When it comes to understanding what is S&P 500 is, it’s important to recognize that the S&P 500, or Standard & Poor’s 500, is one of the most significant and widely followed stock market indices globally.

Established in 1957, the S&P 500 tracks the performance of 500 of the largest publicly traded companies in the United States, making it a key benchmark for the U.S. equity market and an indicator of the overall health of the economy.

This article provides a comprehensive guide to understanding what is S&P 500 is, covering its significance, benefits, and how to invest in it effectively.

What is S&P 500

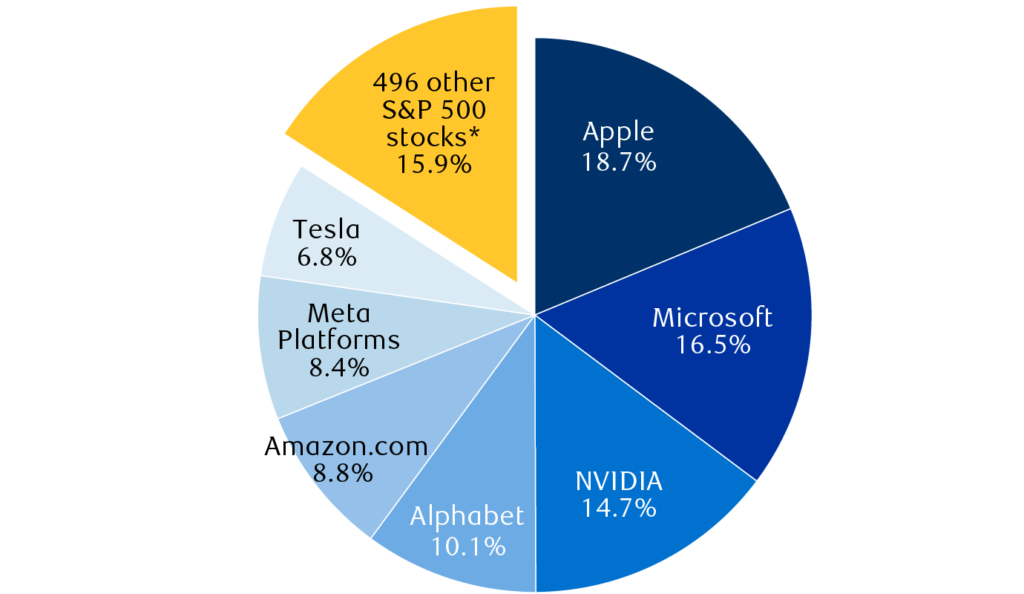

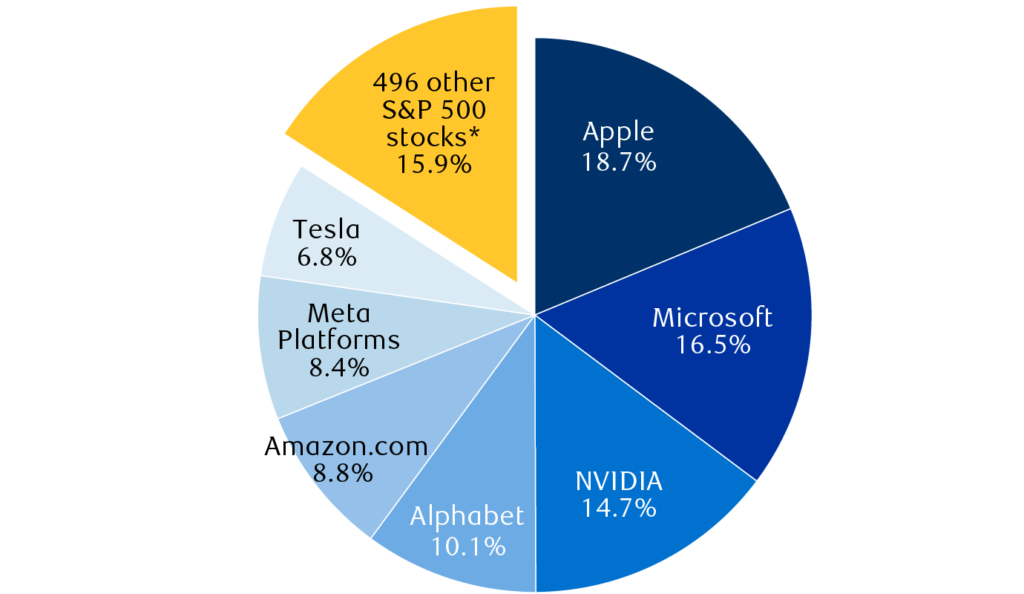

- Market Capitalization: The S&P 500 is a market-cap-weighted index, meaning that each company’s influence on the index is proportional to its market capitalization (the total value of its outstanding shares). Larger companies like Apple and Microsoft have a more significant impact on the index’s performance than smaller companies (more: What companies are in the S&P 500?).

- Industry Representation: The index includes companies from various sectors, such as technology, healthcare, finance, consumer goods, and energy, offering a broad snapshot of the U.S. economy. The S&P 500 covers approximately 80% of the total market capitalization of U.S. equities, making it a comprehensive representation of the U.S. stock market.

