Japan’s government bond market has woken up after 30 sleepy years, and the shock is spreading across stocks, gold and even Bitcoin.

Long-term Japanese Government Bond (JGB) yields have jumped to their highest levels since the 2000s, the yen is sliding toward intervention levels, and investors are suddenly talking about a possible unwind of the famous “yen carry trade.” At the same time, Japan’s new government has approved a huge 21.3 trillion yen stimulus package, the biggest since the pandemic, which is pushing worries about debt and inflation even higher. (Japan $135 B Stimulus Made Yen Fall and Markets Tremble)

All of this matters not only for Japan, but also for US bond markets, global stocks and even Bitcoin.

Let’s break it down step by step.

What are JGBs and bond yields?

A Japanese Government Bond (JGB) is simply an IOU (I owe you) from the government of Japan. The government borrows money by issuing a bond, pays a fixed coupon every year, and repays the face value at maturity. JGBs have maturities from 2 years to 40 years and are considered very low credit risk, similar to US Treasuries.

Bond yield is simply the yearly return an investor gets if they buy the bond today and hold it to maturity. When bond prices fall, yields rise, and vice versa.

Because JGBs are the backbone of Japan’s financial system, their yields matter for:

- The interest rate Japan pays on its enormous public debt

- Mortgage and corporate borrowing costs inside Japan

- Global investors who use the yen as cheap funding

- Pricing of other bonds around the world

Two key points:

- Bond price vs yield move in opposite directions. If investors start selling bonds and the price falls, the yield (the effective interest rate the government pays to new buyers) climbs.

- Higher yields mean higher borrowing costs. When the 10 year JGB yield rises, Japan has to pay more interest as it refinances old debt with new bonds at today’s higher rates.

Japan’s bond market is huge. Government bonds outstanding are worth around 8 trillion dollars equivalent, which makes JGBs one of the largest and most important bond markets in the world.

Why Were Japanese Yields So Low For So Long?

For decades, Japan was the world champion of low or even negative yields. That was not an accident. It was the result of four big forces working together historically.

Deflation after the 1990s bubble: After the property and stock bubble burst in the early 1990s, Japan fell into a long period of weak growth and falling prices. When prices decline, even a zero yield can feel “OK” because your cash can buy more next year. There was very little pressure to push interest rates higher.

Aging population and high savings: Japan has one of the oldest populations in the world. Older households tend to save more and spend less. High savings and low consumption put downward pressure on prices and interest rates. Domestic investors were happy to hold safe JGBs even with tiny yields.

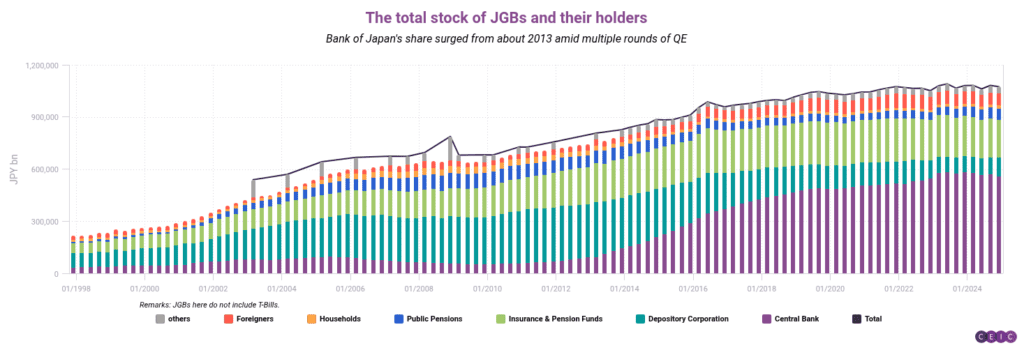

Massive central bank intervention: The Bank of Japan (BoJ) became the biggest buyer of JGBs on the planet. Starting in the early 2010s it launched huge quantitative easing (QE) programs, buying bonds in the open market and flooding the system with yen. By 2020, the BoJ owned around half of all JGBs outstanding.

