Crypto vs Stock Market is a debate many investors face as they navigate the dynamic financial landscape of 2025. Both asset classes have unique risks, rewards, and growth trajectories, making it essential to understand their differences.

What Differentiates Cryptocurrency from the Stock Market?

| Feature | Cryptocurrency | Stock Market |

|---|---|---|

| Nature of Asset | Digital currencies like Bitcoin and Ethereum based on blockchain technology. | Shares of companies representing ownership stakes. |

| Regulation | Loosely regulated; varies significantly by country. | Highly regulated by agencies like the SEC and FCA. |

| Volatility | Prices can swing dramatically within hours or minutes. | Relatively stable for blue-chip stocks; higher volatility in small-cap or growth stocks. |

| Trading Hours | Operates 24/7 globally. | Restricted to trading hours set by exchanges (e.g., NYSE). |

| Market Size | Approximately $1 trillion in market capitalization (2024). | Over $93 trillion in global market capitalization (2024). |

Why Invest in Crypto in 2025?

1. Potential for High Returns

Cryptocurrencies like Bitcoin and Ethereum have historically delivered exceptional returns. For example, Bitcoin grew over 70% in 2023 alone, and new blockchain projects such as Polygon and Avalanche promise significant growth potential in 2025.

2. Decentralization and Accessibility

Cryptocurrencies offer a decentralized structure, free from government control, making them an appealing option for those seeking financial independence. They are also accessible to anyone with an internet connection.

3. Innovative Use Cases

Beyond trading, cryptocurrencies fuel advancements in DeFi (Decentralized Finance), NFTs (Non-Fungible Tokens), and Web3 projects, expanding their value beyond being a speculative asset.

4. Risks in Crypto

- Volatility: Significant price fluctuations make crypto a high-risk asset class.

- Security Concerns: Hacks on exchanges or wallets can result in loss of assets.

- Regulatory Uncertainty: Countries like India and China have introduced crypto bans or restrictions, impacting market sentiment.

Why Invest in the Stock Market in 2025?

1. Steady Returns

The stock market has a proven history of delivering consistent long-term returns. For instance, the S&P 500 averages annual returns of approximately 10%, making it an attractive option for conservative investors.

2. Income Opportunities

Many stocks, especially from blue-chip companies like Apple and Microsoft, pay dividends, offering a stable income stream.

3. Diversification

Stocks allow exposure to a wide range of industries, including technology, healthcare, renewable energy, and finance. ETFs further enable easy diversification.

4. Risks in Stocks

- Economic Downturns: Recessions or geopolitical tensions can negatively impact stock values.

