Amazon heads into tonight’s print with three swing variables in focus: (1) AWS reacceleration on AI demand, (2) operating-income leverage despite AI capex and tariffs, and (3) ad-business momentum (including Prime Video ads). With expectations neither low nor extreme, the stock’s first move will likely be set by AWS growth and operating-income guidance, then refined by management’s capex and tariff commentary.

Consensus Snapshot (what Wall Street is modeling)

- Revenue: ~$162.2B (≈ +9–10% YoY)

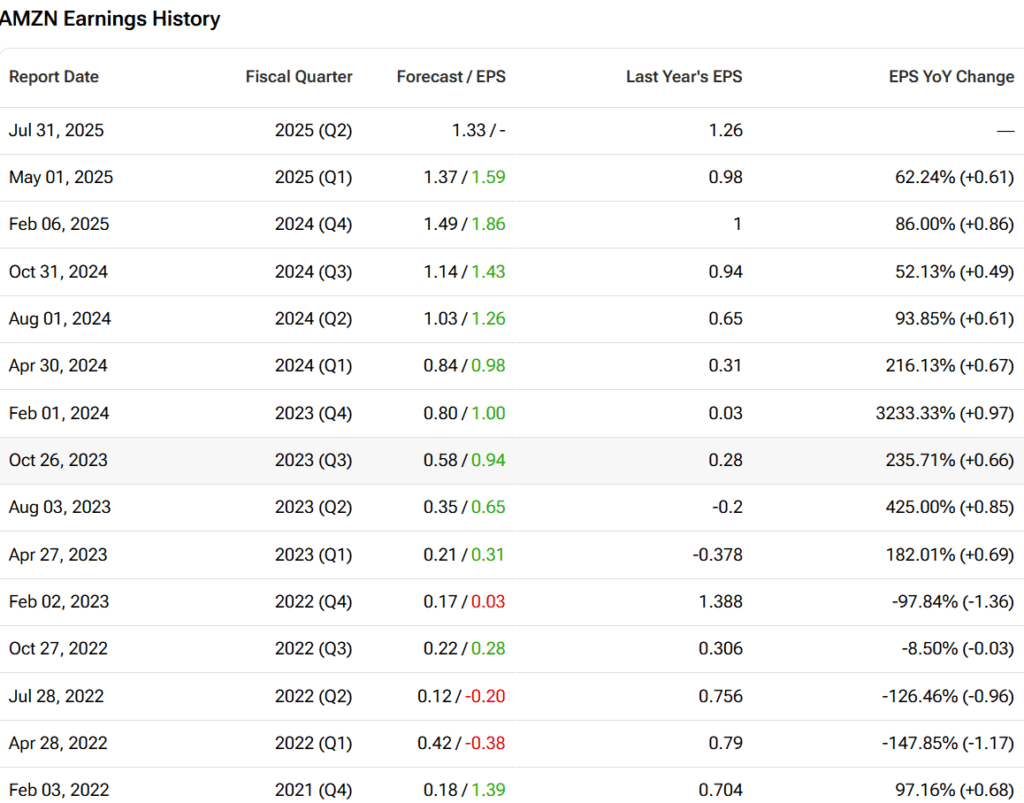

- EPS (GAAP/diluted): ~$1.32–$1.33

- Operating Income: ~$16.7B (≈ +13–15% YoY) → implies ~10–11% operating margin

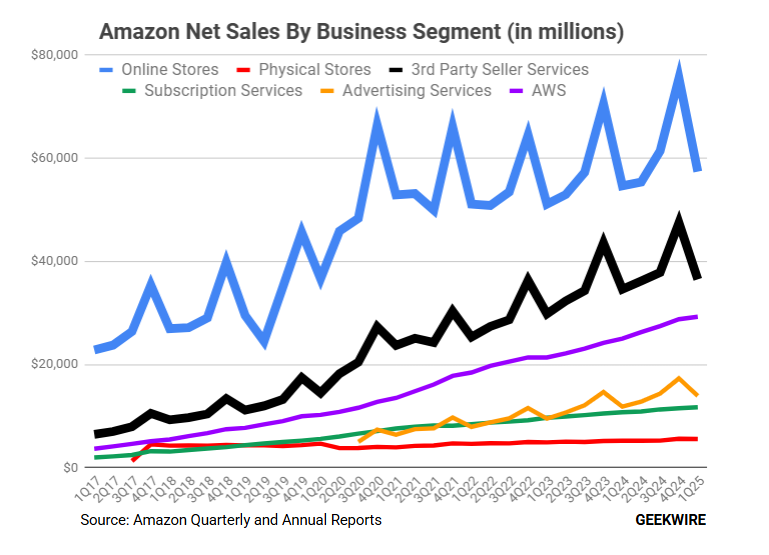

- AWS Revenue: ~$30.5–$30.7B (≈ +17% YoY)

- Advertising + Subscriptions: ~$27B combined (ads growth mid/high-teens)

- North America Retail: ~$99–$103B (mid-single-digit YoY)

- Event timing: Q2 call after the bell; conference call at 5:00 p.m. ET.

