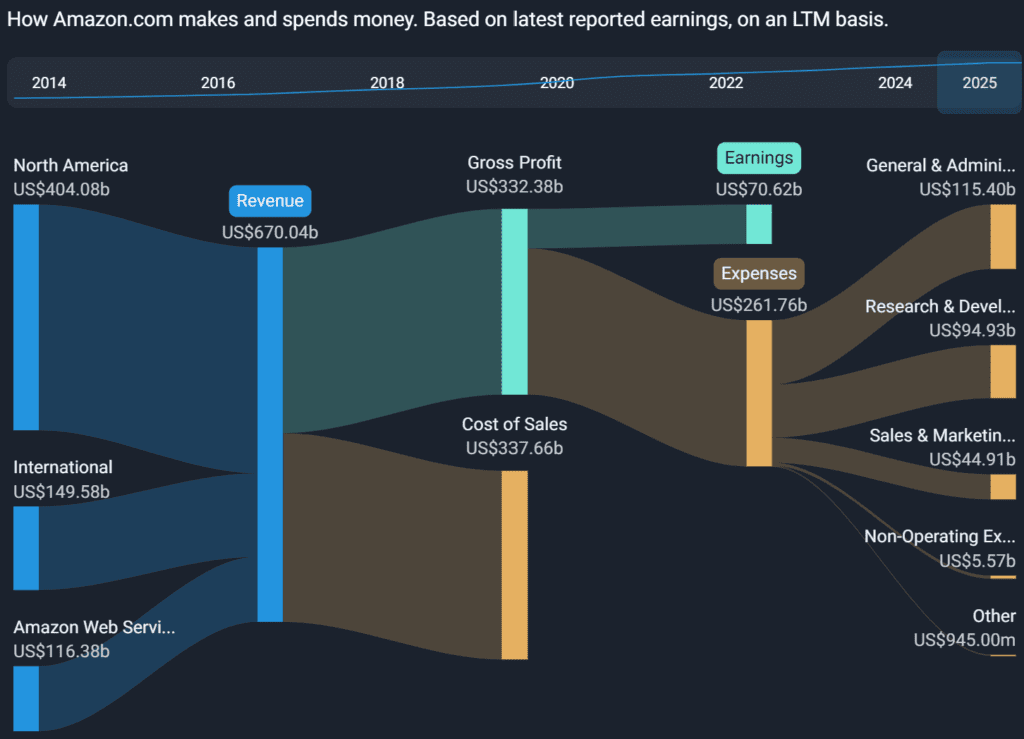

Amazon (AMZN) is set to report its Q3 2025 earnings after the market closes on October 30, and expectations are high following a lukewarm year-to-date stock performance. With AWS showing signs of reacceleration, advertising continuing to scale, and massive bets on AI infrastructure underway, this quarter could mark a key inflection point heading into the critical holiday season.

Investors will be laser-focused on AWS margins, GenAI monetization, and how well Amazon’s retail and logistics strategy is weathering macro pressures.

