Lisa Su says AMD’s AI chip business will grow 80% annually, powered by OpenAI deal, new racks, and “insatiable” demand.

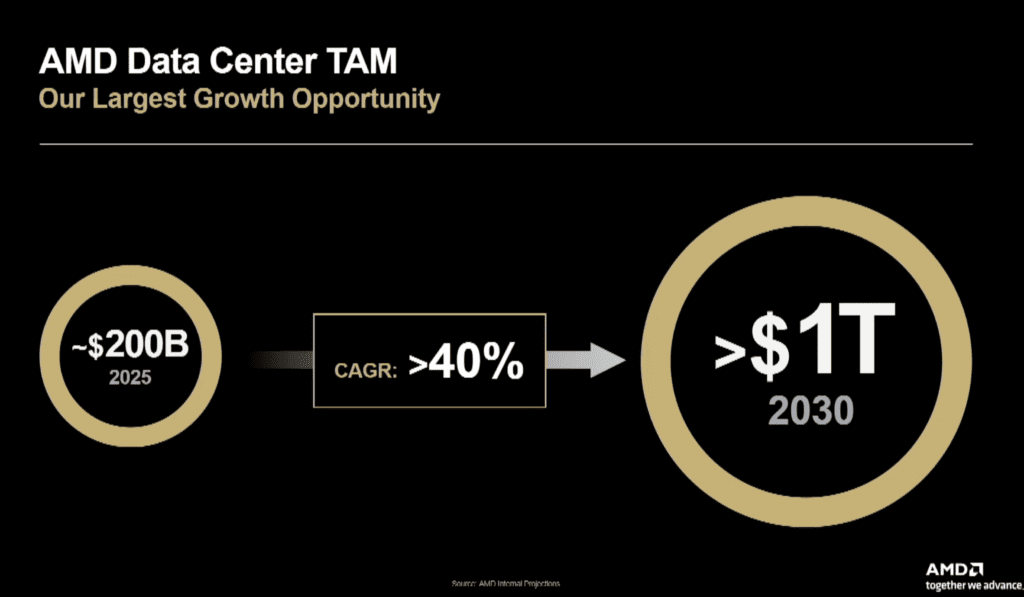

$1 Trillion Market Vision:

AMD CEO Lisa Su told analysts that the AI-driven data center chip market could hit $1 trillion by 2030, doubling AMD’s previous projection of $500B by 2028. This includes CPUs, GPUs, networking chips, and full rack-scale AI systems.

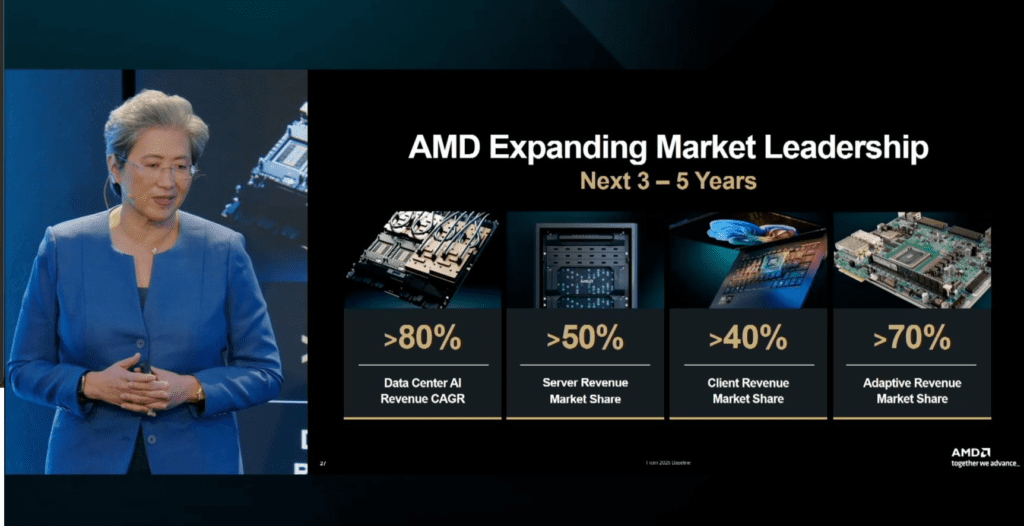

80% CAGR in Data Center AI:

The company projects data center AI revenue to grow more than 80% annually over the next 3–5 years, with total revenue growth accelerating to 35% per year, driven largely by “insatiable” demand for compute power.

