Last week ended with stocks basically flat but still bruised. The S&P 500 closed Friday at 6,915.61 (barely up), the Nasdaq stayed green, and the Dow lagged hard. Meanwhile, investors kept buying “insurance” elsewhere: gold near $5,000, silver above $100, and a weaker dollar are all flashing the same message: people are not fully relaxed.

Now we are walking into one of the busiest weeks of the quarter, where one sentence from the Fed or one surprise from Big Tech can move everything.

1) The Fed decision on Wednesday: it’s not the rate, it’s the tone

The FOMC meeting runs January 27 to 28, with markets set up for a no change decision.

The bigger trigger will be how the Fed talks about:

- Inflation: steady, but still sticky enough to keep the Fed cautious.

- Jobs: not collapsing, but not booming either.

- Timing for the next cut: the market has been leaning toward “later, not now,” with June often mentioned as the next realistic window.

What to watch live:

- Do they sound confident or defensive?

- Do they signal “higher for longer” quietly, or do they open the door to earlier easing?

2) Powell drama and the “next Fed chair” guessing game

This is the part traders cannot price cleanly.

There is fresh anxiety about Fed independence, because the Powell situation is turning into a political headline, not just a monetary policy story. That matters because markets hate one thing more than high rates: unpredictable rules.

So this week, investors will be watching two tracks at once:

- The Fed statement and Powell’s press tone

- Any new signals about who replaces Powell and how aggressive that person might be on cuts

More about: What’s Next for the US Fed in 2026?

3) Big Tech earnings: 2026 is turning into a “prove it” year

Investors tolerated massive AI spending for a long time because the story was exciting. Now the mood is shifting to: OK, where are the returns?

This week’s big idea:

- Are companies turning AI capex into revenue, margin protection, and real demand, or is it still mostly promise?

Names that can set the market tone include Microsoft, Meta, Apple, Tesla, plus key AI supply chain reads like ASML (Europe’s crown jewel in chip equipment).

4) ASML: the quiet kingmaker of the AI buildout

ASML sits in a powerful spot because it sells the equipment that makes the most advanced chips possible.

What traders will listen for:

- Is AI demand pulling forward orders, or are customers spacing out spending?

- Does management sound confident about 2026, or cautious despite the hype?

ASML’s commentary often ends up being a read-through for the whole semiconductor chain.

5) Trump’s fresh tariff threat: Canada is the next stress test

Even after the Greenland tariff drama cooled, the bigger theme is still here: policy headlines can hit markets first, details later.

Now the focus is on a new Trump warning: 100% tariffs on Canada if it pursues a trade deal with China (Canada says it has no intention). The key market risk is not whether it happens tomorrow, but whether this style of threat keeps multiplying and slowly dents confidence.

The Week Ahead: Economic Events Table

| Day | Key events |

|---|---|

| Mon | Chicago Fed National Activity Index; Durable Goods; Dallas Fed Manufacturing |

| Tue | Consumer Confidence; Richmond Fed Manufacturing; housing data |

| Wed | Fed rate decision (FOMC) |

| Thu | Jobless claims; Trade balance; Factory orders |

| Fri | PPI inflation data |

(Your biggest single volatility window is Wednesday into Thursday: Fed decision, then the market processes it alongside major earnings.)

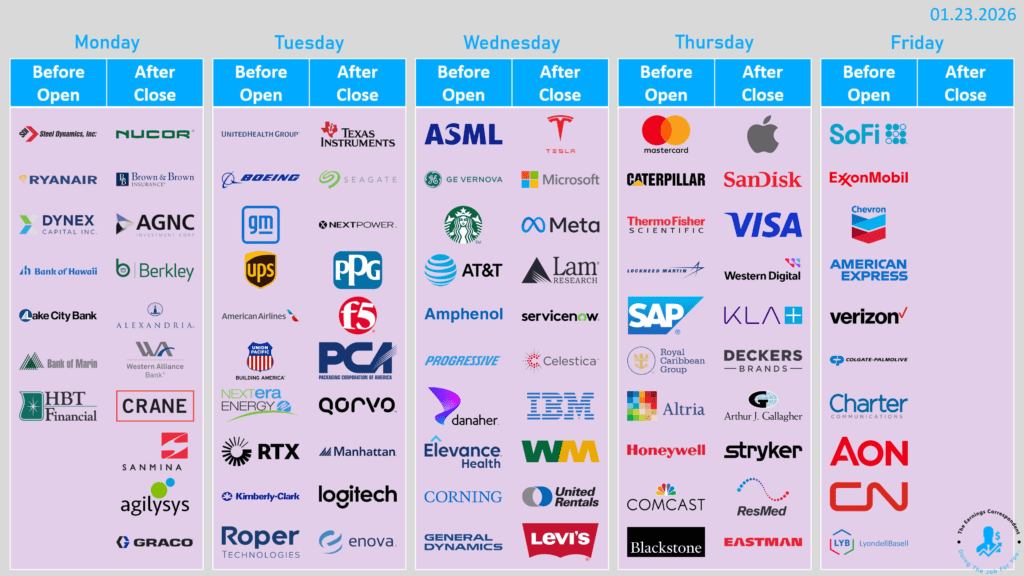

Earnings Calendar Table: The Names That Can Move the Whole Market

| Day | Major earnings (selected highlights) |

|---|---|

| Mon | SCCO, NUE, RYAAY, WAL |

| Tue | UNH, BA, GM, UPS, TXN, RTX, NEE, UNP, HCA |

| Wed | MSFT, META, TSLA, ASML, IBM, NOW, SBUX, T |

| Thu | AAPL, V, MA, CAT, SAP, HON, LMT, BX, KLAC |

| Fri | XOM, CVX, AXP, VZ, SOFI |

This week is all about Wednesday’s Fed decision and Big Tech earnings. Rates will likely stay unchanged, but Powell’s tone and any hint about future cuts can move markets fast. At the same time, Microsoft, Meta, Apple and Tesla must finally show returns on massive AI spending. Add fresh tariff threats and a weaker dollar, and volatility is likely to stay high. Investors should be ready for big swings, especially mid-week.

Related: Gold Nears $5,000, Silver Smashes $100 as Metals Post Stunning Rally