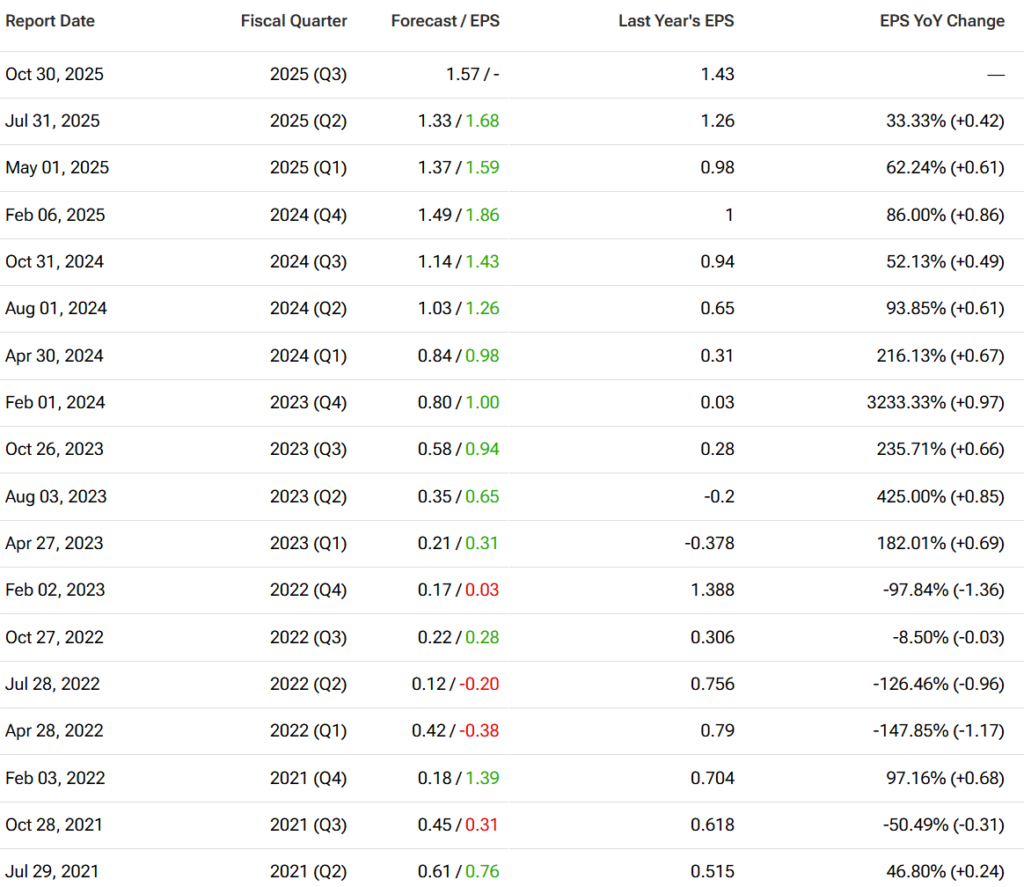

Street Forecast: Revenue Near $178B, EPS Around $1.57

According to consensus from LSEG and FactSet, analysts expect:

| Metric | Estimate | YoY Growth |

|---|---|---|

| Revenue | $177.8 billion | +12% |

| EPS (GAAP diluted) | $1.57 | +10% |

| Operating Income | $18.5 billion (mid) | +16% |

Amazon’s own guidance calls for revenue between $174B–$179.5B and operating income of $15.5B–$20.5B. Analysts largely expect results near the upper end, boosted by strong Prime Day performance and margin discipline.

Prediction: Amazon beats on both revenue and EPS, with upside driven by retail efficiency and ad margin leverage.

AWS: Growth Stabilizing, Margins in Focus

After several quarters of deceleration, AWS reaccelerated to 17.5% growth in Q2, and analysts are now expecting ~18% YoY growth in Q3 (~$32–33 billion). This lags Microsoft Azure and Google Cloud in growth rate, but AWS remains the largest cloud provider by market share.

AI infrastructure spending, particularly on Trainium and Inferentia chips, continues to pressure margins (down to 32.9% in Q2 vs 39.5% in Q1). Yet Amazon is building long-term strength through its Bedrock platform, offering foundational models from Anthropic, Meta, and its own Titan family.

Watch for: AI services adoption metrics, commentary on enterprise AI workloads, and signs of AWS margin stabilization.

Retail and Consumer: Prime Day and Delivery Edge

Retail growth expectations are modest but stable. U.S. e-commerce is forecast to grow 6–9% YoY, helped by July’s Prime Day event, which was the largest ever, and continued expansion of same-day delivery, which grew 30% YoY.

International retail sees modest FX tailwinds (~1.3%), but macro softness in Europe and Asia remains a drag. Analysts are especially focused on operating margin expansion in North America, where regionalized fulfillment is starting to bear fruit.

Prediction: U.S. retail margin improves YoY despite promotional pressure, with international lagging but stable.

Advertising: The Profit Engine Behind the Scenes

Amazon’s ad business is expected to grow ~21% YoY to $17.3 billion, fueled by sponsored product placements, streaming (Fire TV), and Prime Video ad tier expansion. This high-margin segment is helping offset logistics-heavy retail costs.

Amazon’s advantage lies in its first-party shopper intent data, which makes its ads more targeted than traditional display or social formats. New AI-powered ad tools and attribution features continue to attract performance marketers.

Prediction: Ads beat consensus and come in near 22% growth. Commentary will emphasize video and AI-enhanced tools.

Logistics and Fulfillment: Efficiency at Scale

Amazon has invested billions in its regionalized logistics network, trimming cost per package and cutting delivery times. One-day and same-day delivery coverage expanded another 30% YoY this quarter.

