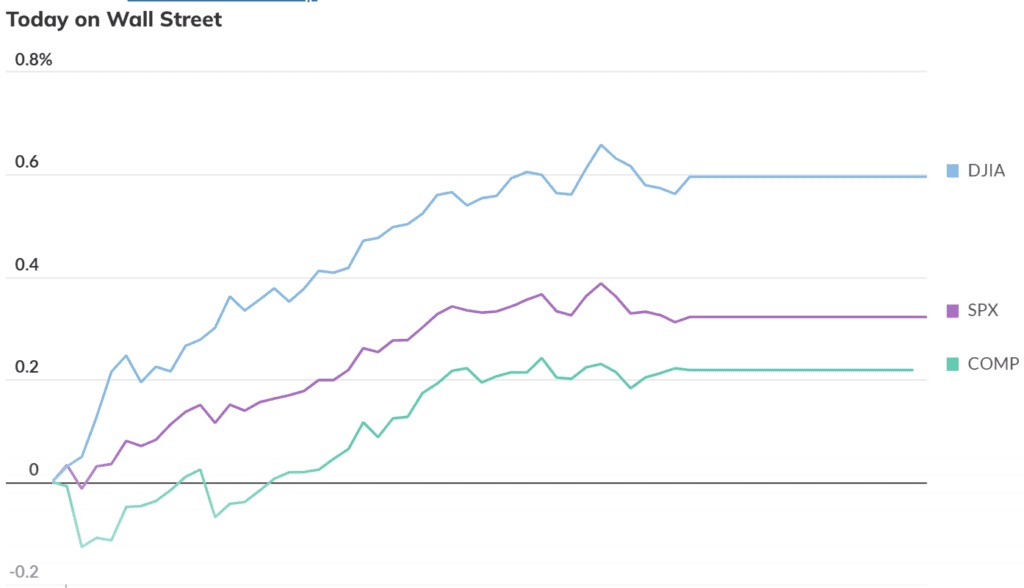

US stocks wrapped up Christmas Eve with a festive tone as the Dow Jones and S&P 500 closed at new all time highs in a quiet, holiday shortened session.

The S&P 500 rose 0.32% to 6,932.05, marking its first record close on Christmas Eve in more than a decade, while the Dow Jones climbed 0.6% to 48,731.16. The Nasdaq added 0.22%, extending a five day winning streak for all three major indexes.

Why markets moved higher:

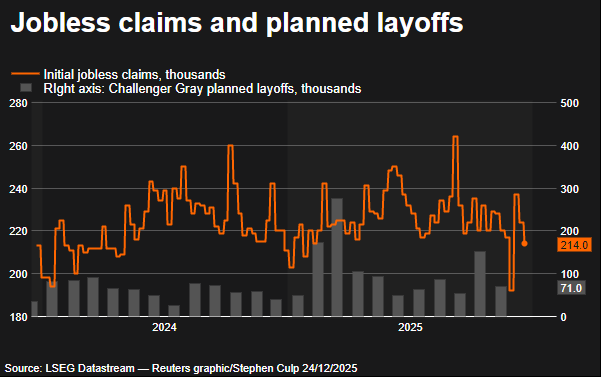

- Strong US economic data reinforced confidence in growth. Third quarter GDP was revised higher, and jobless claims unexpectedly fell, signaling ongoing labor market resilience.

- AI stocks rebounded after last week’s valuation driven selloff, helping lift growth names and overall sentiment.

- Bond yields stayed calm, easing pressure on equities as investors continue to price in roughly 50 basis points of Fed rate cuts in 2026, even if a January cut looks unlikely.

- Light volumes and holiday trading reduced downside volatility, a classic setup for year end strength.

Market participants also pointed to renewed optimism around new AI models from OpenAI and Meta, which helped revive enthusiasm after recent doubts over heavy capital spending in the sector.

Sector and stock highlights:

- Micron surged 3.8% to a record close after strong forward guidance.

- Financials outperformed, gaining around 0.5%.

- Energy was the only S&P 500 sector in the red.

- Nike jumped 4.6% after Apple CEO Tim Cook disclosed a $3 million share purchase.

- Intel slipped following reports Nvidia paused use of its 18A chip process.

With Wednesday marking the official start of the Santa Claus rally window, which runs through early January, investors are watching to see whether seasonal strength carries markets into 2026.

Despite a year filled with tariff headlines, AI valuation fears, and shifting rate expectations, the bull market that began in late 2022 remains intact, with all three major indexes on track for a third straight year of gains.

Quiet sessions, steady data, and cautious optimism. Wall Street is ending 2025 in a surprisingly festive mood.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Trump Says Fed Chair Should Cut Rates When Markets Are Strong

Trade, Tariffs, and Treasuries: The Hidden Cost of Trump’s Protectionism

Big Year for Old School Wall Street Trades Gets Lost in AI Hype

Markets Enter Final Stretch of 2025 With Santa Rally Hopes: What to watch