On December 18, 2024, the U.S. stock market experienced significant declines following the Federal Reserve’s decision to cut interest rates by 0.25 percentage points, bringing the federal funds target range to 4.25%–4.5%. Despite this reduction, the Fed signalled a slower pace of rate cuts in 2025, projecting only two such cuts next year, down from the four previously anticipated.

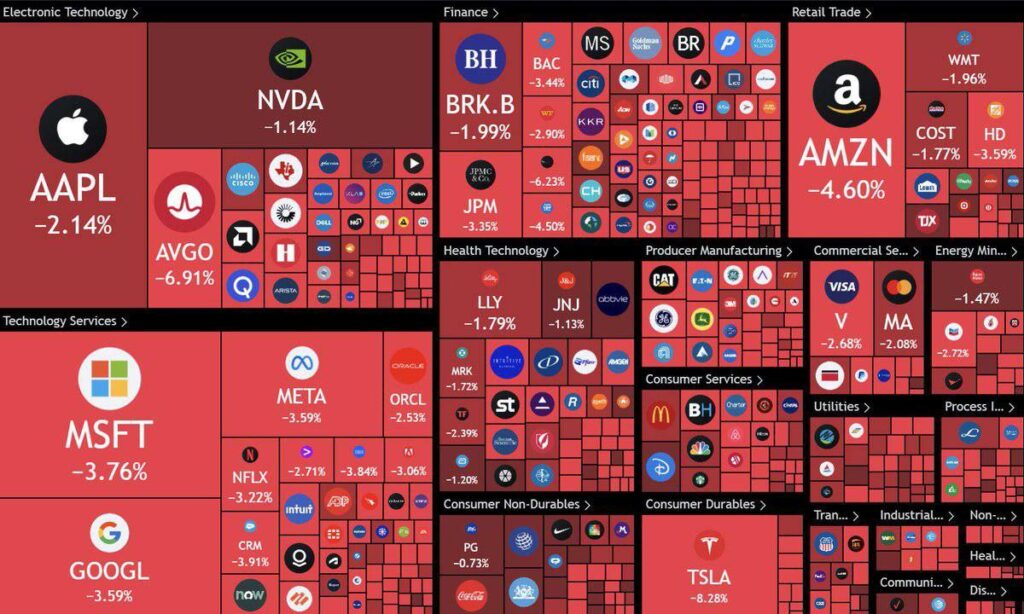

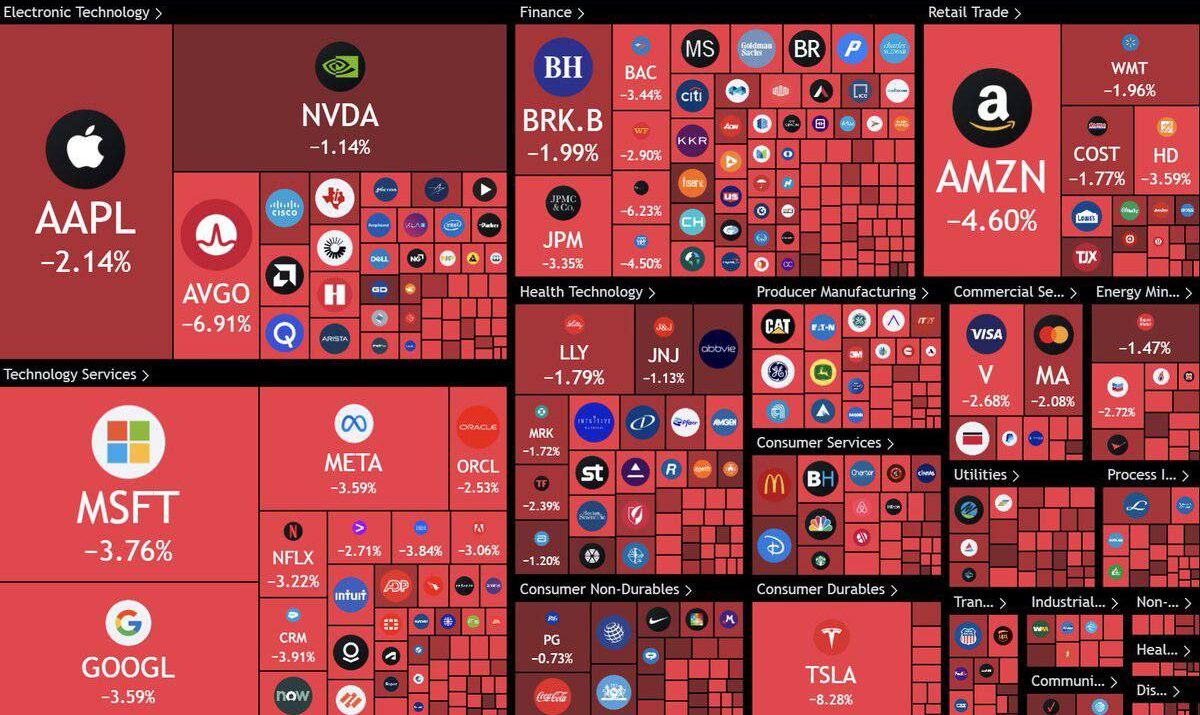

In response to the Fed’s announcement, major stock indices fell sharply:

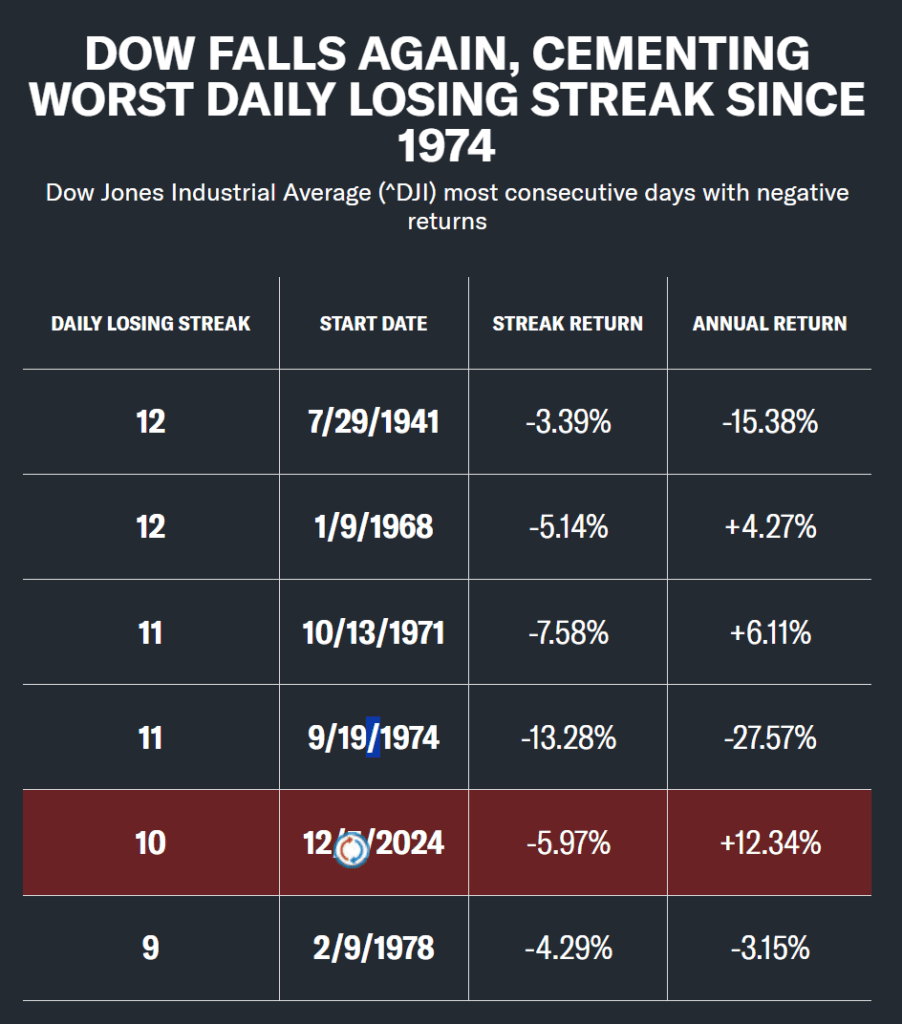

- Dow Jones Industrial Average: Dropped over 1,100 points, marking its steepest decline since August and its longest losing streak since October 1974 regarding The Wall Street Journal.

- S&P 500: Fell by 2.9%, recording its second-worst loss of the year.

- Nasdaq Composite: Decreased by 3.6%, reflecting significant downturns in technology stocks.

The Fed’s cautious outlook, citing persistent inflation concerns and a robust labor market, contributed to investor apprehension. Fed Chair Jerome Powell emphasized the need for more progress in lowering inflation, which remains above the 2% target.

In the bond market, Treasury yields rose, with the 10-year Treasury note climbing to its highest level since May, indicating increased borrowing costs.

The market’s reaction underscores the sensitivity of investors to the Federal Reserve’s policy signals, particularly regarding the trajectory of interest rates amid ongoing economic uncertainties.