Stocks are trying to shake off one of the wildest weeks of the year after New York Fed President John Williams opened the door to another rate cut “in the near term.”

The early bounce came less than twenty four hours after the S&P swung from plus one point nine percent to minus one point six percent in a single session, one of the sharpest intraday reversals of 2025.

At the open, the major indexes moved higher:

- Nasdaq Composite up about 0.6%

- S&P 500 up around 0.5%

- Dow Jones higher by roughly 0.5%

That rebound comes less than twenty four hours after the S&P went from plus 1.9% to minus 1.6% in a single session.

Fresh University of Michigan data showed sentiment weakening again in November, with a final reading of fifty-one. Inflation expectations eased slightly, but consumers remain worried about higher prices and job losses.

Markets are still heading for weekly losses across the board, but Friday’s early move showed traders are willing to test the upside again if rate cut hopes hold.

Williams lights the fuse

Speaking in Santiago, Williams said policy is only “modestly restrictive” and that he still sees “room for a further adjustment” to bring rates closer to neutral as the labor market cools.

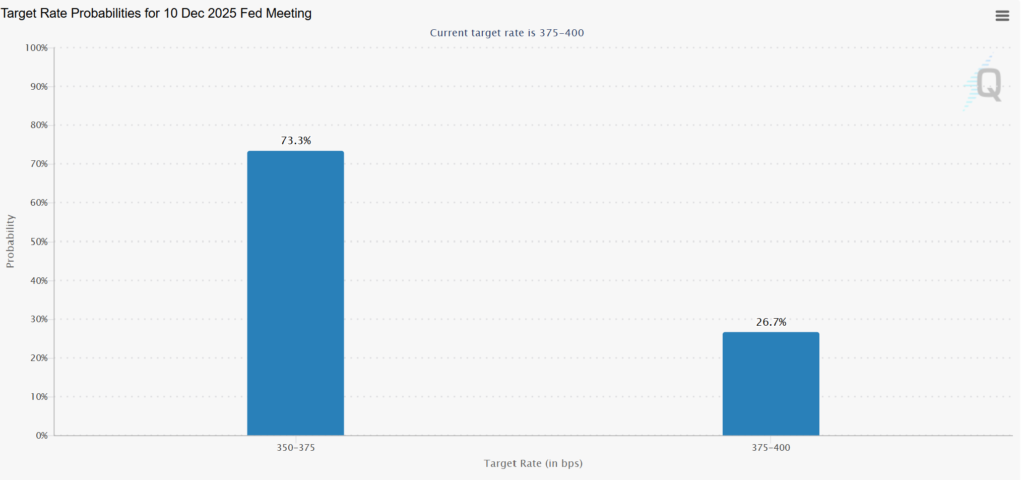

Traders loved it. Fed futures now price roughly 70–75% odds of a December cut, up from about 40% before the speech. In other words, one comment from a key Powell ally just flipped the narrative back toward easier policy.

A divided Fed, a confused market

The message from Washington is anything but unified:

- Lorie Logan says she would still find it hard to support a December cut

- Austan Goolsbee calls rising services inflation “disturbing” and is uneasy about cutting too fast

- Michael Barr warns that with inflation near 3%, the Fed must be “careful and cautious”

On top of that, the record shutdown has scrambled the data flow. The delayed September jobs report showed 119,000 new jobs and unemployment at 4.4%, but the October report was cancelled and November’s numbers will only land after the December meeting.

So the Fed is heading into its final decision of 2025 with partial data and very loud internal disagreement. Markets hate that mix.

Related: Fed’s December Rate Cut Now in Doubt After Mixed Jobs Data

Treasury Yields Slide

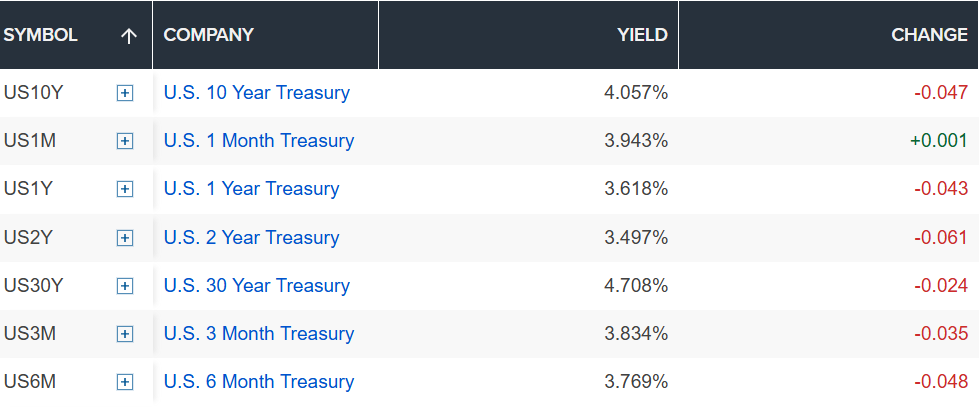

Treasury yields moved sharply lower on Friday after New York Fed President John Williams signaled the central bank still has room to ease policy again next month.

