Japan’s 30-year government bonds surged on Thursday after a strong auction showed investors piling into long-dated debt despite growing expectations of a Bank of Japan (BOJ) rate hike this month.

The yield on the 30-year Japanese Government Bond (JGB) fell four basis points to 3.38% after the Ministry of Finance’s auction drew a bid-to-cover ratio of 4.04, the highest since 2019 and well above last month’s 3.125. The strong turnout followed a solid 10-year auction earlier this week, where investors also stepped in as yields reached attractive levels.

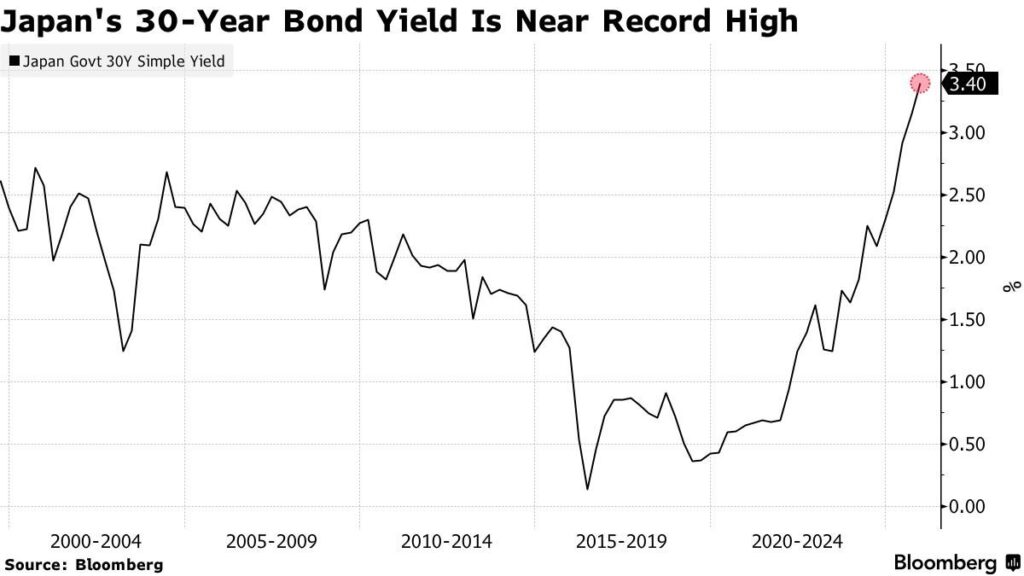

Before the auction, 30-year yields had touched 3.445%, the highest since the maturity was introduced in 1999, while the 10-year yield climbed to 1.92%, its highest since 2007.

Ryutaro Kimura, senior fixed-income strategist at AXA Investment Managers, said the unexpectedly strong demand reflected renewed confidence in the super-long end of Japan’s bond market. “Many investors considered it acceptable to increase exposure to super-long bonds when yields exceeded 3.4%,” he said. “This outcome provided reassurance to those worried about an unending rise in rates.”

The auction’s tail, the gap between average and lowest accepted prices, narrowed to 0.09 from 0.27 last month, further signalling robust demand.

BOJ Rate Hike Bets Intensify

The surge in demand comes despite hawkish remarks from BOJ Governor Kazuo Ueda, who said the central bank would “weigh the pros and cons of lifting rates” while keeping financial conditions accommodative. Swaps now imply an 80% chance of a BOJ rate hike at its December 18–19 meeting, up from 56% a week ago, with over 90% odds priced in for January.

Minoru Kihara, Japan’s chief cabinet secretary, said the government is “closely watching” long-term rate moves and assessing their potential economic impact.

Fiscal Policy and Global Impact

Investors are also monitoring the government’s upcoming fiscal 2026 budget, amid worries that Prime Minister Sanae Takaichi’s ¥20 trillion (US$135 billion) stimulus package could fuel higher borrowing needs. The Ministry of Finance recently announced plans to raise short-term debt issuance by adding ¥300 billion to two- and five-year note auctions and ¥6.3 trillion to Treasury bill supply.

Traders said pension funds and foreign investors helped drive the latest rally in long-term JGBs, even as life insurers remained cautious buyers. Stephen Spratt, rates strategist at Société Générale, said, “This 30-year auction should cool things down after a frenzied few weeks in regional bond markets.”

Still, analysts warn Japan’s bond market remains fragile. “Although the latest auction was firm, we need to see consistent buying before declaring stability,” said Shoki Omori, chief desk strategist at Mizuho Securities.

The rally eased immediate pressure on Japan’s debt market but underscored a larger shift: the world’s third-largest economy is entering its first serious tightening cycle in nearly two decades, one that could ripple across global bond markets.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Japan Bond Market Explained: Why Yen Carry Trade Still Moves Stocks And Crypto?