Investors are shifting away from crowded tech trades and piling into smaller, cheaper companies, signalling a clear change in risk appetite after weeks of sharp market swings.

The rotation was on full display late last week. While the Dow Jones Industrial Average hit a fresh record, software stocks lost roughly $1 trillion in market value over the week, highlighting how quickly sentiment has turned against some of the market’s biggest winners.

From megacaps to small caps

The shift showed up clearly in the indexes. The Russell 2000, which tracks smaller US companies, jumped 3.5% on Friday, outpacing both the S&P 500 and the Nasdaq 100. Investors are increasingly questioning whether the biggest AI beneficiaries can justify their valuations after years of outsized gains.

Market participants are reassessing exposure to AI hyperscalers such as Amazon, Microsoft, and Alphabet. Concerns center on whether massive capital spending plans will translate into durable profits, and how much disruption AI could cause to existing business models.

As one strategist put it, investors are now “chasing cheaper companies”, sometimes broadly, as they rebalance away from the most crowded trades.

Market broadening accelerates

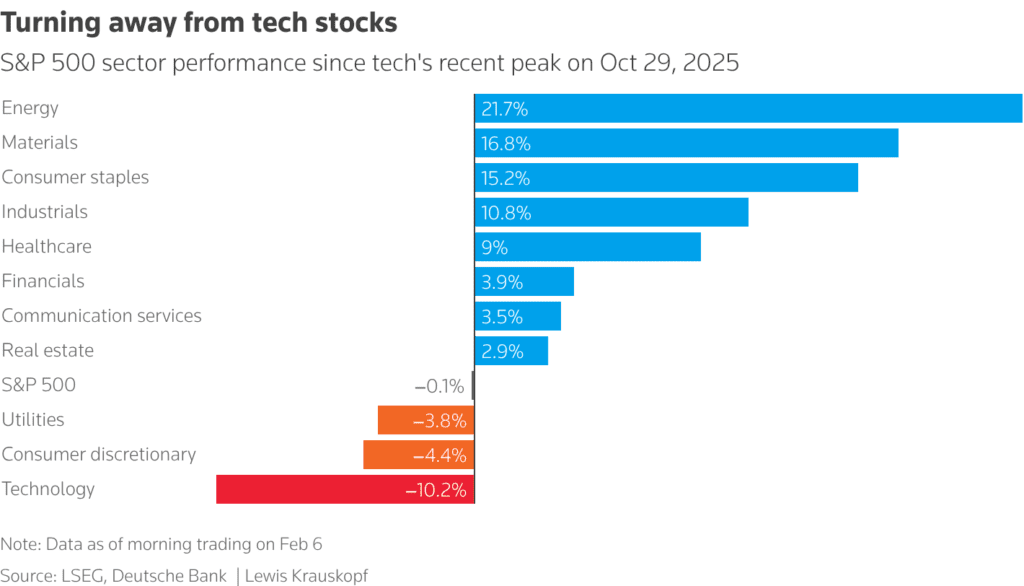

After years in which megacap technology dominated returns, money is flowing into areas that had been sidelined. Industrials, healthcare, energy, materials, staples, dividend growers, equal-weighted indexes, and small caps are all seeing renewed interest.

This broadening reflects a deeper change in risk perception. Volatility has spiked across assets that were previously seen as one-way trades, including tech, precious metals, and cryptocurrencies. Bitcoin, for example, briefly fell to a 16-month low near $60,000 before rebounding, underscoring how fragile confidence has become.

Doubts linger over AI returns

Despite Friday’s rebound in major indexes, caution remains. Tech-focused funds recovered some ground, but many are still sharply lower on the week, suggesting the rally did not erase underlying anxiety.

Strategists say the key questions now revolve around returns on AI investment and the long-term impact on legacy businesses. Defensive stocks have begun to outperform, a sign that investors may be positioning not just for a short-term trade, but for a more durable shift in market leadership.

The bigger picture

The result is a market increasingly split between longtime favorites and a new group of potential leaders. While headlines remain dominated by the AI debate, money has already been moving quietly into energy, materials, staples, and industrials, many of which are posting double-digit gains year to date, far ahead of the broader market.

In short, investors are no longer content to simply buy more of what already worked. They are repricing risk, widening their focus, and preparing for a market where leadership looks very different from the last few years.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: America’s Most Successful Small-Caps: The Little-Known Companies Powering The AI Revolution

New Market Divide: Growth Stock Power vs. Small-Cap Opportunity

12 cheap stocks to consider as small-caps start looking like market leaders

How Some Small Businesses Could Escape from the Trump’s Tariff Plans