The 10 year yield fell more than 4 basis points to 4.06%, while the 2 year dropped over 5 basis points to 3.50%. Longer maturities eased as well, with the 30 year slipping to 4.71%.

Yields had already been sliding after Thursday’s equity selloff and rising concerns around stretched AI valuations. Markets are also processing the delayed September jobs report, which showed 119,000 jobs added but an unemployment rate rising to 4.4%, the highest since 2021.

From AI mania to defensive shuffle

Thursday’s selloff started as a celebration. Nvidia delivered another blowout quarter, briefly blasting tech stocks higher. Within hours, the entire AI trade flipped red as worries about stretched valuations, circular AI deals and a less friendly Fed took over.

Friday’s bounce is powered by the same tech names again. Nvidia and other AI leaders trimmed losses in premarket trade after Williams spoke, while defensive stocks like Walmart stayed firm as investors hedge both ways.

Even after today’s move higher, all three major indexes are still on track for weekly losses above 2%, and the S&P 500 is staring at its worst November since 2008.

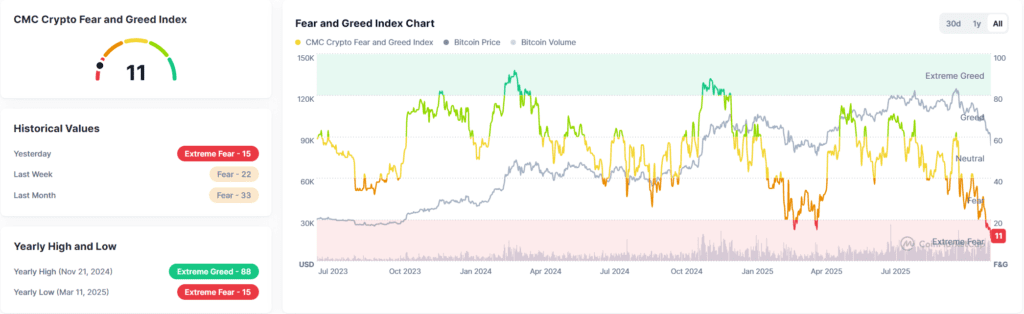

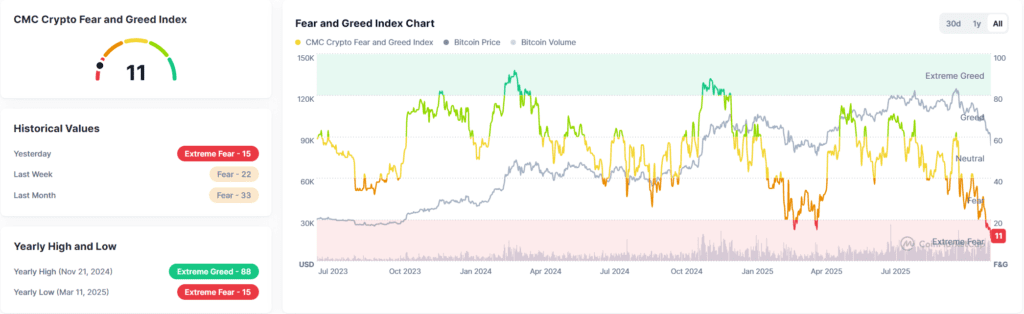

Crypto shows the real risk mood

If you want to see how nervous risk appetite really is, look at bitcoin. The token slid again on Friday toward 82,000 dollars, heading for its worst month since the 2022 crypto winter.

The Fear and Greed Index for crypto and stocks has slumped back into “Extreme Fear”, even with the S&P only about 5% below record highs. That combination tells you investors are positioned nervously and ready to hit the sell button fast.

What this all adds up to

Right now markets are trading on headlines and mood swings, not slow and steady fundamentals:

- A single Fed speech can push trillions of dollars of assets higher in minutes

- A delayed jobs report and missing October data keep everyone guessing

- AI stocks are caught between “this is a bubble” and “this is the future”

- Bitcoin’s slide is amplifying the overall risk off tone

Today’s rally is real, but it is built on hope that the Fed cuts again in December. If that hope fades, or the next data point surprises in the wrong direction, this bounce can unwind just as quickly as Thursday’s AI surge did.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.