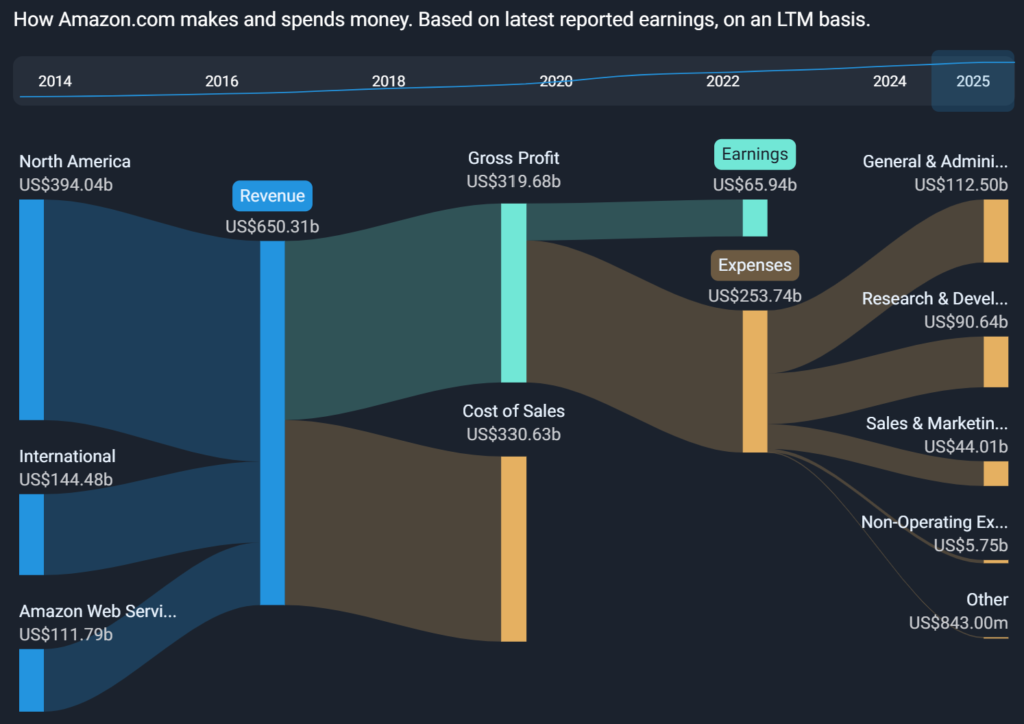

Why it matters: AWS contributes <20% of sales but ~60% of operating income, so even modest beats/misses in cloud flow through disproportionately to the consolidated margin profile and the reaction in the shares.

What to Watch (and why it moves the stock)

1) AWS reacceleration & AI demand color

Beyond the headline ~+17% YoY growth, listen for AI contribution to growth (training vs. inference mix), bookings/backlog, and any update on GPU capacity and regional expansions. Several previews suggest AI demand remains robust and that select partner workloads (e.g., model providers) may be adding ~1ppt to growth. Clean ~17% with confident AI commentary is the bull script; anything closer to mid-teens, or weaker color on backlog, tilts the other way.

2) Operating-income leverage vs. capex/tariffs

Street OI centers on ~$16.7B (margin ~10–11%). Watch the north-America retail margin (efficiencies vs. tariff pass-through), and whether the company-wide OI can beat despite data-center depreciation. A strong OI guide for Q3—even with tariffs stepping up into June—would support the mix-shift story (cloud + ads).

3) Ads momentum & Prime Video ad tier

Advertising remains a quiet engine: previews peg mid/high-teens growth, supported by retail traffic, measurement improvements, and the Prime Video ad tier. If ads growth and color on Q3 seasonality (back-to-school → holiday) come in solid, it cushions any retail gross-margin volatility and supports EPS durability.

4) Capex cadence into FY26

Press and sell-side roundups highlight a very large AI capex year. The key investor question: does management outline a measured FY26 cadence (slower growth from this year’s step-up), or signal an even bigger build program? The capex arc will shape margin, FCF, and multiple.

