Meta just delivered one of its strongest quarters in years. But the real market mover was not the numbers. It was the message.

After a difficult 2025 for Meta’s AI ambitions, CEO Mark Zuckerberg used the Q4 earnings call to lay out a full reset of the company’s AI strategy. Wall Street liked what it heard.

Shares jumped more than 10%.

Strong quarter sets the stage

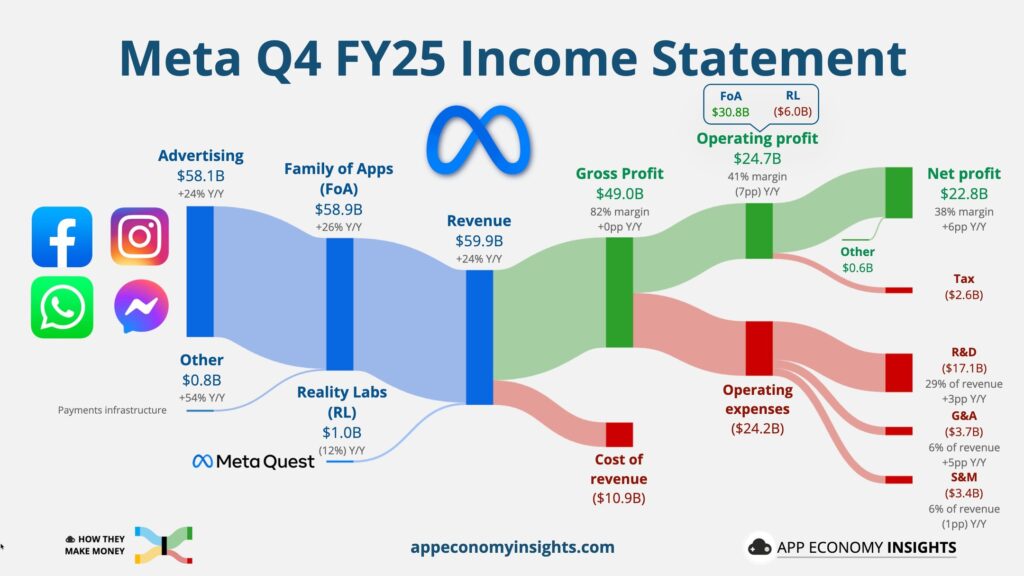

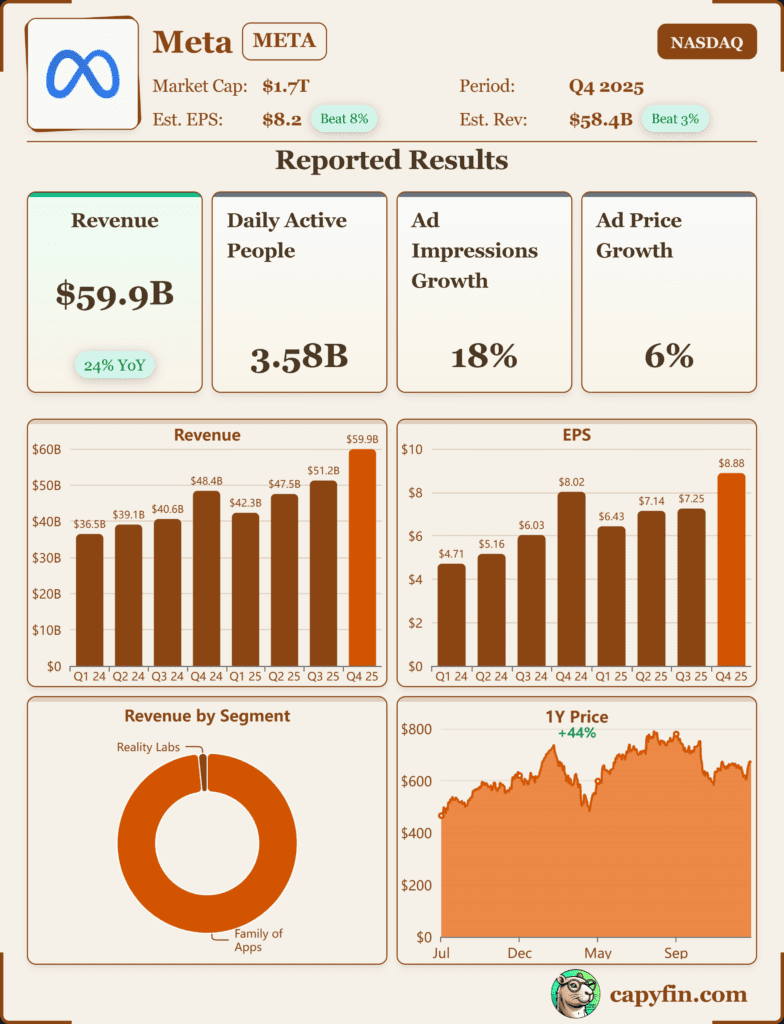

Meta reported a clear beat on both earnings and revenue in Q4, reinforcing that its core advertising business remains healthy. But investors were focused less on the backward looking results and more on what comes next.

And Zuckerberg made it clear: 2026 is all about AI execution.

From AI stumble to AI reboot

Meta spent much of 2025 repairing damage from its AI missteps.

The release of the Llama 4 models last spring disappointed developers and researchers. The company delayed its most ambitious model, Llama 4 Behemoth. Then came further embarrassment when former chief AI scientist Yann LeCun said publicly that some benchmarks were overstated.

Zuckerberg responded aggressively.

- Meta bought a $14.3 billion stake in Scale AI

- Scale AI CEO Alexandr Wang was hired to lead Meta’s new Superintelligence Lab

- Meta reorganized its AI leadership and hiring strategy

By late 2025, Meta’s AI group looked very different.

What Meta plans to ship in 2026

Zuckerberg told investors new AI models and products will begin rolling out in the coming months.

He said early versions will be “good” but emphasized steady improvement throughout the year, with Meta pushing model capabilities forward month by month.

The core goal is personalization at scale. Meta plans to embed its AI models deeply into:

- Advertising systems

- Content recommendations

- User feeds across Instagram, Facebook, and other apps

Zuckerberg said Meta’s AI will understand individual goals and preferences, then tailor content to help users “improve their lives in the ways that they want.”