- Other S&P Indices: The S&P 500 is part of the broader S&P Global 1200 family of indices. Other notable indices include the S&P MidCap 400, representing mid-cap companies, and the S&P SmallCap 600, which tracks small-cap companies. Together, the S&P 500, S&P MidCap 400, and S&P SmallCap 600 make up the S&P Composite 1500, covering 90% of the U.S. market capitalization.

- Criteria for Inclusion: To be included in the S&P 500, a company must meet specific criteria, such as being based in the U.S., having a market capitalization of at least $14.5 billion, and demonstrating consistent profitability. The S&P 500 committee regularly reviews the index’s composition to ensure it accurately reflects the U.S. economy

Why Invest in the S&P 500?

Investing in the S&P 500 is a popular strategy due to its many benefits, including diversification, historical performance, and cost-effectiveness.

- Diversification: Investing in the S&P 500 gives you exposure to 500 large, well-established companies across various industries. This diversification helps spread risk, as poor performance in one sector or company is often offset by better performance in others.

- Historical Performance: The S&P 500 has a strong track record of delivering solid returns over the long term. Historically, it has provided an average annual return of about 10%, making it a reliable option for long-term investors looking to grow their wealth.

- Low-Cost Investment: You can invest in the S&P 500 through index funds or ETFs, which typically have low expense ratios. These funds passively track the index, requiring less management than actively managed mutual funds, thereby reducing costs.

- Accessibility: The S&P 500 is easily accessible to all investors, regardless of experience level. It is available through various financial products, including index funds, ETFs, and mutual funds, making it simple to include in any investment portfolio.

What is S&P 500 Competitors

While the S&P 500 is the most recognized U.S. stock market index, it has several competitors that also track the performance of various segments of the market.

- Dow Jones Industrial Average (DJIA): The DJIA, often referred to as the Dow, is another major U.S. stock market index that tracks 30 large, publicly-owned companies. Unlike the S&P 500, which is market-cap-weighted, the Dow is price-weighted, meaning companies with higher stock prices have a greater influence on the index’s performance. The DJIA is more concentrated and less diversified than the S&P 500.

- Nasdaq Composite: The Nasdaq Composite Index includes over 3,000 stocks listed on the Nasdaq exchange, with a heavy emphasis on technology and growth-oriented companies. It is more tech-focused than the S&P 500, making it more volatile but also offering higher growth potential during bull markets.

- Russell 2000: The Russell 2000 index measures the performance of the smallest 2,000 stocks in the Russell 3000 Index. It is a widely used benchmark for small-cap stocks in the U.S., providing exposure to the smaller, more nimble companies that are not included in the S&P 500.

How to Invest in the S&P 500

To start investing in the S&P 500, you’ll need to select the right investment vehicle and follow a few straightforward steps.

- Index Funds and ETFs: The most common way to invest in the S&P 500 is through index funds and ETFs. Index funds are mutual funds designed to replicate the performance of the S&P 500, while ETFs are traded on stock exchanges like individual stocks. Both options offer broad market exposure and low fees.

- Popular S&P 500 Index Funds: Some of the most popular index funds that track the S&P 500 include the Vanguard 500 Index Fund (VFIAX), the Fidelity 500 Index Fund (FXAIX), Schwab S&P 500 Index Fund (SWPPX), T. Rowe Price Equity Index 500 Fund (PREIX) and the SPDR S&P 500 ETF (SPY). These funds are widely available and provide an easy way to gain exposure to the S&P 500.

- Choose a Brokerage Account: To buy shares of an S&P 500 index fund or ETF, you’ll need a brokerage account. Many online brokers offer commission-free trading on ETFs and low-cost access to index funds, making it easier for you to start investing.

- Dollar-Cost Averaging: Implementing a dollar-cost averaging strategy allows you to invest a fixed amount of money regularly, regardless of the index’s price. This approach reduces the impact of market volatility and helps you steadily build your investment over time.

- Reinvest Dividends: Many S&P 500 index funds and ETFs offer the option to reinvest dividends automatically. Reinvesting dividends allows you to buy more shares, compounding your returns over time.

Risks and Benefits of Investing in the S&P 500

While the S&P 500 offers many benefits, it’s important to understand both the advantages and the risks involved.

Benefits:

- Diversification: The S&P 500 provides broad exposure to the U.S. economy, reducing the risk associated with individual stocks or sectors.

- Long-Term Growth: The index has historically delivered strong long-term returns, making it a solid choice for long-term investors.

- Inflation Hedge: Over time, the S&P 500 has outpaced inflation, helping to preserve the purchasing power of your investment.

Risks:

- Market Volatility: The S&P 500 is subject to short-term volatility due to factors like economic data, geopolitical events, and changes in investor sentiment.

- Concentration Risk: Despite its diversification, the index is heavily weighted toward large-cap stocks, particularly in the technology sector, which can lead to concentration risk.

- Inflation Risk: While the S&P 500 has historically outpaced inflation, there is no guarantee that it will continue to do so in the future, especially during periods of economic downturn.

Sources: