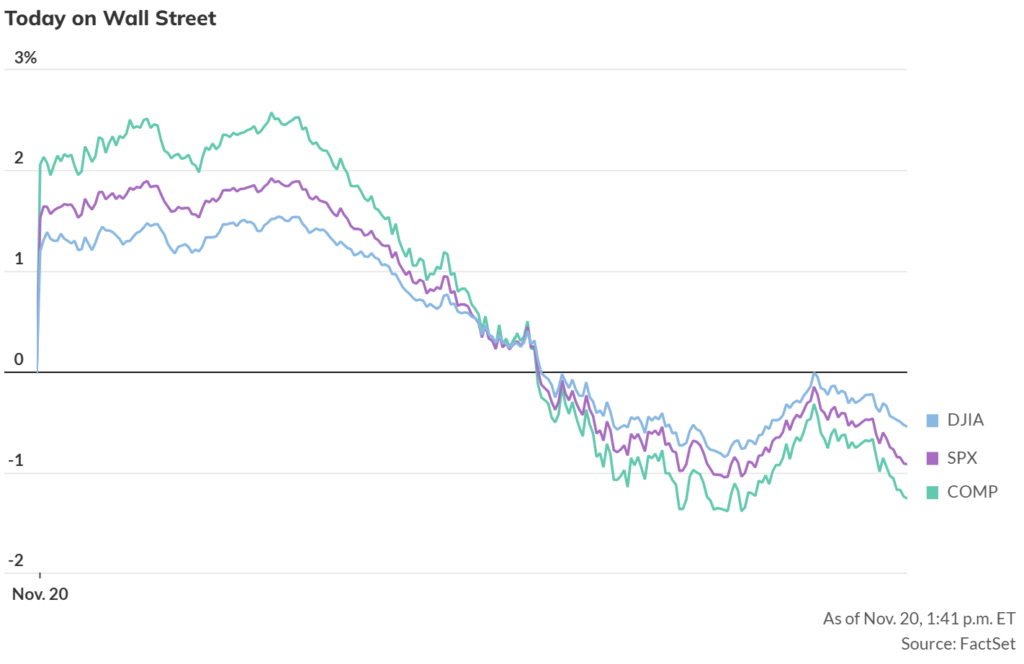

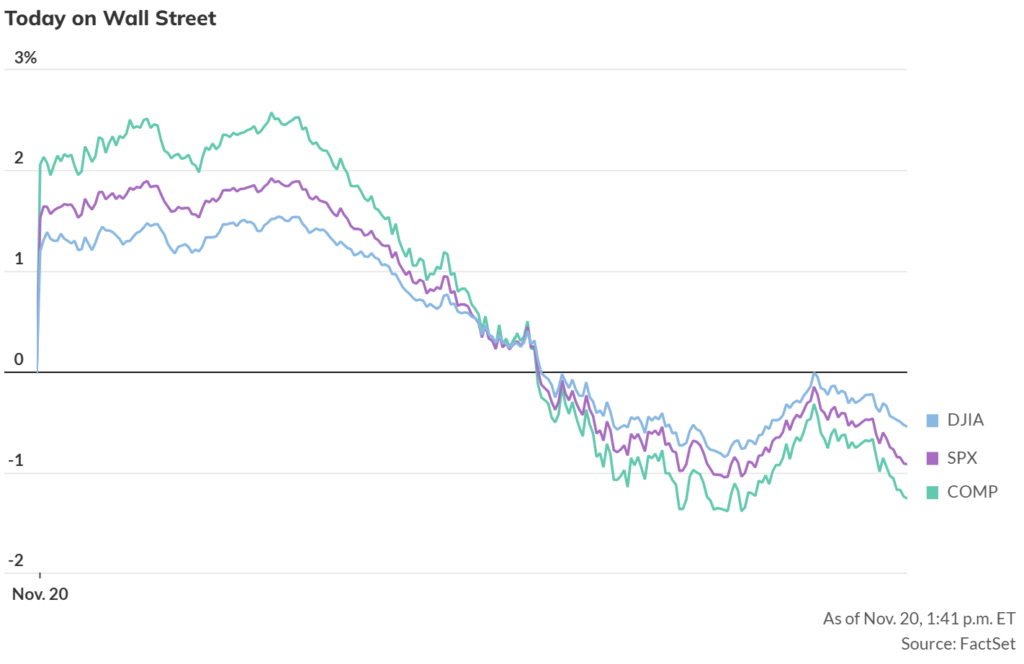

Wall Street lost momentum on Thursday as a powerful early rally collapsed, with the Dow swinging more than 1,100 points intraday and the S&P 500 and Nasdaq erasing strong morning gains. The reversal came as Nvidia’s post-earnings surge fizzled, the market digested delayed jobs data, and expectations for a December Fed rate cut weakened again.

The S&P 500 fell about 0.5%, the Nasdaq lost 0.7%, and the Dow slipped 0.3%, despite being up more than 700 points earlier in the session. The sudden shift reflected growing doubts about overextended AI valuations and fresh concerns about the Fed’s policy path.

Nvidia: Strong Earnings, Weak Market Reaction

Nvidia initially jumped more than 5% after beating Wall Street estimates and issuing a stronger fourth-quarter sales forecast. CEO Jensen Huang said demand for its Blackwell chips is “off the charts” and rejected the idea of an AI bubble.

But enthusiasm faded quickly as traders focused on valuations and the Fed backdrop. Nvidia shares turned negative, dragging the market with them. Oracle and AMD also slipped into the red.

As one trader put it, “The Nvidia sizzle is being extinguished by the lowering probability of a December rate cut.”

Stale Jobs Report Complicates the Fed’s Next Move

A shutdown-delayed September payrolls report showed:

• Nonfarm payrolls: +119k (vs. 51k expected)

• Unemployment rate: 4.4% (highest since 2021)

• Two-month revisions: -33,000 jobs

The report was originally scheduled for October 3, but the government shutdown delayed it and forced the cancelation of the entire October employment report. October’s data will now be combined with November’s and published December 16.

More about: Fed’s December Rate Cut Now in Doubt After Mixed Jobs Data

The missing October data leaves the Fed with incomplete visibility ahead of the December 9–10 policy meeting.

Fed funds futures now show less than 40% odds of a December rate cut.

Dollar Pares Gains After Jobs Data: The Bloomberg Dollar Spot Index pulled back from a six-month high after the unemployment rate rose to 4.4%. Treasury yields slipped, while traders slightly increased expectations of a February move instead of December.

Market Fear Rises as AI Trade Cools

The selloff deepened as Wall Street’s “fear gauge,” the VIX, jumped sharply. The AI trade, a key driver of 2025’s market gains, has struggled this month, with Nvidia on track for its worst month since March.

More about: AI boom brings fresh risks to US markets, and more money to M&A

Investors rotated into consumer staples, where Walmart led the sector with a 6% jump after strong earnings.

But for tech, sentiment remains fragile. As one strategist noted, “There’s nothing wrong with the AI story, but markets have rarely stayed this stretched without correcting.”

The market is now caught between Nvidia’s strong fundamentals, a cooling AI trade, rising volatility, delayed and incomplete labour data, and uncertain Fed policy.

With the Fed minutes, a missing October jobs report, and another inflation print all ahead, traders face more uncertainty than usual heading into year-end.

The next few sessions will determine whether Thursday’s reversal is just turbulence, or the start of something deeper.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.