The first week of December brings a packed schedule of economic releases and corporate earnings that could shape investor sentiment ahead of the Federal Reserve’s policy meeting on December 9–10. With traders betting heavily on a December rate cut, this week’s data on inflation, spending, and employment will be crucial in confirming whether the economy is cooling fast enough for the Fed to ease further.

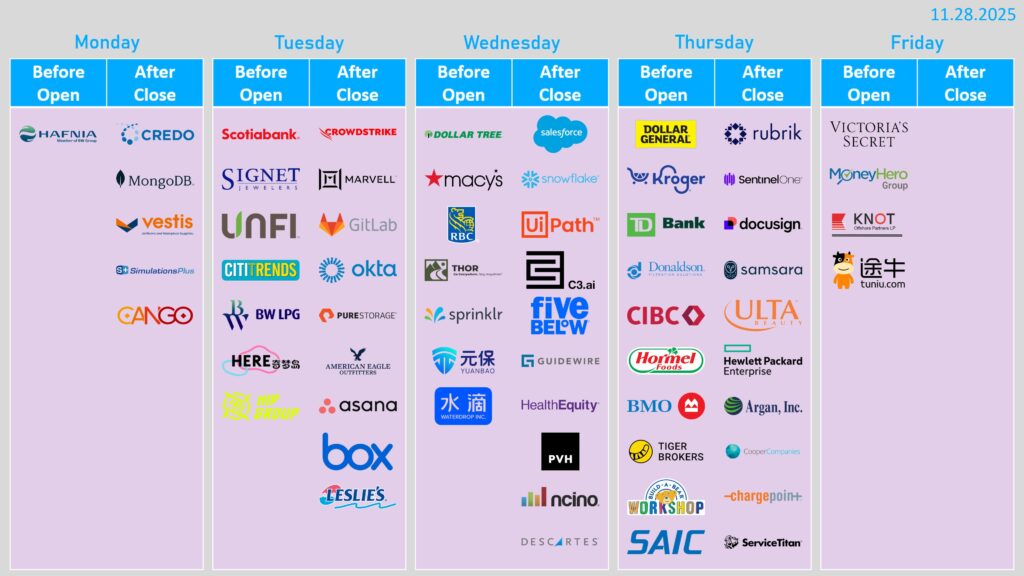

Markets will also be watching several big-name earnings, including Salesforce, Snowflake, Macy’s, and Dollar General, as retailers and tech companies wrap up one of the busiest quarters of the year.

Monday, Dec. 1

- Economic Data: October Construction Spending (0%), ISM Manufacturing Index (49.3, up from 48.7)

- Earnings: Credo Technology Group (CRDO), MongoDB (MDB), New Fortress Energy (NFE)

Tuesday, Dec. 2

- Economic Data: None scheduled

- Earnings: CrowdStrike (CRWD), Bank of Nova Scotia (BNS), Marvell Technology (MRVL), Okta (OKTA), American Eagle Outfitters (AEO)

Wednesday, Dec. 3

- Economic Data: ADP Employment (+42.5K), Capacity Utilization (77.3%), Industrial Production (0%), S&P Global US Services PMI (55), ISM Services Index (52)

- Earnings: Salesforce (CRM), Snowflake (SNOW), Dollar Tree (DLTR), Five Below (FIVE), Macy’s (M), C3.ai (AI), Uranium Energy (UEC), Royal Bank of Canada (RY)

Thursday, Dec. 4

- Economic Data: Initial Jobless Claims (previous 216K), Challenger Job Cuts (YoY)

- Earnings: TD Bank (TD), Bank of Montreal (BMO), Hewlett Packard Enterprise (HPE), Ulta Beauty (ULTA), Dollar General (DG), Samsara (IOT), DocuSign (DOCU), Brown-Forman (BF.A, BF.B), Rubrik (RBRK)

Friday, Dec. 5

- Economic Data: Personal Income (+0.3%), Personal Spending (+0.3%), PCE Deflator (+2.8% YoY), Core PCE (+2.8% YoY), University of Michigan Sentiment (53 expected)

- Earnings: Victoria’s Secret (VSCO)

Investors will be laser-focused on Friday’s PCE inflation data, the Fed’s preferred price gauge, to gauge whether another rate cut is justified. Strong retail and tech earnings could reinforce optimism heading into year-end, but any upside surprise in inflation may quickly test that confidence.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Markets This Week: Investors Eye PCE Data, Fed Rate Cut Hopes, and Big Earnings