A wave of AI anxiety is reshaping the stock market, sparking a long-awaited rotation into value and cyclical sectors as investors question Big Tech’s stretched valuations.

- Recent weakness in tech stocks, led by sharp pullbacks in Oracle and Broadcom, has triggered a shift toward small caps, energy, and industrial names.

- The Russell 2000 Index hit record highs this week, showing investors are ready to look beyond AI-driven giants.

- Fed rate cuts have further boosted cyclical optimism, while corporate earnings outside tech continue to impress.

From AI Euphoria to Market Maturity

After a year dominated by AI-powered enthusiasm, Wall Street is entering a new phase. As Eric Teal of Comerica Wealth Management noted, “The market has shifted as valuations, sustainability around margins, and debt controversy developed around the technology sector.”

That shift is healthy, analysts argue. A pullback in tech stocks gives space for other sectors to recover and broadens the rally’s foundation. As Thomas Shipp of LPL Financial put it, “A retreat from the AI theme may be required for value stocks to outperform next year.”

Volatility Returns, But Not Doom

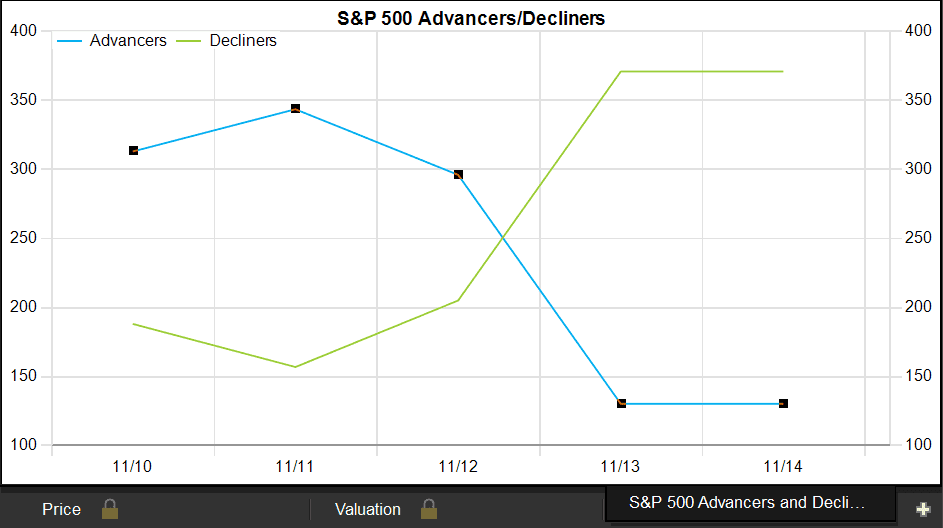

Volatility is rising, but investors aren’t panicking. Joe Mazzola of Charles Schwab said the week’s trading showed a sector reshuffle, not a meltdown. Healthcare and energy stocks climbed more than 4% this month, while information technology fell nearly 4%.

The S&P 500 remains near its 50-day moving average, showing resilience despite turbulence. Meanwhile, 10-year Treasury yields rose to 4.14%, a reminder that inflation worries still hover even as markets price in more Fed cuts.

AI, Inflation, and the Next Chapter

The AI trade isn’t dead, it’s maturing. After massive spending by cloud and chip leaders, investors are demanding clearer profits. Some analysts even see the pullback as essential to sustain the bull market.

As Adam Hetts of Janus Henderson Investors noted, “This volatility is an opportunity to focus on names with more staying power.”

With rate cuts on the horizon and rotation accelerating, the market’s leadership may finally expand beyond Silicon Valley.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: US Treasury’s Bessent: AI Will Be the Single Biggest Driver of Economic Growth