Later it introduced Yield Curve Control (YCC). Under YCC the BoJ promised to keep the 10 year JGB yield around zero, buying unlimited amounts of bonds if yields tried to move too high. That policy pinned long term yields close to zero for years.

Very little inflation: Unlike the US or Europe, Japan struggled to generate inflation. Consumer price growth was often below the BoJ’s 2 percent target. With weak inflation and weak growth, there was no rush to raise rates.

Put together, these factors created a strange world where ten-year JGB yields hovered near zero and sometimes dipped below, even while other countries offered much higher rates.

For global investors, Japan became:

- A source of nearly free money

- A stable anchor that kept global yields suppressed

This is where the yen carry trade and Japan’s global importance come in.

Why Would Anyone Buy A Negative Yielding Bond?

It sounds irrational to lend money to the government and guarantee a loss if you hold to maturity. Yet huge institutions still bought JGBs.

Here is why.

Capital safety and regulation: Pension funds, insurers and banks must hold a lot of safe assets. JGBs are treated as risk free in regulation and can be used as collateral. Sometimes the priority is not return, but simply making sure the money is there when retirees need it.

Currency reasons: A foreign investor might buy a JGB even at a small negative yield if they expect the yen to strengthen. A stronger yen can more than offset the tiny negative coupon when measured in dollars or euros.

Riding the BoJ: If you know the central bank is a huge buyer at almost any price, you can buy JGBs and later sell them to the BoJ at a profit, even if the headline yield is negative. Traders can still make money on price moves.

So JGBs stayed in demand, and yields stayed pinned to the floor.

The quiet giant behind global markets

Japan is the world’s second-largest net creditor. Japanese households and institutions have accumulated trillions of dollars in foreign assets over decades.

Two key channels mattered for the world:

The yen carry trade

For many years, Japan’s interest rates were close to zero, while those in the US, Europe, and emerging markets were much higher.

So investors did the obvious:

- Borrow cheaply in yen

- Convert those yen to dollars or other currencies

- Buy higher yielding assets, like US Treasuries, corporate bonds, tech stocks, emerging market bonds, and even crypto

- Earn the yield difference as profit, as long as the yen stays weak and funding is cheap

This is the yen carry trade. It works as long as: Yen funding is cheap, the yen does not strengthen too much, and Global risk assets keep rising.

Because the trade is often leveraged many times, even small moves in yields or exchange rates can force rapid selling.

Japan as a major buyer of foreign bonds

Japan also became one of the most important buyers of US Treasuries and other sovereign bonds:

- Japan’s holdings of US Treasuries have usually been around one trillion dollars, often the largest or second largest foreign holder.

- Japanese life insurers and pension funds liked US bonds because domestic yields at home were near zero.

In US Treasury auctions, foreign buyers show up as indirect bidders. Analysts and official data have often linked large chunks of this foreign demand to Japanese institutions.

In simple terms:

Japan’s zero rate world was like a standing promise to the globe:

“We will keep lending cheaply and buying your bonds.”

That promise is now changing.

What Changed In 2024–2025?

After years of fighting deflation, Japan finally got what it wanted: inflation above target and rising wages. Unfortunately it arrived together with huge public debt, a weakening yen and political pressure to support households with more spending.

Several things happened almost at once.

BoJ started normalising policy: The BoJ ended negative rates in 2024 and gradually relaxed Yield Curve Control. It also slowed its bond buying. With the central bank stepping back, natural market forces started to push yields higher. Ten year JGB yields climbed toward and above 1.8 percent in late 2025, the highest since before the global financial crisis in 2008.