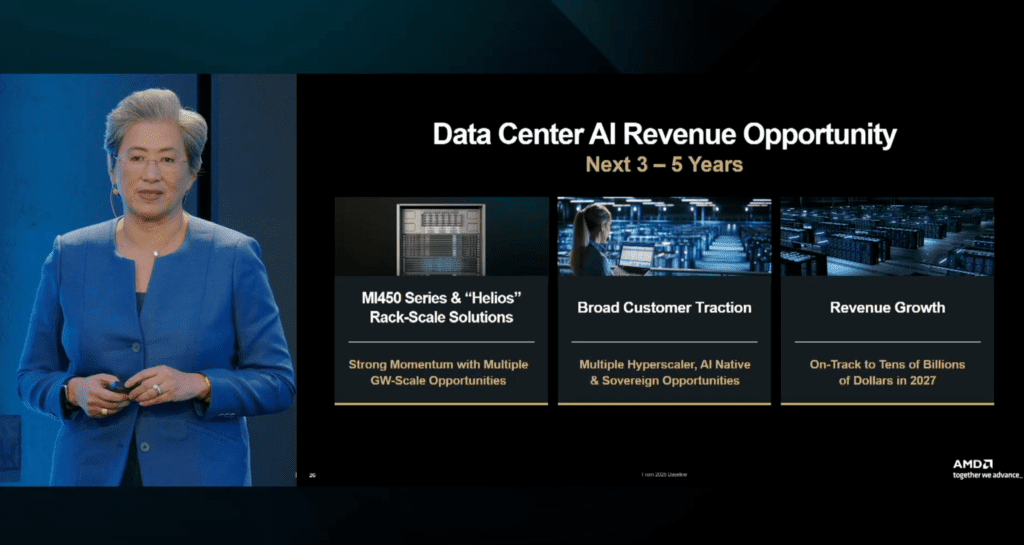

OpenAI Deal Worth $100B+:

A key catalyst is AMD’s multibillion-dollar deal with OpenAI, announced in October. The agreement includes chip sales starting in 2026 and warrants for OpenAI to acquire up to 10% of AMD, marking one of AMD’s largest customer partnerships ever.

MI400 and Rack Systems in 2026:

AMD will launch its Instinct MI400 AI chips in 2026, alongside rack-scale systems akin to Nvidia’s GB200 NVL72 — a major leap in AMD’s vertical integration and competitiveness in AI infrastructure.

Major Acquisitions & Software Push:

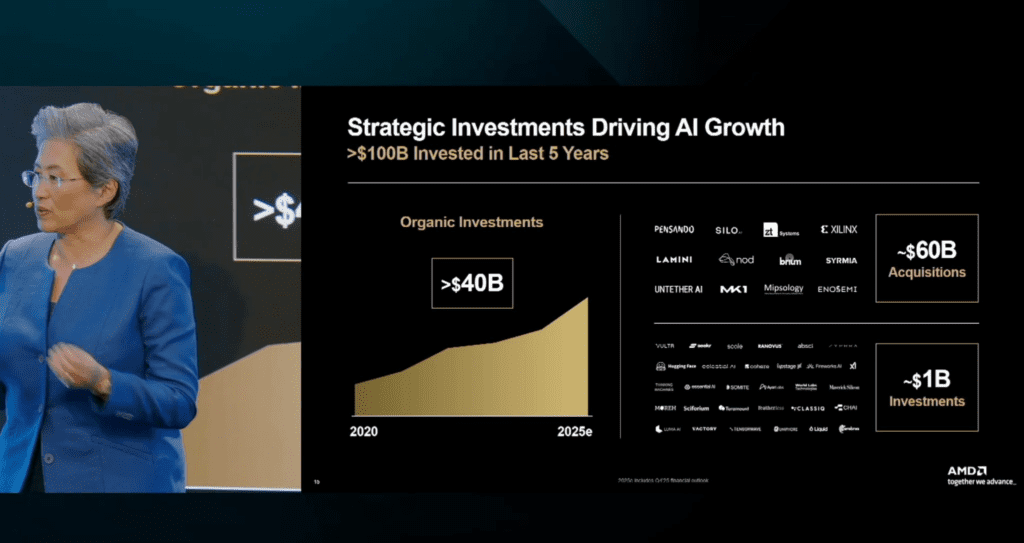

AMD has invested over $100B in AI since 2020, including:

- $40B in organic R&D

- $60B in acquisitions (Xilinx, Pensando, Nod, etc.)

- Recent buyouts like MK1 and ZT Systems to expand AI software and hardware integration

Nvidia Still Dominates, But AMD Gains Ground:

Nvidia remains the market leader with >90% AI GPU share, but AMD expects to reach double-digit share in the data center AI market within 3–5 years. Nvidia estimates the total AI infrastructure market could grow even larger, to $3–4 trillion by 2030.

Not Just AI — Everything’s “Firing”

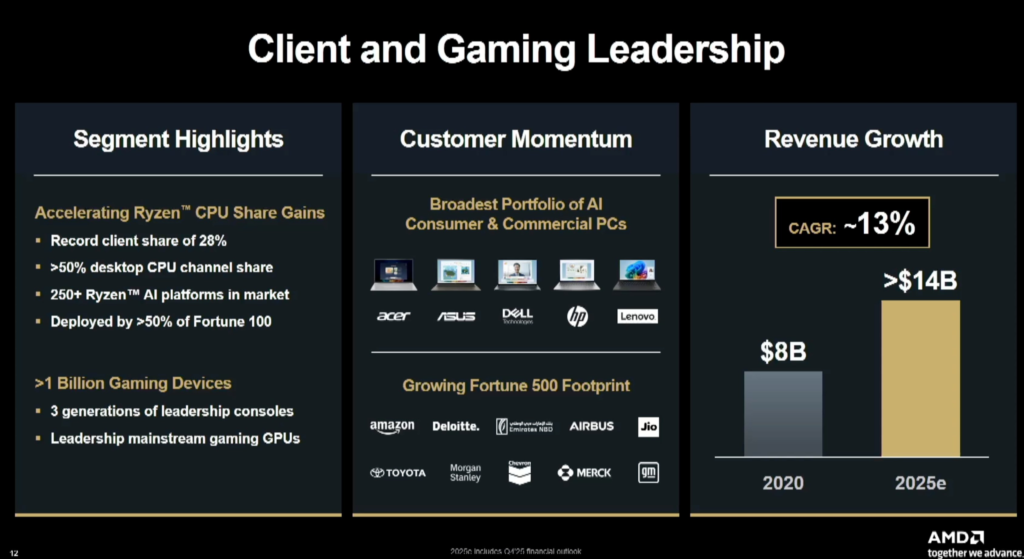

Lisa Su stressed that all AMD segments are growing, including:

- Client & Gaming: Ryzen holds >28% share, over 250 AI PC platforms shipped

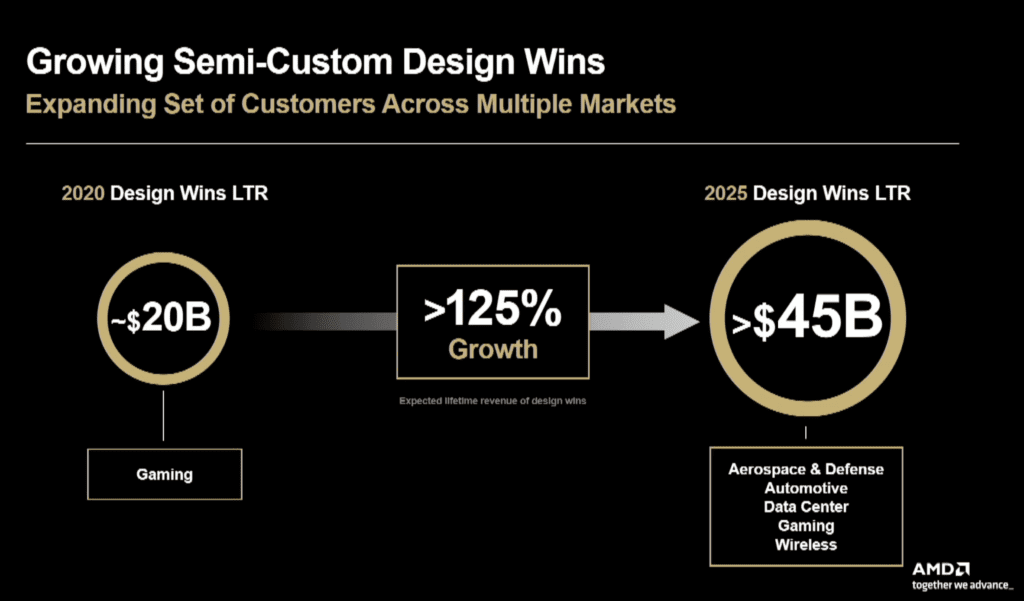

- Semi-Custom: Design wins up from $20B (2020) to >$45B (2025 expected)

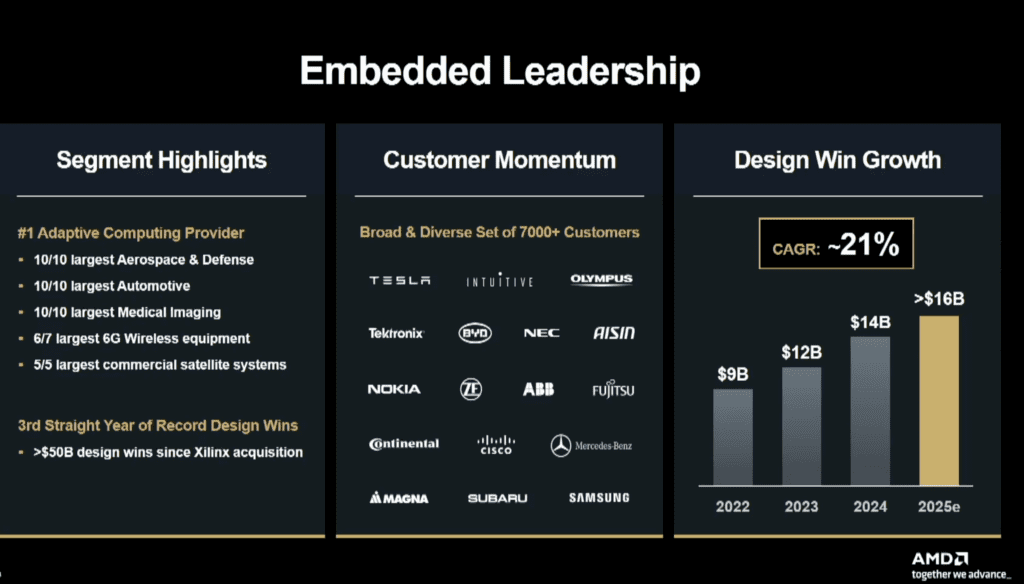

- Adaptive Computing: Serving all top 10 aerospace, auto, and medical imaging firms

Financial Outlook: Despite shares falling 3% after hours, AMD’s gross margin guidance of 55–58% beat expectations. The company previously beat Q3 earnings and raised its Q4 forecast.

AMD is betting big, not just on GPUs, but on full-stack AI infrastructure. While Nvidia is far ahead, AMD is carving out a credible second-mover strategy, backed by OpenAI, Meta, and Oracle. If AMD delivers on MI400 performance and software stack integration, it could meaningfully close the gap by 2027.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:What to Watch This Week: Shutdown Deal Lifts Markets