Since the turn of the century, Nike (NYSE: NKE) and Pool Corporation (NASDAQ: POOL) have delivered impressive returns of 1,560% and 7,790%, respectively. However, both have seen their share prices fall significantly in recent years, with Nike down 47% and Poolcorp down 59%, due to softer consumer spending, persistent inflation, and higher interest rates.

Despite these challenges, both companies present a unique opportunity for long-term investors as their stocks are now available at once-in-a-decade valuations.

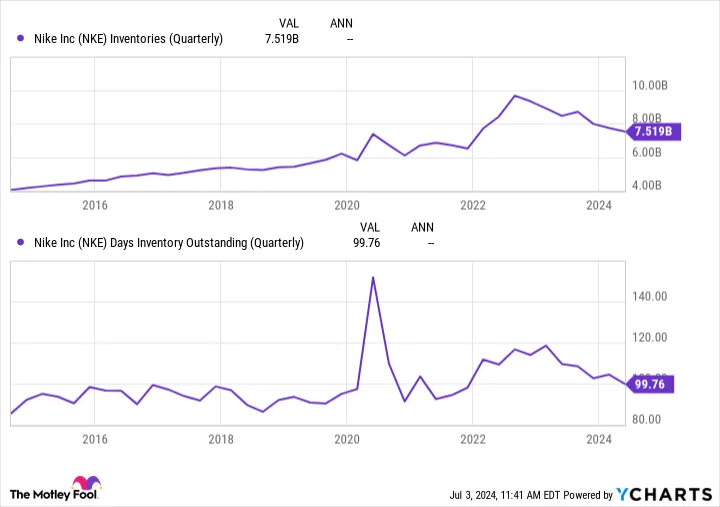

- Nike: Nike’s share price is currently down 59% from its all-time highs. However, the company’s inventory levels are normalizing, allowing it to focus on innovation. Despite recent setbacks, Nike remains a powerful brand, especially among Gen Z shoppers. Trading at a P/E ratio of 20, its lowest in 10 years, and offering a 1.9% dividend, Nike is a strong contrarian pick for patient investors.

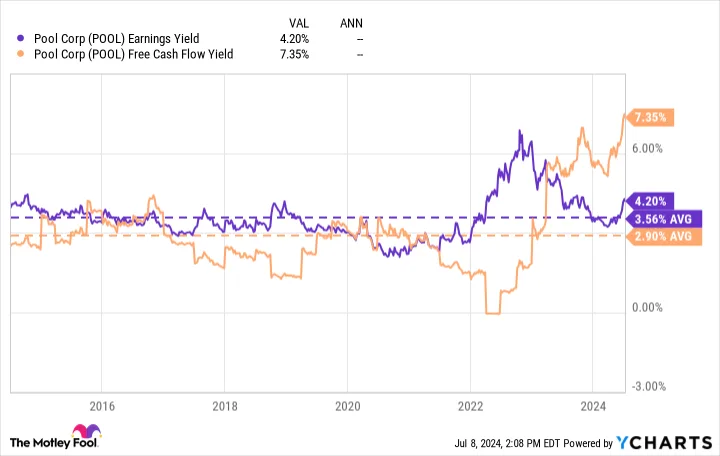

Pool Corporation: Poolcorp’s shares have declined 47% since 2022 due to reduced consumer spending. However, 86% of its sales come from recurring items like pool maintenance, showcasing its resilience. Poolcorp has consistently lowered its share count and increased dividends for 13 years. Trading at a deep discount to its 10-year averages and offering a 1.5% dividend yield, Poolcorp is another undervalued gem.

Long-term investors may find these stocks attractive, especially using dollar-cost averaging to capitalize on their potential rebound.

©2024 Yahoo.Finance