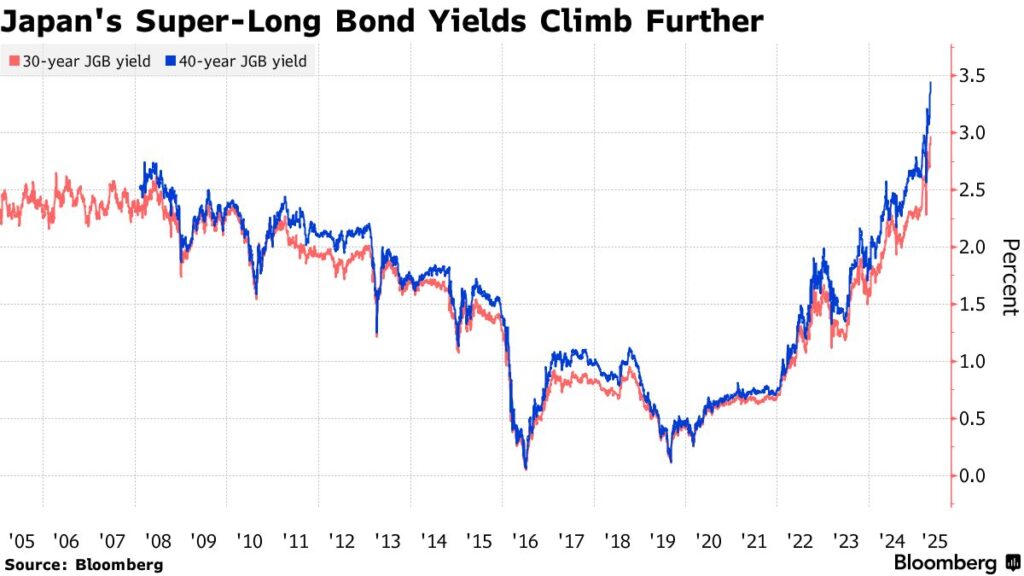

Long term yields spiked: Twenty, thirty and forty year JGB yields jumped sharply. The forty year yield approached record highs around 3.7 percent in November, reflecting investor worries about long term inflation and Japan’s ability to manage its huge debt load.

A huge stimulus package: The new Takaichi government approved a 21.3 trillion yen economic package, including 17.7 trillion in extra budget spending, 2.7 trillion in tax cuts and extra defence and crisis management outlays. Officials say it should lift GDP by about 1.4 percentage points per year for three years and cut headline inflation by around 0.7 point next year through energy subsidies. More about: Japan $135 B Stimulus Made Yen Fall and Markets Tremble

Here is how this links to yields and debt.

Bigger deficits and higher JGB yields: The government is financing a large part of the package by issuing more bonds. Investors know Japan already has debt above 250 percent of GDP, the highest in the developed world. More supply, plus a less aggressive BoJ, means markets demand higher yields to absorb all this paper. Long-dated JGB yields, especially those of 20, 30, and 40 years, have jumped as a result.

The “sell Japan” mood: As yields rise, the yen weakens, and stocks wobble, some global investors talk about a “sell Japan” trade. They worry Japan is moving from a very stable, low-yield, low volatility system to something more like the UK in 2022 when a surprise fiscal package triggered a bond sell-off. Articles in global media now compare Japan’s situation to that British gilt crisis, warning that markets are testing how far Japan can push its debt and stimulus.

Bond market no longer sleepy: For years, the JGB market barely moved. Now, volatility is the highest in two decades, and analysis from Bloomberg shows US Treasuries are more sensitive to moves in Tokyo than before. Japan’s nearly eight trillion dollar bond market has effectively “woken up,” and it is shaking other markets with it

Now markets see something:

- Japan already has the highest debt to GDP ratio in the developed world.

- More stimulus means more bond issuance, at a time when the BOJ is buying fewer bonds and interest rates are rising.

Where yields stand now (and why it matters)

Here is a simplified picture of how far JGB yields have moved.

