU remedies). Near-term P&L hit appears limited, but investors watch for incremental disclosures on costs or concessions.

Revenue & Expenses Breakdown

Investor Sentiment: Cautiously Constructive

Coverage is broadly bullish; price targets cluster around the mid-$250s with upside scenarios toward $280–$300 if holiday guide is upbeat. Options imply ~3–4% move; skew leans positive but sensitive to guide tone.

Will Apple Clear a Low Bar—and Talk Up the Holiday?

Base case: Apple prints ~$102B / ~$1.77, iPhone +high-single digits, Services +low-teens, GM ~46–47%. If holiday color is confident and China stable, shares likely drift higher post-print. Risk: cautious guide (China, FX/tariffs, iPad/Wearables softness) triggers a sell-the-news reaction despite a headline beat.

Our thoughts: Slight beat on EPS, in-line to modest beat on revenue; guidance/tone the catalyst. If Apple threads the needle on China commentary and Services momentum, the stock reaction skews positive.

Disclosure: All predictions and insights shared in this article are based on a comprehensive review of publicly available analyst reports, media coverage, and market consensus. These views are for informational purposes only and do not constitute investment advice. Please conduct your own research or consult a licensed financial advisor before making any investment decisions.