Global markets enter the final week of November weighed down by volatility, delayed US data, and shifting investor sentiment. Here are the key themes and events to watch:

1. Retail Sales and Inflation Data Return After Shutdown

A flood of delayed US data will define this week, led by the September retail sales report due Tuesday. Consumer spending, which accounts for about two-thirds of US GDP, is expected to have grown 0.4% month-over-month, down from 0.6% in August. Analysts will also closely watch the Producer Price Index (PPI), another report postponed by the 43-day government shutdown. The PPI is forecast to rise 0.3%, compared to a 0.1% decline in August. These figures will be crucial for gauging inflation trends and the Federal Reserve’s next move ahead of its December policy meeting.

2. Fed’s Beige Book and Rate-Cut Expectations

The Federal Reserve’s Beige Book—a qualitative snapshot of economic conditions across US regions—will be released midweek. It is expected to show continued signs of softening demand and a cooling labor market. After two consecutive rate cuts of 25 basis points each in September and October, markets are pricing in the likelihood of another move in December. CME’s FedWatch tool shows growing expectations for a further reduction, though policymakers remain divided.

3. Trump’s Ukraine Peace Plan and Oil Market Implications

Oil traders are watching geopolitical developments closely as peace talks between the US and Ukraine continue. President Trump’s proposal to end the war faces resistance, with critics calling it overly favorable to Russia. Brent crude trades near $61.70, while WTI hovers around $57.80. Analysts from ING note that any deal could increase the odds of sanctions being relaxed on Russia’s energy sector, potentially reshaping the global oil supply outlook.

4. UK Autumn Budget: Reeves Faces Tough Balancing Act

In London, all eyes will be on Finance Minister Rachel Reeves, who will present the Autumn Budget on Wednesday. Facing a fiscal gap of roughly £30 billion, Reeves is expected to raise taxes for the second time since Labour’s election victory. The aim is to stabilize public finances while funding new welfare and infrastructure spending, without triggering a bond market selloff. The announcement comes as the UK economy continues to struggle with sluggish growth post-2008.

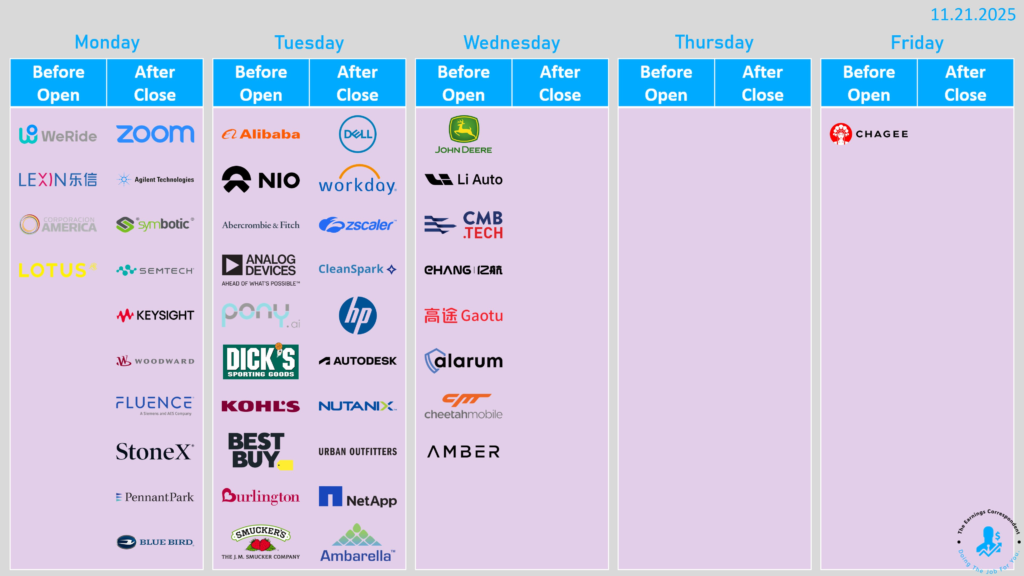

5. Corporate Earnings: Alibaba, Dell, John Deere, and More

Earnings season continues with a diverse lineup. Alibaba, Dell, HP, Autodesk, and Workday headline the week, offering insight into consumer demand, cloud spending, and global manufacturing sentiment. John Deere’s results on Wednesday will be watched for signals about agricultural and industrial demand amid tariff-related pressures. Also reporting are NIO, Zoom, Li Auto, Analog Devices, Dick’s Sporting Goods, and Best Buy—each providing a read on consumer and tech sentiment heading into year-end.

Market Outlook: After last week’s steep declines—the worst since April—investors will look for signs of stabilization. Despite solid results from Nvidia, tech-led volatility persists as concerns about AI spending excesses, tariff impacts, and global fiscal tightening weigh on sentiment. With a shortened Thanksgiving trading week ahead, volatility is expected to remain elevated as markets digest delayed data, geopolitical shifts, and earnings surprises.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Japan Bond Market Explained: Why Yen Carry Trade Still Moves Stocks And Crypto?