Approximate JGB yield levels

| Maturity | Typical level during YCC years (around 2016-2021) | Recent level in late 2025 |

|---|---|---|

| 10 year | Around 0 percent, sometimes slightly negative | Around 1.7 to 1.8 percent, highest since 2008 |

| 20 year | Well below 1 percent | Around 2.7 percent, highest since 2000 |

| 30 year | Under 1 percent for long stretches | Above 3 percent, near record highs |

| 40 year | Around 1 percent or lower | Around 3.7 percent, all time high |

Why Japan Matters So Much For US Bonds

On the surface, Japan’s direct holdings of US Treasuries are about 1.1 trillion dollars, just a slice of a forty trillion dollar US bond market. That sounds small. The real story is about flow and who the marginal buyer is.

For more than twenty years:

- Japanese exporters earned large trade surpluses in dollars

- Domestic rates in Japan were near zero

- US Treasuries yielded 2 to 4 percent more than JGBs

So Japanese institutions routinely recycled their extra dollars into US Treasuries and other foreign bonds. In many long term US auctions, indirect bidders (foreign buyers) regularly took 60 to 80 percent of the bonds, and analysts estimate Japan was often a very large part of that bid.

In plain language: Japan was often the biggest regular customer at US Treasury auctions.

Now the math is changing.

- JGB yields are rising closer to US yields

- The cost of hedging dollar exposure back into yen is high

- Japan sometimes needs to sell dollars to support the yen

So instead of buying more Treasuries, Japanese investors are slowing purchases or even selling some holdings. At the same time the US is running large fiscal deficits and needs to issue more debt.

Why this matters: When your biggest regular customer stops showing up, you have to find new buyers. Those new buyers usually only step in if yields are higher. That is why many analysts expect US long-term rates to drift 2 to 3 percentage points higher over the next few years compared with the last decade, even if inflation falls.

Higher US yields mean:

- More expensive mortgages

- Lower valuations for high growth tech stocks that rely on low discount rates

- Tighter financial conditions globally

Analysts already see this shift in the data:

- US Treasury statistics show changes in foreign holdings, including Japan’s stock of Treasuries trending lower in recent years.

- Japan’s Ministry of Finance reports swings in cross border flows as Japanese investors trim foreign bond purchases.

The yen carry trade unwind

Higher JGB yields and the risk of a stronger yen are bad news for the yen carry trade.

Remember, the trade is:

- Borrow in yen at low rates

- Use it to buy risk assets elsewhere

If: Yen funding costs rise, and the yen starts to strengthen, then leveraged funds suddenly face: Higher interest bills, Potential currency losses

To protect themselves, they often cut positions fast. That means selling the most liquid things they hold: US mega cap tech stocks, Global index futures, Gold, Bitcoin and other large crypto coins

This is why you often see days where JGB yields spike and almost everything risky sells off together.

How This Links To Crypto And Bitcoin

Crypto might feel very far from Japanese government bonds, but the connection runs through liquidity and risk appetite.

Stimulus and liquidity:

Japan’s stimulus and continued low short term rates still add liquidity to the global system. That can be supportive for Bitcoin when investors feel comfortable taking risk.

Bond yields and carry trade stress:

However, rising JGB yields and fears of a carry trade unwind can create sudden deleveraging. When large funds have to close yen funded positions, they often sell whatever is liquid: US stocks, gold, and crypto.

We already saw an example. After the latest Japanese stimulus announcement, Bitcoin dropped below 84k dollars and briefly touched around 83.3k, with nearly two billion dollars of crypto positions liquidated in 24 hours. Analysts tied part of that move to worries about the yen, higher Japanese yields and global risk aversion.

Two opposite forces for Bitcoin:

- A weaker yen and more stimulus can push some Japanese savers toward assets like Bitcoin to protect purchasing power

- But if higher yields trigger a global sell off and carry trade unwind, crypto can fall together with other risk assets

So Japan’s bond market is both a potential tailwind and a serious risk for crypto, depending on how the story evolves.

Why this matters for ordinary investors and the real economy

You do not need to trade JGB futures to be affected by this.

