A holiday-shortened week is still packed with market-moving moments, and investors are heading in with one big question: is the US economy cooling gently, or are markets about to get another AI-driven “shoot first, ask questions later” wave?

Last week’s turbulence showed how fast sentiment can flip when a new AI headline hits software, finance, logistics, or even retail. Now, the focus shifts to inflation, growth, the Fed’s next move, and two bellwether earnings reports.

1) PCE inflation: the Fed’s favorite gauge

Friday’s Personal Consumption Expenditures (PCE) report is the main event. Markets will watch both consumer spending and core PCE inflation, the Fed’s preferred inflation gauge.

The expectation is 0.3% month-on-month for core PCE, up from 0.2% previously, with the yearly pace seen around 3.0%. After the recent CPI surprise on the cooler side, this report matters because it can either keep rate-cut hopes alive or push them back.

2) GDP check: is growth slowing from Q3?

Investors also get an advance look at Q4 US GDP. Forecasts point to growth cooling from 4.4% in Q3 to roughly 2.8% in Q4.

Why it matters: if growth slows while inflation stays sticky, markets can get stuck in a messy middle where the Fed feels less pressure to cut quickly.

3) Fed minutes: what did policymakers really say behind closed doors?

Wednesday’s FOMC meeting minutes should add more color to the Fed’s January decision to hold rates steady. Traders will be reading for:

- how worried officials are about inflation persistence

- how confident they are in labor market stability

- what conditions could justify rate cuts later in 2026

Leadership uncertainty is also in the background, with investors trying to game out what a potential shift at the top could mean for the Fed’s tone and tolerance for inflation.

4) Walmart earnings: the consumer’s reality check

Walmart is the headline earnings report. It matters because it is one of the clearest windows into how US consumers are behaving, especially after the holiday season.

Investors will listen for:

- traffic and volume trends

- whether shoppers are trading down

- guidance that hints at consumer confidence into spring

5) Palo Alto Networks: cybersecurity meets the AI spending debate

Palo Alto Networks reports Tuesday after the close, and it lands right in the middle of two market obsessions: AI disruption and AI-driven spending.

Cybersecurity demand has held up well, but markets are sensitive right now. If guidance disappoints, the reaction could spill into other tech names that are already being repriced on fears of AI shifting competitive moats.

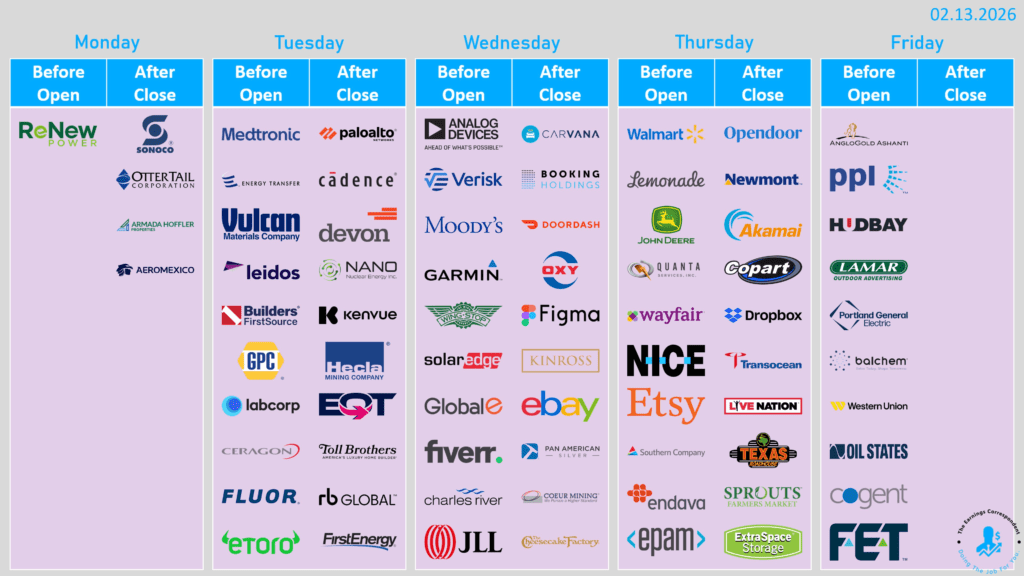

Quick cheat sheet: the week’s main catalysts

- Monday: US markets closed for Presidents’ Day

- Wednesday: Fed minutes

- Thursday: Walmart earnings

- Friday: PCE inflation + consumer spending, plus GDP

If you want, paste your current watchlist tickers and I will turn this into a tight “week-ahead trading plan” style summary with bull case, bear case, and key levels to watch for each.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: US Stocks are losing the global race. Should Investors Be Worried?