Third-party logistics (Buy with Prime, Amazon Shipping) are gaining traction, and new warehouse automation initiatives are ramping. However, any unexpected surge in fulfillment costs could pressure margins during the holiday build-up.

Watch for: Operating efficiency metrics, commentary on fulfillment capex, and Buy with Prime penetration.

AI Infrastructure: Bedrock vs Azure and Gemini

Amazon is positioning Bedrock as its response to Azure OpenAI and Google’s Gemini. While Bedrock isn’t dominating headlines, it’s quietly building an ecosystem of enterprise tools, APIs, and third-party models.

With $118B in 2025 capex, much of it tied to GenAI and cloud infrastructure, Amazon needs to show that its investments are translating into adoption and retention.

Prediction: Continued spend with a focus on Bedrock maturity and new GenAI customer wins — but monetization still early-stage.

Regulatory and Macro Backdrop

The FTC’s antitrust lawsuit and unionization momentum are long-term threats, but unlikely to impact Q3 directly. Macro-wise, easing inflation and solid consumer confidence support modest discretionary spend, though cautiousness lingers in Europe and Japan.

Watch for: Any comment on labor cost pressure or legal exposure, particularly around pricing or marketplace dynamics.

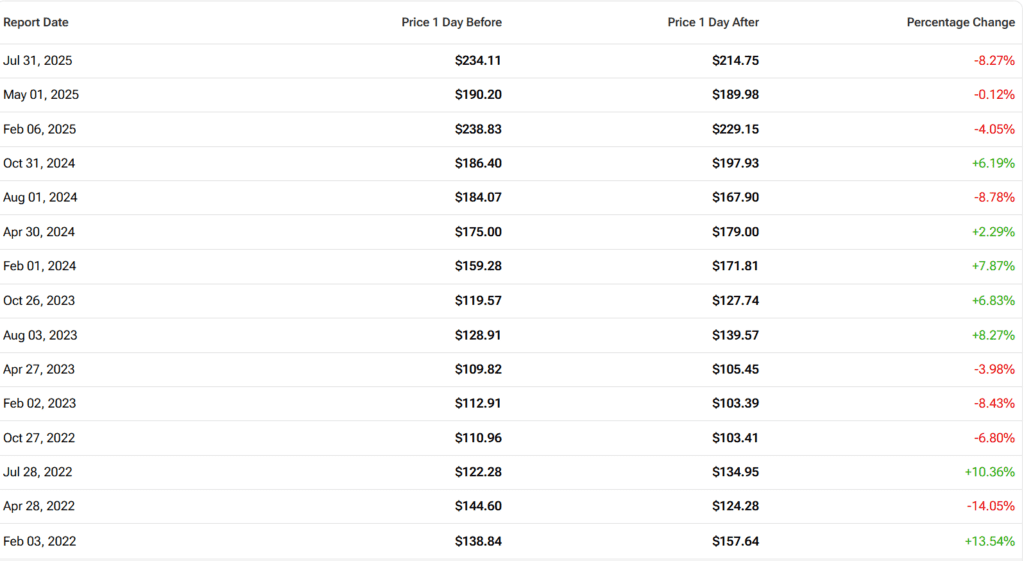

Investor Sentiment and Stock Outlook

Amazon stock is up just ~4.5% YTD, underperforming peers like Microsoft (+29%) and Meta (+35%). Analysts remain bullish: over 95% rate the stock a “Buy,” with a median price target of $268 — implying ~17% upside from current levels.

Options markets are pricing in a ~4% post-earnings move, with bulls hoping for Q4 holiday guidance to reawaken enthusiasm.

Will Amazon Regain Its Big Tech Premium?

Amazon heads into Q4 with stable momentum across cloud, ads, and retail. But to reignite investor enthusiasm, it must prove that AWS margins are bottoming, AI infrastructure investments are paying off, and holiday retail demand will remain resilient.

Prediction: Amazon delivers a clean beat on Q3 revenue and EPS. If AWS surprises to the upside and Q4 guidance is strong, shares could finally break out of their 2025 trading range. If margins disappoint or guidance is muted, the stock may stay stuck — at least until holiday results arrive.

Disclosure: All predictions and insights shared in this article are based on a comprehensive review of publicly available analyst reports, media coverage, and market consensus. These views are for informational purposes only and do not constitute investment advice. Please conduct your own research or consult a licensed financial advisor before making any investment decisions.