The cryptocurrency market, led by Bitcoin, has shown significant fluctuations in 2024, driven by institutional interest and mainstream acceptance. Bitcoin’s price has been influenced by global economic trends, central bank policies, and geopolitical events.

German Government’s Bitcoin Sell-Off Shakes the Market

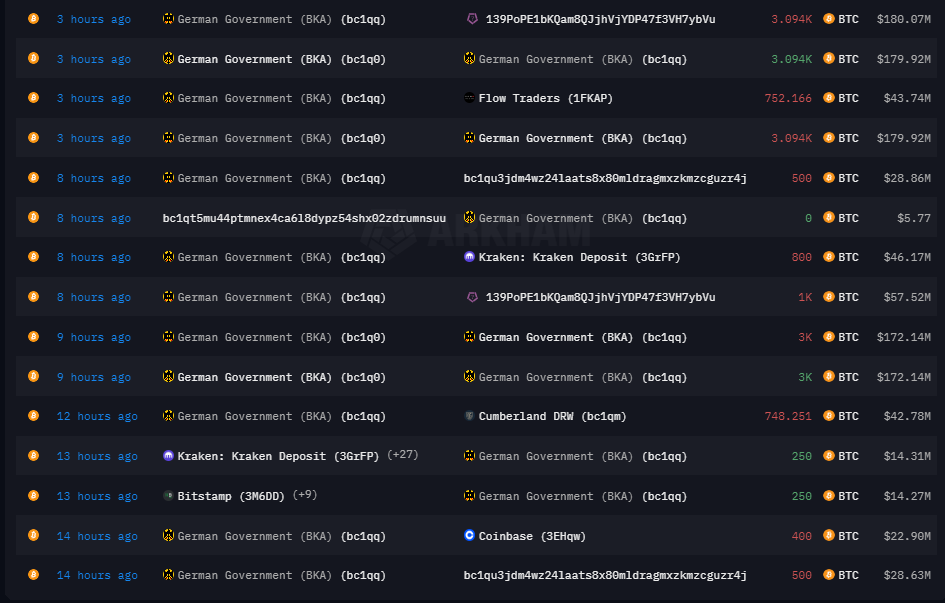

The recent German government sell-off of 50,000 Bitcoin has sent shockwaves through the cryptocurrency market. Initially holding these Bitcoins from seized illegal activities, the German government decided to liquidate its holdings. This massive sell-off culminated in the transfer of 3,846.05 BTC, valued at approximately $223 million, to entities like Flow Traders and 139Po. This final transaction marked the complete depletion of Germany’s Bitcoin reserves.

The rapid disposal of 42,000 Bitcoin within a week, averaging 250 Bitcoin per hour, flooded the market and exerted significant downward pressure on Bitcoin’s price, causing a 25% decline to levels not seen since February. This price drop, coupled with the concurrent Mt. Gox repayments, led to a $170 billion loss in combined market capitalization within a single day.

Market Reaction and Future Predictions

Despite the current bearish trend, analysts see the potential for a bullish reversal if the market successfully absorbs the remaining selling pressure. Bitcoin’s resilience and continued growth amidst these fluctuations solidify its position as a cornerstone of the cryptocurrency ecosystem.

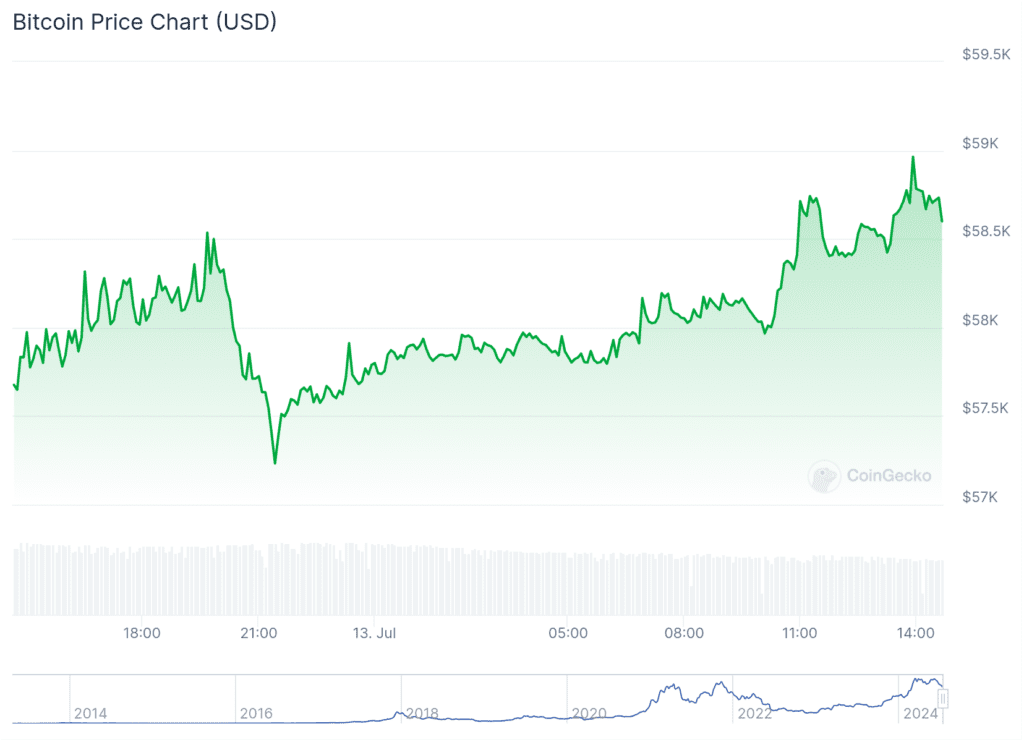

As of now, Bitcoin was trading above $58k after surging by 1.7% in the last 24 hours and 3.2% in the last seven days. The $60,000 level is seen as a critical supply zone, and the market’s ability to absorb recent selling pressure will be instrumental in determining future price trends.

Some analysts emphasize the importance of reclaiming the $59,000 mark as a confirmation of a broader upward reversal, with $56,500 acting as a crucial support level. Technical indicators and historical price patterns suggest that this price zone holds significant importance for Bitcoin’s immediate trajectory.

Bullish Outlook

Looking ahead, some analysts, like Crypto Rover, predict a bullish surge to $100,000, driven by factors like the launch of spot Ethereum ETFs in the USA and reduced sell pressure following the German government’s Bitcoin offload. Similarly, Mikybull Crypto suggests a potential spike to $90,000, citing a bullish megaphone pattern characterized by higher highs and lower lows. However, not all analysts share this optimism; Yoddha notes that Bitcoin’s dominance has been consolidating, hinting at a potential drop if resistance levels fail to break.

The optimistic forecasts hinge on Bitcoin’s ability to break through these critical thresholds, potentially setting the stage for a significant price rally towards the $100,000 mark. Investors remain cautious, closely monitoring price movements and potential catalysts for future trends.