Global markets remained tense on Wednesday as investors waited for President Donald Trump’s speech at the World Economic Forum in Davos, hoping he may ease tensions over Greenland after a brutal selloff earlier in the week.

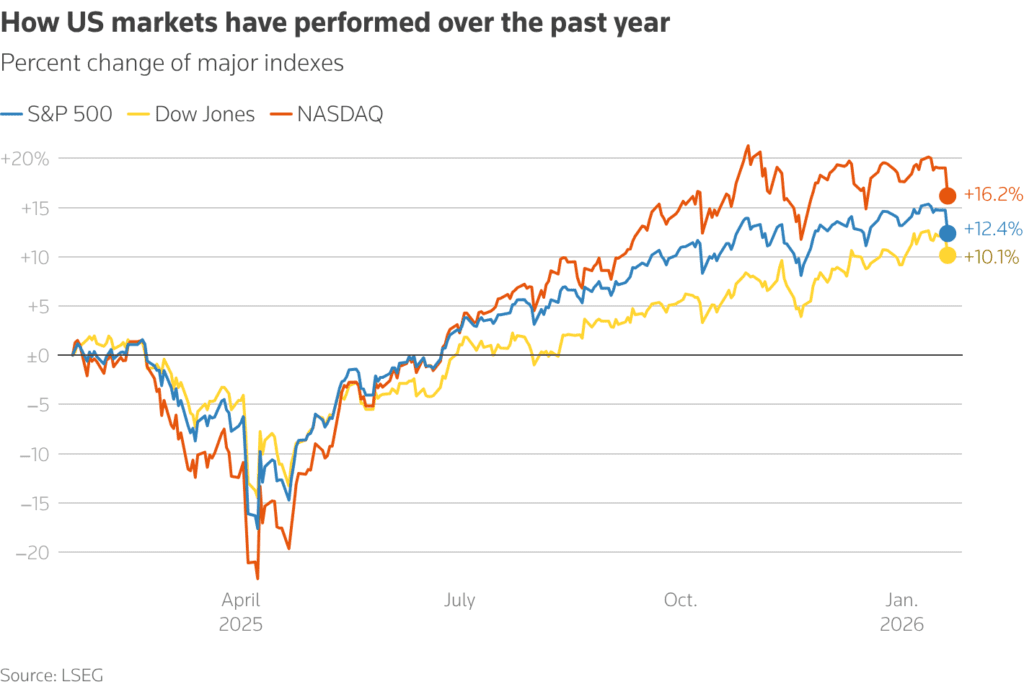

Wall Street had its worst one-day fall in three months on Tuesday. All three major US indexes dropped sharply, the dollar slid the most in a month, and US Treasuries were hit hard, with the 30-year yield racing toward 5 percent. The moves revived fears of a new “Sell America” trade.

Despite Trump signaling there would be no backing down on Greenland, investors are still hoping his Davos speech could bring a softer tone and reduce the risk of a trade war with Europe.

Markets Stabilize Slightly

Asian markets showed signs of calm:

- US stock futures rose about 0.3 percent

- Treasuries steadied after heavy selling

- Japan’s Nikkei cut losses to 0.5 percent

- European futures pointed to a flat open

Bond markets also paused after a sharp rout. Japan’s 40-year government bond yield fell slightly after a big jump the day before, easing pressure on global debt markets.

Safe Havens Stay Strong

Investors continued to seek protection: Gold jumped 1.5 percent above $4,800 per ounce

Platinum crossed $2,500 for the first time

The rally shows that fears over geopolitics, US assets, and central bank independence remain strong.

Big Events Today

Markets are watching several key events that could move prices:

- Trump’s major speech at Davos (The Trump Drama Hits Davos)

- UK inflation data

- ECB President Christine Lagarde speaking in Davos

- US Supreme Court hearing on Trump’s attempt to remove Fed Governor Lisa Cook

For now, investors are clinging to hope that Davos could bring de-escalation after days of sharp volatility driven by politics and trade tensions.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Gold powers above $4,800 as global risks fan record safe-haven rally