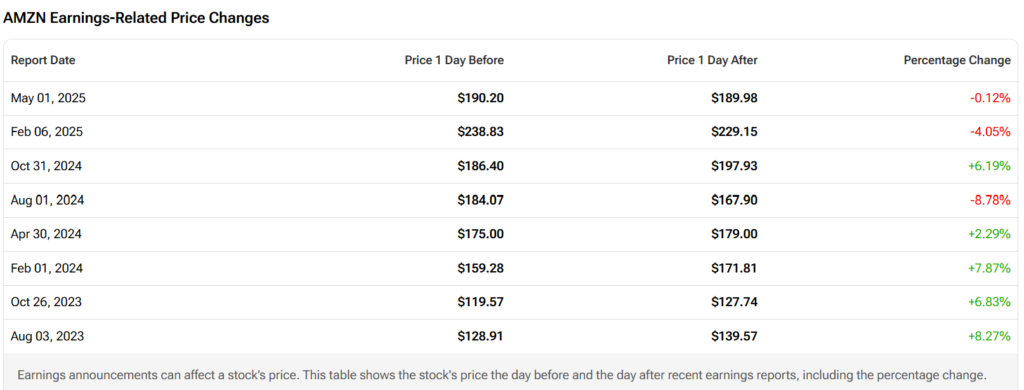

Trading Setup (implied move & sentiment)

Options pricing points to an ≈ 5% post-earnings swing by week-end. Positioning skews optimistic (most analysts rate Buy/Outperform), but the bar is not low; “meet-and-maintain” could be a muted reaction. Traders are primed for AWS growth, OI margin, and capex commentary to set the tone.

Bullish Case — with facts investors will look to confirm

- AWS prints ~+17% with AI tailwinds: Consensus clusters around $30.5–$30.7B; previews attribute incremental growth to gen-AI workloads and specific partner ramps. A bookings/backlog update pointing to sustained H2 demand would reinforce the multi-quarter runway.

- Operating income up double-digits: ~$16.7B (+~13–15% YoY) suggests profit expansion even while building AI capacity, driven by ads mix and retail efficiencies (route density, same-day coverage, regionalization).

- Advertising flywheel: Mid/high-teens growth in ads—plus early monetization from Prime Video ads—supports mix and margin resilience even if retail faces tariff/friction headwinds.

- Cloud + Ads pillars: Together, they can offset near-term retail variability. If both pillars hit (AWS ≳ +17%, ads ≳ mid-teens), upside to OI and EPS is plausible.

Bearish Risks — what could disappoint (and why it matters)

- Tariff/cost overhang: U.S. tariff rates stepped up into June; if pass-through is staggered or demand proves elastic, Q3 outlook for retail margins could soften, capping consolidated OI.

- Capex & depreciation gravity: A larger-than-expected data-center build could extend high depreciation into FY26, limiting margin expansion and tempering FCF even if revenue reaccelerates.

- Cloud competition: A more promotional environment to capture AI workloads (pricing/performance incentives) could limit incremental margin in AWS despite revenue growth.

- High bar for upside: With consensus already modeling healthy growth, anything shy of AWS ≈ +17% and OI ≈ $16.7B risks a “good-but-not-good-enough” tape.

Scenario Map (how the reaction might set up)

- Bullish reaction: AWS ≥ +18% with upbeat AI/backlog color and OI > $17B; capex cadence framed as measured into FY26.

- Base/Neutral: AWS ~+16–17%, OI ~$16.5–$16.9B, capex commentary balanced; guidance maintains trajectory.

- Bearish: AWS ≤ +15% or cautious cloud commentary; OI ≤ $16.3B; capex outlook heavier than expected or tariff headwinds emphasized in Q3.

Three levers will likely determine tonight’s tape: AWS growth, operating-income leverage, and capex cadence. If Amazon delivers clean cloud reacceleration, strong OI, and a disciplined spend arc into FY26, the mix-shift (cloud + ads) story remains intact. A merely in-line cloud print or heavier-than-anticipated capex guide, however, narrows the path for upside in a market that’s already leaning constructive.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only

Sources: Investopedia; MarketWatch; Barron’s; Reuters; Yahoo Finance; GeekWire; Seeking Alpha; TipRanks / The Fly; Wall Street Horizon; Nasdaq; The Motley Fool.

Related:

What Happens After Tariff Deadline and What Next 72 Hours Look Like for Markets

Trump’s Tariffs Are Real, But Are His Trade Deals Just for Show?

Figma Is Largest VC-Backed American Tech Company IPO in Years