The general government financial accounts cover transactions in financial assets and liabilities as well as the stock of financial assets and liabilities. In recent quarters, the liabilities of euro-area governments increased because governments borrowed to finance their deficits to acquire assets. The incurrence of liabilities occurred notably by issuing long-term debt securities (bonds) that are issued with a maturity longer than a year. At the end of the first quarter of 2024, these financial instruments made up around 70% of the total liabilities of the euro-area governments.

This information comes from data on quarterly government finance published by Eurostat today. The article presents a handful of findings from the more detailed Statistics Explained article.

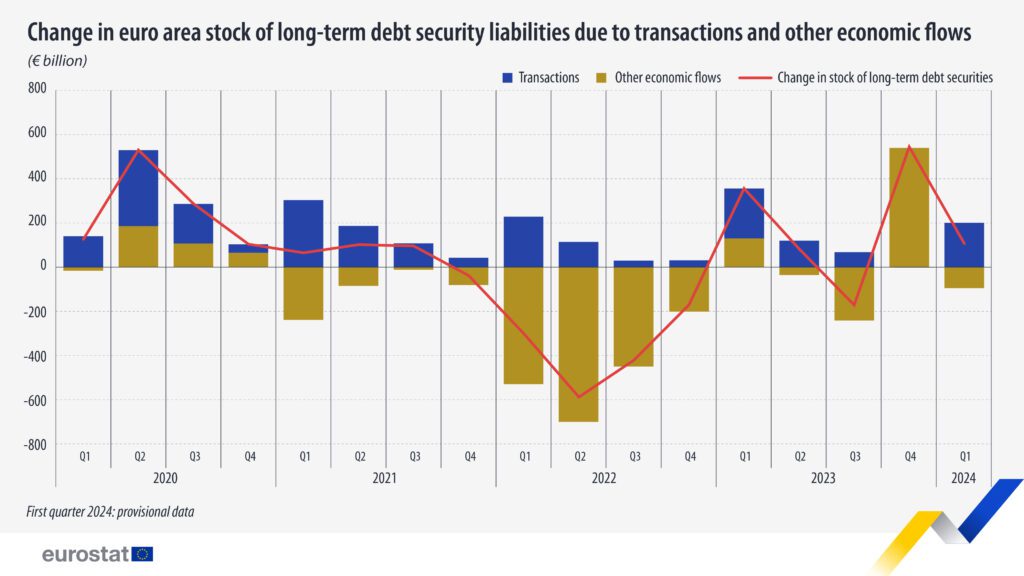

The outstanding amount of liabilities changes either due to transactions (mainly due to net issuances, but also due to accrued interest) or due to other economic flows (mainly price changes also known as nominal holding gains or losses, e.g. due to changes in the prevailing interest rates). As long-term debt securities are traded on the financial markets, the market value of these instruments changes constantly over time. In the first quarter of 2024, the market value of euro area long-term debt securities declined by around €95 billion, while the net issuance of long-term debt securities amounted to around €201 billion. This resulted in a €106 billion higher stock at market value at the end of the first quarter of 2024 as compared with the end of 2023.

Credit: Europa.eu