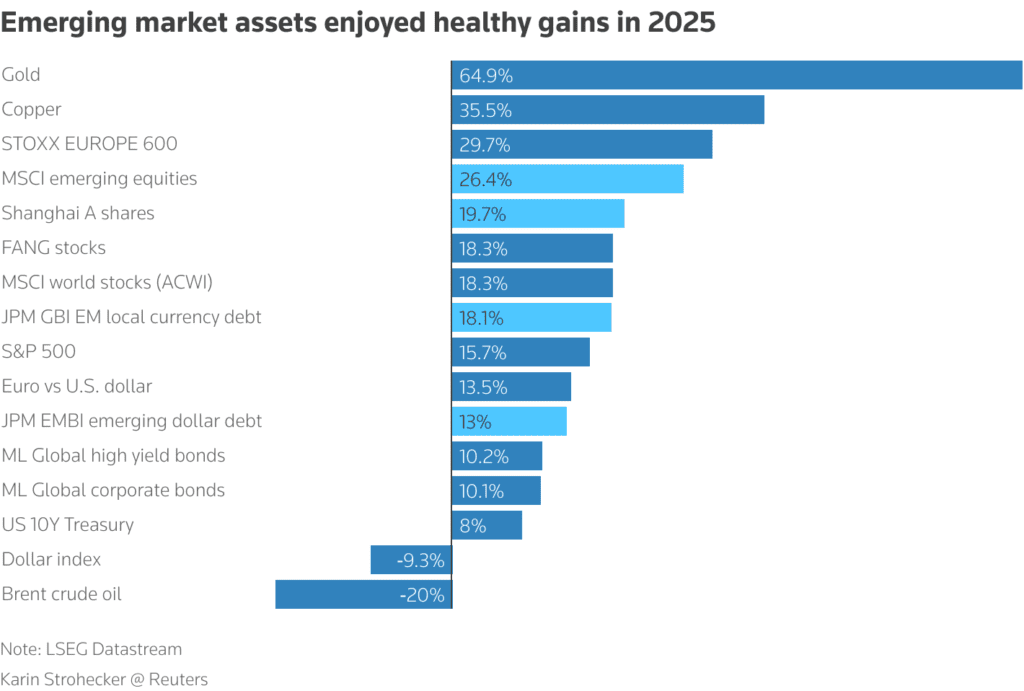

Emerging markets delivered exceptional returns in 2025, defying trade tensions, geopolitical risks, and policy uncertainty in the US and Europe. With local currency bonds up around 18% and stocks gaining roughly 26%, many investors now believe the asset class could extend its momentum into 2026.

Investors point to a mix of policy discipline, structural reforms, and diversification away from US assets as key drivers of the rally. Years of tough fiscal decisions and credible monetary policy have left many emerging economies on firmer footing than in the past.

“There are a lot of tailwinds transferring into next year,” said Elina Theodorakopoulou of Manulife Investment Management, citing improved policymaking and stronger fundamentals across several countries.

Reforms Pay Off Across Key Economies

Country-level shifts played a major role. Turkey’s return to orthodox economic policies, subsidy reforms in Nigeria, IMF-backed adjustments in Egypt, and post-default restructurings in Ghana, Zambia, and Sri Lanka have helped restore investor confidence. Analysts also highlight a growing trend of credit rating upgrades, reinforcing the view that fundamentals are improving.

“From a sovereign credit perspective, momentum is clearly positive,” said James Lord of Morgan Stanley, noting year-on-year gains in ratings across emerging markets.

Currencies and Central Banks Boost Returns

Emerging market central banks earned praise for credible and cautious rate cuts, often moving ahead of the US Federal Reserve without undermining currencies. That discipline helped EM currencies outperform as the dollar weakened, driving strong inflows into local currency debt.

“When it comes to monetary policy, credibility is probably as high as it has ever been in EM,” said Charles de Quinsonas of M&G.

Optimism Rises, But Risks Remain

Despite concerns over US growth, potential Fed policy shifts, and elections across emerging economies, investor sentiment has turned decisively positive. An HSBC survey showed bearish views on emerging markets have disappeared, with sentiment at a record high.

That optimism itself is giving some strategists pause. David Hauner of Bank of America warned that unanimous confidence can be a contrarian signal, noting that history suggests caution when “everybody agrees on the direction of the market.”

Still, many investors argue that emerging markets are less vulnerable to US shocks than in the past, thanks to stronger balance sheets, better policy frameworks, and a broader global investor base.

As 2026 approaches, the debate is no longer about whether emerging markets can recover, but whether their resilience and reforms can sustain another year of outsized gains.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Wild Currency Swings Put Emerging Markets in the Global Spotlight as Dollar Weakens