- Buffett sold nearly half of Berkshire’s position in Apple last quarter.

- He stopped buying one of his favorite stocks too.

- The combination suggests Buffett doesn’t like what he sees in the market right now.

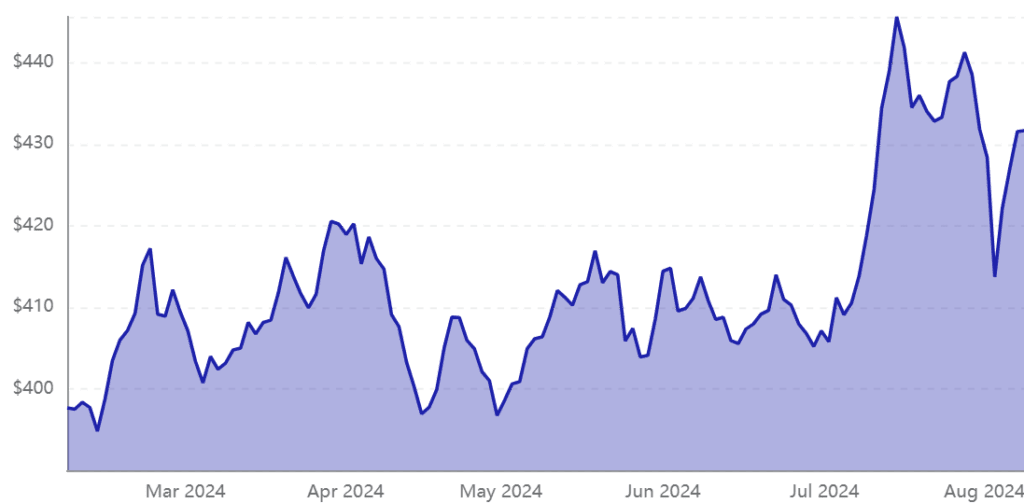

Warren Buffett, revered as one of the greatest investors, has turned Berkshire Hathaway into a $900 billion conglomerate through astute investments. However, recent moves suggest Buffett is wary of the current market. Berkshire’s cash and Treasury bills surged to $277 billion in Q2, signalling that Buffett isn’t finding attractive opportunities.

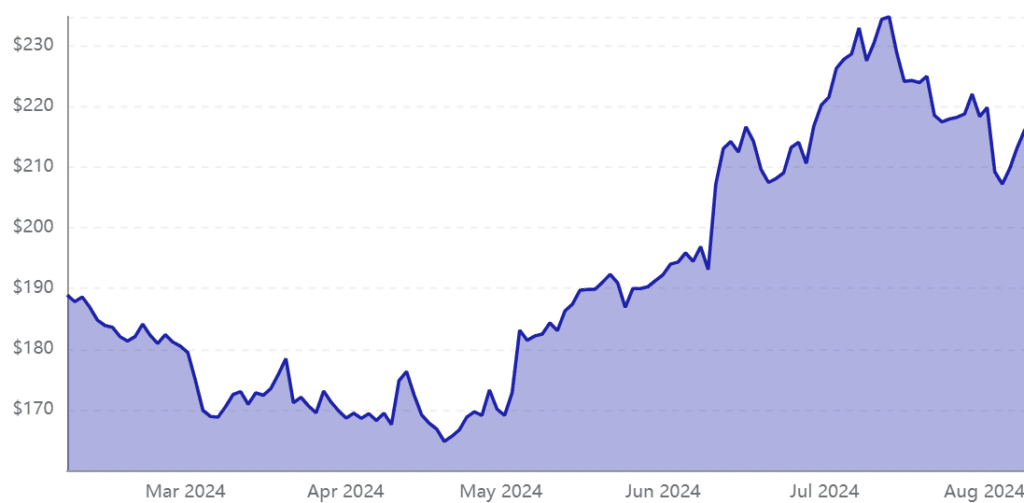

Last quarter, Buffett sold over $77 billion in stocks, marking his largest sale ever, including significant trimming of Apple shares. Despite the favourable tax environment, Buffett’s minimal reinvestment indicates caution. Even his long-standing strategy of buying back Berkshire stock has paused, with repurchases in June the smallest since 2018.

Buffett’s actions hint at his scepticism about current market valuations. While he’s always optimistic about America’s long-term prospects, the short-term outlook seems less promising. For average investors, though, opportunities in small-cap stocks or broad-based index funds remain viable, even if Buffett is holding back.