He also teased new AI generated media formats, moving beyond static photos and traditional video toward more interactive and immersive content.

Smart glasses become part of the AI story

AI is not just staying on screens.

Meta said sales of its Ray Ban Meta smart glasses tripled in 2025. Zuckerberg positioned smart glasses as a key interface for AI going forward, blending assistants, content, and real world context.

The long term vision is simple: open a Meta app or put on Meta glasses, and your AI is already there, personalized and proactive.

The price tag is massive but the tone changed

All of this comes at a cost. Meta expects to spend up to $135 billion in capital expenditures in 2026, mostly on AI infrastructure and data centres.

In past quarters, that number scared investors. This time, it did not.

Analysts said the spending outlook was “not as bad as feared,” and more importantly, that Meta is already seeing revenue upside from prior AI investments.

As Wedbush noted, the aggressive investment cycle is now showing returns, shifting the debate from “is this too expensive?” to “how big can this get?”

More about: Meta’s Billion-Dollar Chip Shift Shakes the AI Market: Nvidia, Google, Meta

Why the market bought in

The difference this quarter was credibility.

Meta showed:

- Strong core business performance

- Clear AI leadership changes

- A focused product roadmap

- Early signs of AI driven revenue impact

After a year of uncertainty, Zuckerberg sounded confident, structured, and specific. Investors responded accordingly.

This was not just an earnings call. It was a reset. Zuckerberg is asking investors to forget Meta’s AI mistakes of 2025 and focus on a rebuilt AI organisation heading into 2026. The market, at least for now, is willing to give him that chance.

The next test is execution.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.