Financial markets are juggling fresh signals on Federal Reserve policy, a possible change at the top of the central bank, and new comments from US Treasury Secretary Scott Bessent linking inflation relief to progress in Russia-Ukraine peace talks.

Hassett emerges as frontrunner for Fed chair

According to Bloomberg, former Trump economic adviser Kevin Hassett has emerged as the leading contender to become the next Fed chair under President Trump, with a decision expected before Christmas. The reported shortlist also includes Kevin Warsh, current Fed officials Chris Waller and Michelle Bowman, and Rick Rieder from BlackRock.

A Hassett or Warsh pick would likely be seen as more market-friendly and growth-focused, while Waller or Bowman would signal continuity from inside the Fed. Rieder would bring a markets background but is a political wild card. Until Trump makes a final choice, rate-cut expectations and long-term yields may stay volatile.

Mixed Fed signals ahead of December meeting

Fed officials are still sending different messages on the next move:

- San Francisco Fed President Mary Daly told the Wall Street Journal she supports a December rate cut, pointing to a cooling labor market and progress on inflation.

- By contrast, Boston Fed President Susan Collins said policy remains only “mildly restrictive” and stressed she has not made up her mind about December, arguing there is still a case for caution.

That tension reflects the broader debate: inflation has come down, but services prices remain sticky, and officials do not want to ease too fast just as Trump’s tariff and fiscal policies are reshaping the outlook.

Bessent: pockets of recession, but optimistic on 2026

US Treasury Secretary Scott Bessent tried to calm recession fears while acknowledging pain in interest-rate-sensitive parts of the economy.

Key points from his latest remarks:

- “Interest-rate-sensitive sectors are in recession” – housing, autos and some credit-heavy industries are clearly under pressure.

- Despite that, he said he is “confident about 2026 growth”, framing current weakness as an adjustment phase rather than the start of a deep downturn.

- He argued inflation is now driven mainly by services, not imported goods, and suggested lower energy prices plus targeted policy steps could help cool price pressures further.

- Bessent said the administration expects an announcement “this week” on health-care costs, hinting at measures that could lower one of the stickiest components of core inflation.

- He put a number on the political damage from Washington gridlock, saying the past government shutdown caused an $11 billion permanent hit to US GDP.

For markets, the message is that the Treasury sees growth risks as manageable and still wants rates lower over time, but will not call for aggressive easing while services inflation remains high.

Peace process and inflation

In one of his most striking lines, Bessent described the effort to cool prices as “essentially a peace negotiation involving Russia and Ukraine.” He said he is “confident the Ukraine–Russia peace process is moving forward,” and that Trump is putting pressure on Moscow to move toward an agreement.

If that process leads to a durable cease-fire and lower energy and commodity prices, it could speed up the final leg of disinflation, especially in Europe and emerging markets that were hit hardest by the original shock.

What it means for markets

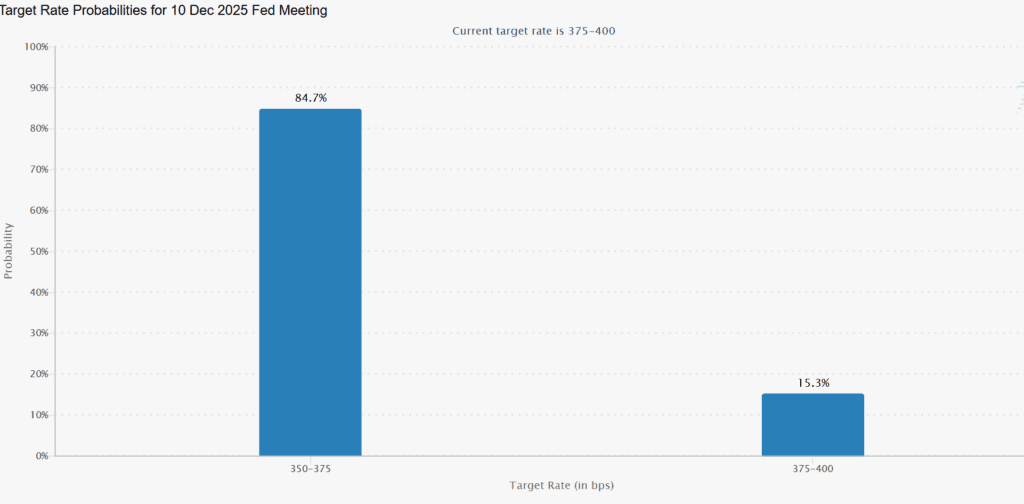

- Rate-cut odds for December will swing with every new Fed comment. Daly’s support pushes in favor of a cut, while Collins’ caution keeps a “skip” on the table.

- The Fed chair race adds another layer. A more dovish or growth-focused candidate could steepen the curve and support equities, while a more hawkish choice might keep long yields higher for longer.

- Bessent’s comments suggest the Treasury is not preparing for an imminent hard landing, which supports risk assets in the medium term, but his admission that rate-sensitive sectors are already in recession explains why markets remain nervous despite the S&P 500 sitting only a few percent off all-time highs.

- Any concrete progress on Ukraine–Russia peace would be a positive shock for energy, European assets and global risk sentiment, and could also give the Fed more confidence to cut in 2025 if inflation falls faster than expected.

For now, investors are trading a tricky mix: a Fed that is edging toward cuts but not fully committed, a potential change at the top of the central bank, and a Treasury secretary who insists the broader economy is resilient even as parts of it already feel like they are in a downturn.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.