After a turbulent year marked by trade wars, market swings, and the longest government shutdown in US history, the US economy managed to avoid the recession many feared. Growth held up, inflation cooled, and output expanded. But for millions of households, survival has not translated into relief.

As 2026 approaches, the economy looks resilient on paper, yet strained on the ground.

Growth Held Up, but Momentum Slowed

Fresh data released after the shutdown-induced blackout shows the US economy never fully derailed in 2025. Economists expect revised figures to confirm that GDP grew at a solid pace in the third quarter, with full-year inflation-adjusted growth likely around 1.5%. That marks a slowdown from 2024, but it falls well short of a recession.

Job growth remained positive in November, retail sales stayed firm, and inflation eased. These outcomes contrast sharply with last spring’s warnings that sweeping tariffs under Donald Trump would trigger runaway inflation or stagflation.

Still, the data tells a more fragile story beneath the surface.

Unemployment Is Rising as Wage Growth Slows

While hiring continued, the unemployment rate rose, and wage growth began to cool, especially for lower-income workers. The labor market has softened enough to raise anxiety without collapsing outright, creating what economists describe as an uneasy limbo.

That tension is reflected in consumer sentiment surveys, where Americans consistently report feeling worse about their finances, even as macro indicators remain stable.

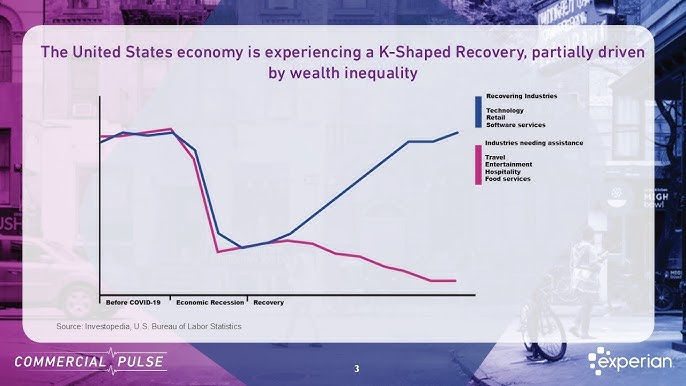

A K-Shaped Economy Becomes More Entrenched

The disconnect between economic growth and lived experience is widening. Consumer spending in 2025 has increasingly been driven by wealthy households, while lower-income Americans fall behind on bills. Car repossessions and other signs of financial distress have risen.

Economists say this bifurcation helps explain why many Americans feel left out of the recovery. Stock market gains tied to artificial intelligence have disproportionately benefited high earners, while slower wage growth and higher living costs weigh on everyone else.

More about: Why US Economy Is Being Called “K-Shaped” Again

Tariffs Did Not Break the Economy, but They Raised Costs

Tariffs did not ignite the inflation surge some predicted, but they did push up prices for certain goods. Housing remains unaffordable for many, child care costs stay elevated, electricity bills are rising, and health insurance premiums are set to increase as subsidies expire.

Trump has argued he inherited an economic mess, but when he returned to office, unemployment was low, wages were rising, and inflation was already easing from its 2022 peak. What followed was a volatile policy environment that rattled confidence.

Markets plunged after April’s tariff announcement, then recovered after partial rollbacks and delays. Companies adapted by stockpiling inventories and reworking supply chains, while many absorbed higher costs rather than passing them on to price-sensitive consumers.

AI Boom Propped Up Growth, but Benefits Were Uneven

One of the economy’s biggest shock absorbers in 2025 was the AI investment boom. Massive spending on data centers helped support business investment and lifted equity markets, encouraging consumer spending among asset-rich households.

“If it weren’t for the AI spending boom, we would be in a different place,” said economists tracking the data.

But that same boom deepened inequality. Stock gains accrued mostly to wealthy households, while workers with fewer assets faced slower pay growth and growing job insecurity.

Labor Market Strains Hit Some Groups Harder

Recent college graduates are facing their toughest job market since the aftermath of the Great Recession. Meanwhile, the unemployment rate for Black workers jumped sharply to 8.3% in November, more than double the rate for white workers.

Cuts to the federal workforce and safety net programs have hit Black households disproportionately. Economists warn these pressures may soon spread more broadly as labor conditions continue to cool.

Why Americans Still Feel Behind

Economists note that people judge the economy through a simple lens: affordability and opportunity. When housing, health care, energy, and child care remain out of reach, aggregate growth numbers carry little comfort.

“You can’t tell people what their reality is,” said former White House economic adviser Heather Boushey, reflecting on lessons learned from the previous administration.

Cautious Optimism for 2026

Looking ahead, many forecasters expect conditions to improve modestly next year. Tax cuts passed in 2025 should boost refunds and support early-year spending. Lower interest rates, following multiple cuts by the Federal Reserve, could ease pressure on borrowers and businesses.

Reduced policy uncertainty may also encourage companies to invest again after a year of hesitation.

Officials including John Williams say the economy proved its resilience in 2025. But risks remain. A slowdown in AI investment, renewed tariff escalation, or continued labor market erosion could quickly shift the outlook.

The US economy made it through 2025 without breaking. But for many Americans, survival came with higher stress, weaker job prospects, and rising costs. Whether 2026 brings relief will depend less on headline growth and more on whether jobs, wages, and affordability finally move in the right direction.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

From Inflation to His Wife’s Underwear Drawer, Trump’s Wide-Ranging NC Speech