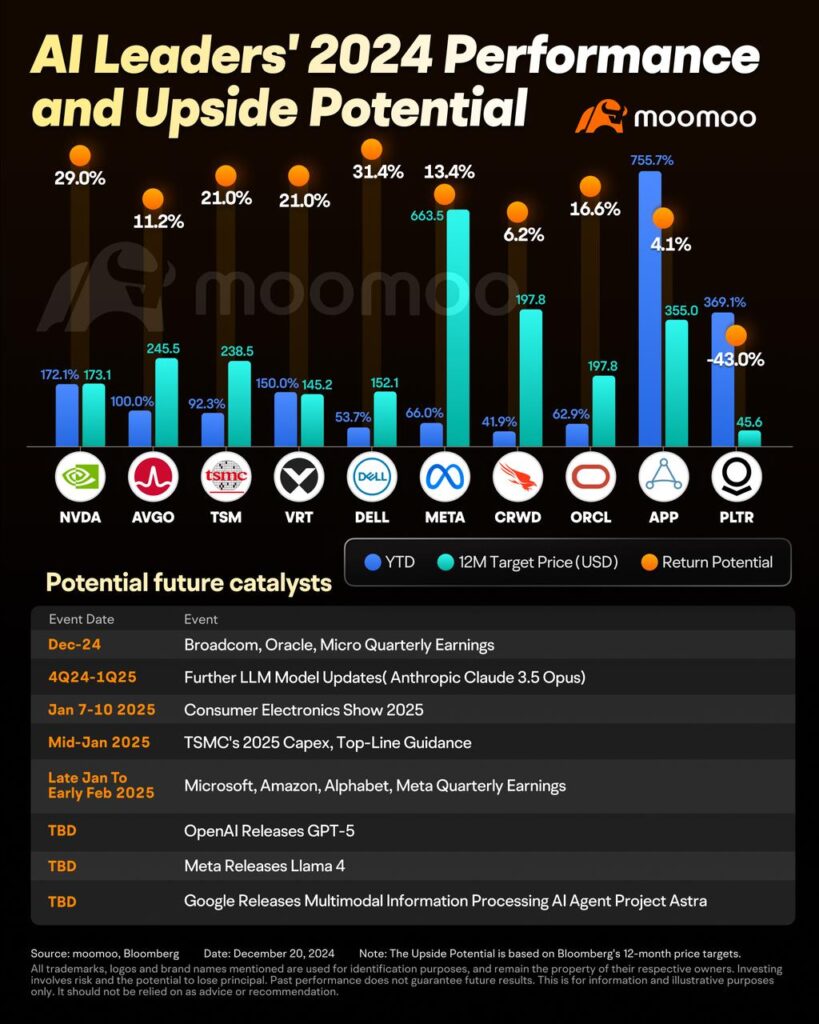

- Sector-Specific Risks: Stocks in emerging industries like AI or clean energy can face higher volatility.

- Lower Returns Compared to Crypto: While less volatile, stock market returns are generally lower than potential gains in crypto.

Crypto vs Stock Market: A Comparison of Returns

Cryptocurrency Returns

- Bitcoin grew 70% in 2023 and could see double-digit growth in 2025 based on institutional adoption and rising use cases.

- Altcoins like Solana and Cardano have outpaced Bitcoin in past years, with growth rates exceeding 300% during bullish cycles.

Stock Market Returns

- The S&P 500 delivered a 17% annual return in 2023.

- Emerging sectors like AI and clean energy are expected to outperform traditional industries, with potential growth of 20%–25% annually.

Investment Strategies for Crypto vs Stock Market

| Strategy | Cryptocurrency | Stock Market |

|---|---|---|

| Diversification | Invest in a mix of established coins like Bitcoin and newer tokens. | Combine blue-chip stocks with high-growth sectors like AI and green energy. |

| Dollar-Cost Averaging (DCA) | Invest small, fixed amounts regularly to reduce impact of volatility. | Apply DCA to reduce risks, especially during market downturns. |

| HODLing/Long-Term Holding | Hold Bitcoin or Ethereum for 5+ years to maximize returns. | Buy and hold ETFs or dividend-paying stocks for steady compounding returns. |

| Trend Following | Trade based on momentum in bullish crypto cycles. | Invest in stocks with strong performance metrics and growth trends. |

Tools for Managing Crypto and Stock Investments

| Tool | Crypto Example | Stock Market Example |

|---|---|---|

| Trading Platforms | Binance, Coinbase | Robinhood, E*TRADE |

| Portfolio Trackers | CoinMarketCap, CoinGecko | Morningstar, Seeking Alpha |

| Educational Resources | Binance Academy, CryptoCompare | Investopedia, Motley Fool |

| Security Tools | Ledger (hardware wallets) | SIPC-insured brokerage accounts |

Future Trends to Watch

1. Institutional Adoption

Institutional investors are increasingly entering the crypto space, bringing more stability and liquidity. For stocks, institutional involvement remains strong, especially in high-growth sectors like AI and clean energy.