Here is how the Japan bond story can spill into the everyday world:

- Higher global long term rates: If Japanese demand for US and European bonds fades, yields in the US and Europe may need to be higher to attract replacement buyers. That can mean more expensive mortgages, higher corporate borrowing costs and pressure on stretched equity valuations.

- More volatile markets: A potential carry trade unwind can cause sudden swings in global equities and currencies. Even diversified portfolios can feel that volatility.

- Pressure on overvalued assets: High growth tech stocks and speculative crypto projects are most sensitive to rising discount rates and tighter liquidity. They face double pressure from both higher yields and reduced risk appetite.

- Policy dilemma for Japan

The Japanese government must juggle three conflicting goals:- Keep debt affordable

- Protect households from inflation

- Avoid a market panic in bonds and currency

What to watch next

If you want to track how the Japan story evolves, a few simple indicators can tell you a lot:

| Indicator | What it tells you | Key levels to watch | Why it matters for markets and crypto |

|---|---|---|---|

| 10 year JGB yield | Core price of Japan government borrowing for the next decade | A decisive move above 2 percent, staying there | Signals rising pressure on Japan’s fiscal position and pushes global yields higher, which can hurt stocks, risky credit and crypto. |

| 30 and 40 year JGB yields | Investor fear about long term inflation and debt sustainability | Persistent levels above 3.5 percent | Shows long term confidence breaking. Higher long end yields can trigger global risk off moves and make safe bonds more attractive than tech or crypto. |

| Dollar yen (USDJPY) | Relative strength of yen vs dollar and carry trade conditions | Moves toward or above 160 | Sharp yen drop can trigger FX intervention and forced unwinds of yen carry trades, leading to selling in global stocks, bonds and crypto. |

| BOJ policy meetings | Direction of Japan’s interest rates and bond buying pace | Hints of another hike or heavier JGB buying | A hike tightens financial conditions and supports the yen. Aggressive bond buying can weaken the yen again and fuel risk trades, including Bitcoin. |

| Capital flow data (MOF, TIC) | Whether Japanese investors are buying foreign bonds or repatriating | Rising net buying of JGBs, net selling of US and global bonds | Large repatriation means fewer Japanese buyers of US Treasuries and global assets, pushing global yields up and pressuring risk assets like equities and crypto. |

Putting it all together

Putting everything together:

Japan was the world’s “free money machine” for decades: Zero rates and constant BoJ buying kept its yields low and made it cheap to borrow yen and invest elsewhere. That helped keep global yields down and supported risk assets everywhere.

Now that machine is reversing:

- Inflation is above target

- The BoJ is slowly stepping back

- The government is borrowing more through stimulus

- Investors are demanding higher yields to hold JGBs

Higher Japanese yields mean:

- Potential repatriation of Japanese money from US and European bonds

- Upward pressure on global interest rates

- Risk of a yen carry trade unwind if the currency strengthens

- More volatility in stocks, credit and crypto

In other words, Japan’s bond market is no longer a sleepy corner of global finance. It is one of the main drivers of the risk environment

This is why traders keep repeating one simple line:

“Watch JGB yields. If Japan moves, the world moves.”

For now, the story is still unfolding. The next few BOJ decisions, and how investors digest Japan’s stimulus and rising yields, will tell us whether this is a manageable adjustment or the start of a much bigger global repricing.

Summary

Japan kept global interest rates artificially low for twenty years. Its central bank bought massive amounts of bonds and kept yields near zero. That allowed investors to borrow cheap yen and buy risk assets everywhere. This fuelled carry trades into US stocks, bonds and even crypto.

Now yields in Japan are finally rising, and the free money era is ending. The biggest quiet buyer at US bond auctions is stepping back, the yen carry trade is under pressure, and markets are suddenly re pricing risk. From here, everything depends on whether Japan can stabilise its bond market around slightly higher, but still manageable, yields or whether the move turns into a bigger unwind that forces selling across global assets.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.