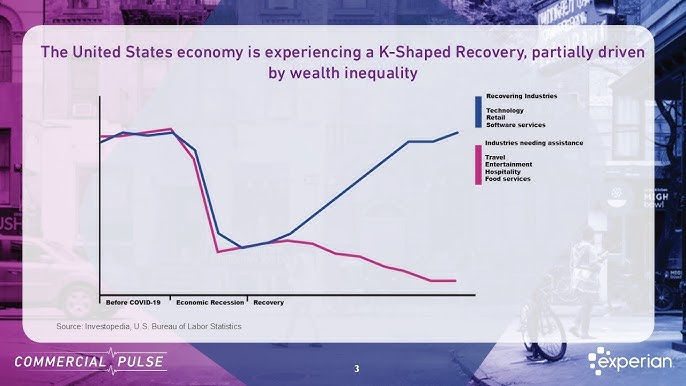

As US holiday spending is set to exceed $1 trillion for the first time, economists say the benefits are not being felt evenly across society. Instead, the economy is increasingly described as “K-shaped,” meaning different groups are experiencing very different financial realities.

In a K-shaped economy, wealthier households continue to spend confidently, while lower-income Americans face rising pressure from higher living costs, slower wage growth, and job market uncertainty. Data from Moody’s Analytics shows the top 10% of households account for nearly half of all consumer spending, highlighting the growing gap.

Consumer surveys reflect this divide. According to the University of Michigan, higher-income households report stable or improving sentiment, while lower-income consumers say they are cutting back, shopping at discount stores, or relying more on credit cards. A Bank of America holiday survey found 62% of Americans feel financially strained, and most plan to prioritize lower-cost purchases.

Labor market trends add to the picture. The unemployment rate has risen to 4.6%, its highest level in four years, while wage growth has slowed most for lower-paid workers. At the same time, financial markets remain near record highs, benefiting households with significant investments.

Corporate earnings also show the split. Companies selling luxury or premium products report strong demand, while many mass-market retailers note customers are trading down to cheaper options. Delta Air Lines, for example, has said premium ticket sales are growing faster than economy-class demand.

Federal Reserve Chair Jerome Powell has acknowledged the divide, noting that many companies report financial stress among lower-income consumers, even as wealthier Americans continue spending.

Economists say the term “K-shaped,” first popularized during the pandemic recovery, has endured because the underlying conditions remain. While parts of the economy continue to expand, others are struggling to keep pace, leaving Americans experiencing growth in sharply different ways.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: How Big Tech Created the 2025 AI Boom on Debt

6 Charts That Show How Stock Markets Got Reshaped in 2025