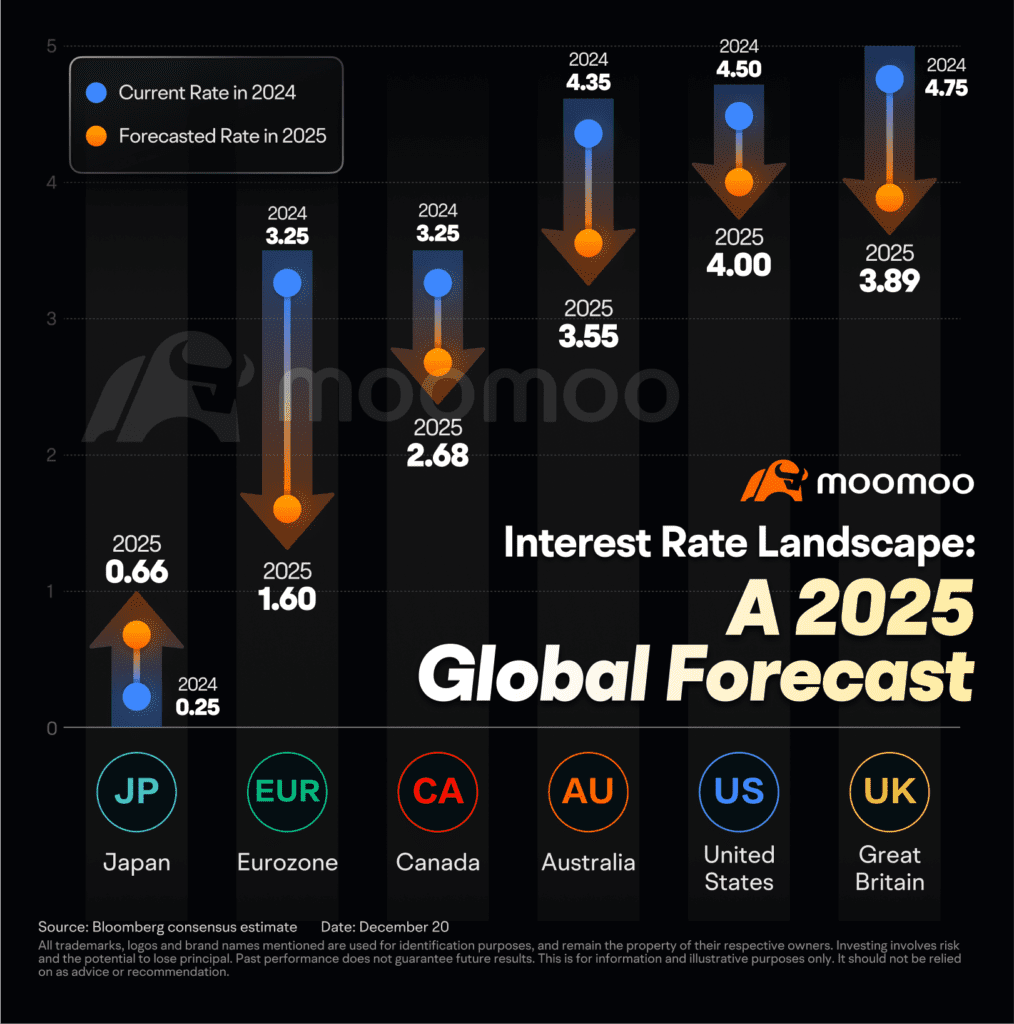

2. Regulatory Changes

- Crypto: Global regulation frameworks like MiCA (Markets in Crypto-Assets) in the EU may stabilize the market.

- Stocks: Regulations around ESG (Environmental, Social, and Governance) investing will influence portfolio decisions.

3. Technological Advancements

- Cryptocurrencies: Innovations in blockchain scalability, such as Ethereum 2.0 and Layer 2 solutions, will enhance usability.

- Stocks: Companies focusing on AI, renewable energy, and 5G technology will lead market growth.

Related articles:

- What is Crypto Analysis: Types and Strategies – Part 1

- What is Crypto Analysis: Techniques and Indicators – Part 2

- What are some benefits of using cryptocurrency as a method of payment?

- What is cryptocurrency mining? A Beginner’s Guide to Getting Started

- What is Cryptocurrency Solana (SOL) and How Does It Work?

- How to Buy Solana Meme Coins and Create Your Own on Solana

- How to Sell Bitcoin: A Step-by-Step Guide for Beginners

- How to Pay with Cryptocurrency: A Guide to Digital Payments

- What Are Meme Coins & How Do They Work?

- How to Buy Meme Coins: A Beginner’s Guide

- How to Trade in Crypto: Risks and Rewards

- Which are Best FREE Crypto Exchanges & Apps in 2024

- How to Invest in DeFi: A Step-by-Step Guide

- Cryptocurrency Trading: What it is and How to Trade?

- How to Invest in Gold and Silver: A Step-by-Step Guide

- How To Invest $1,000 And Grow Your Money in 2025

- CD vs. mutual fund: Which is a better investment?

Sources: