The final full week of November is shaping up to be one of the most important stretches of trading left in 2025.

Investors will get:

- A fresh stress test of the AI trade from Nvidia (NVDA)

- A reality check on the US consumer from Walmart (WMT), Target (TGT), Home Depot (HD), Lowe’s (LOW) and others

- The long-delayed September jobs report after the record 43-day government shutdown

- Plus, more signals from housing data, PMIs, and consumer sentiment – all against the backdrop of a sharp crypto pullback and shaky rate-cut expectations.

Here’s your full breakdown of what matters and why.

1. Market Mood: Flat Indexes, Nervous Investors

On paper, last week didn’t look dramatic: S&P 500 basically flat, Dow Jones up about 0.3%, Nasdaq down about 0.4%

In reality, it felt much worse.

A tech-led selloff slammed markets on Thursday, and nerves stayed high into Friday as investors digested the end of the government shutdown, shifting Fed expectations, and spreading worries from crypto and credit markets.

The Nasdaq saw a sharp intraday drop before dip-buyers stepped in. Oracle’s (ORCL) credit default swaps widened, feeding fears about pockets of stress in tech.

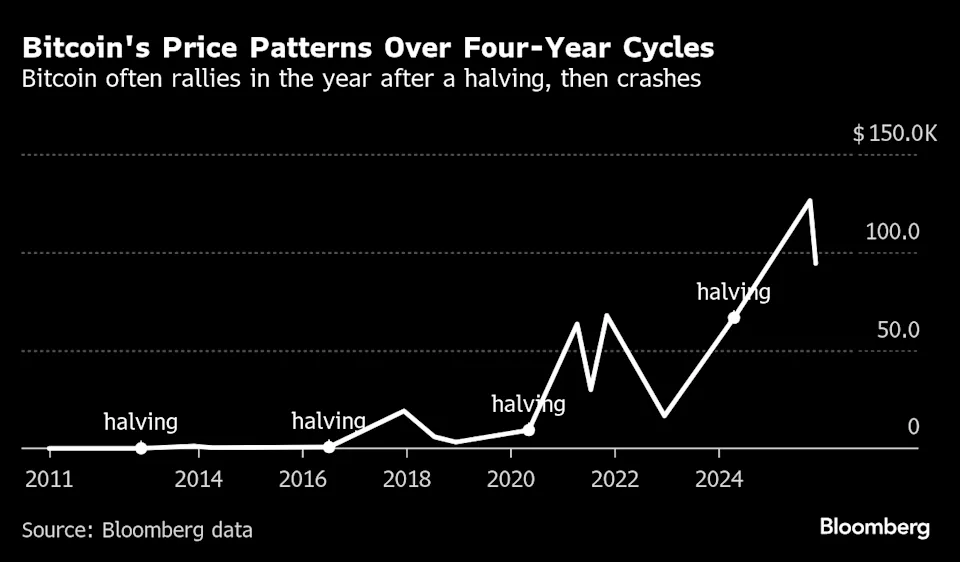

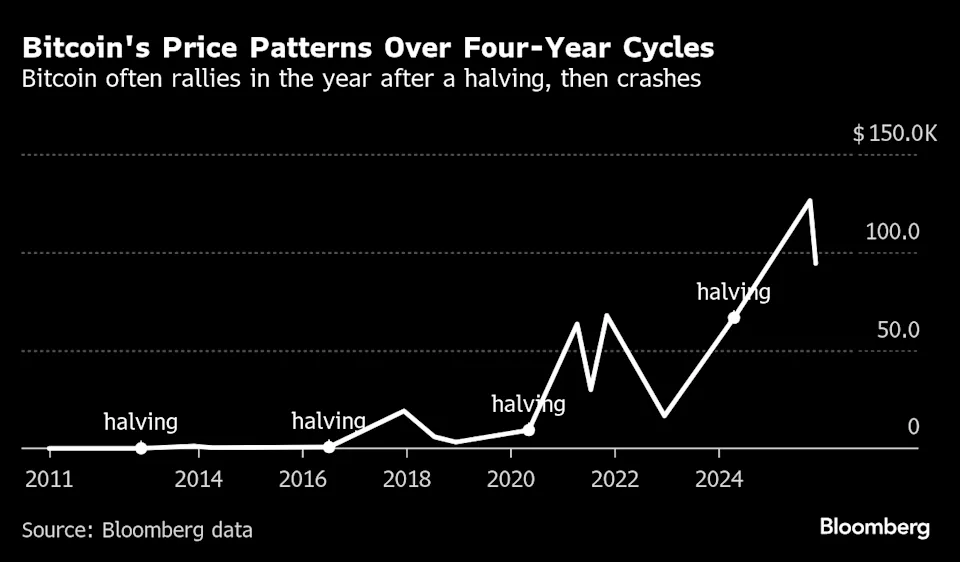

Bitcoin (BTC-USD) sank back below $95,000, nearly erasing its year-to-date gains and pressuring crypto-linked stocks such as Coinbase (COIN) and Robinhood (HOOD).

As Truist’s Keith Lerner put it, the bull market still “deserves the benefit of the doubt,” but sentiment is clearly wobbling. The S&P 500 is up nearly 40% since the “Liberation Day” tariff shock in April, while the Nasdaq is up more than 50% – all with no 5% pullback since that correction. A reset in optimism was probably overdue.

This week will decide whether that reset becomes a healthy pause, or something more.

2. Nvidia: The AI Trade Faces Its Biggest Test Yet

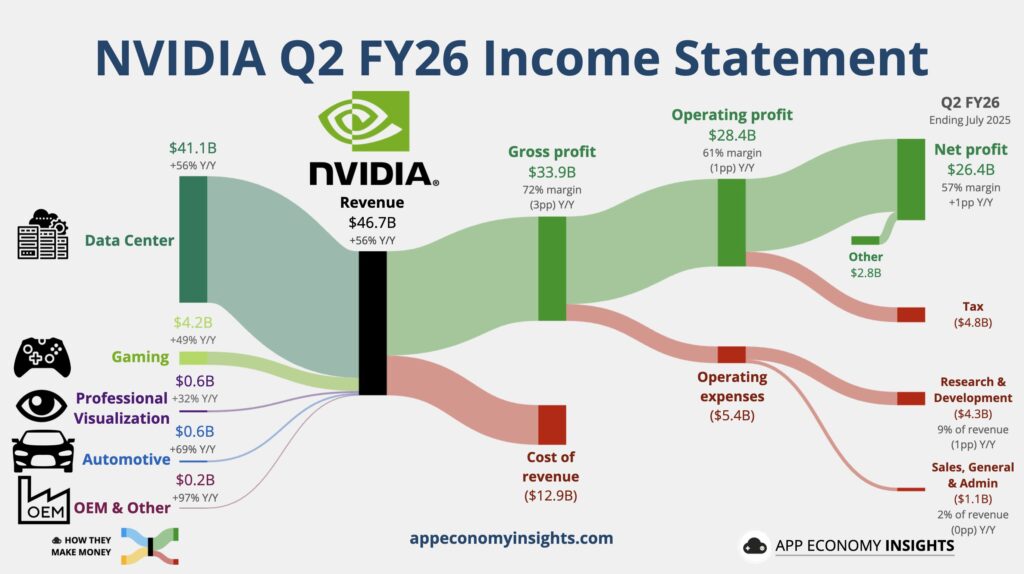

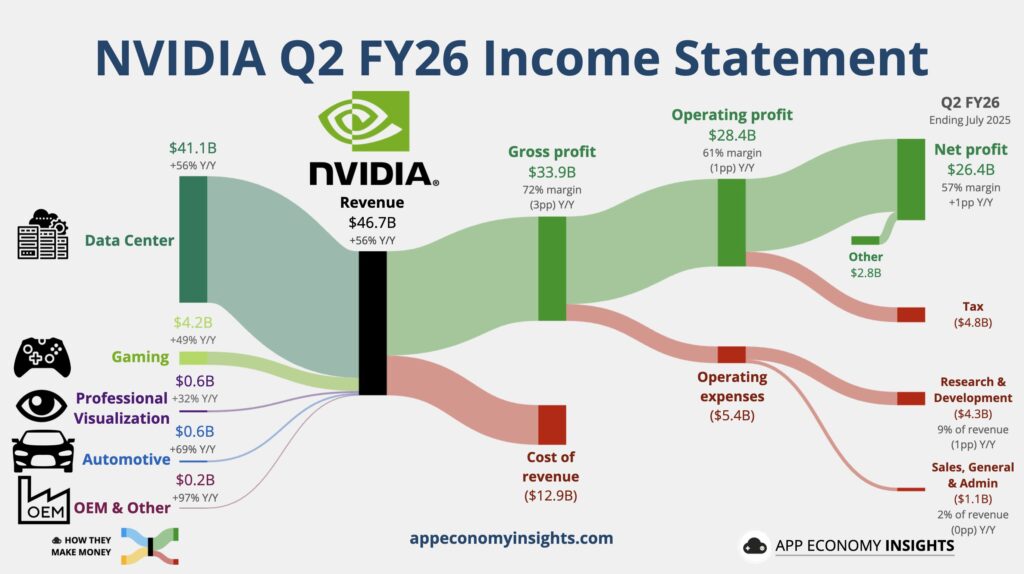

The headline event of the week (Q3 FY2026) is Nvidia’s earnings report after the close on Wednesday.

Why it’s huge:

- Nvidia is now the world’s most valuable company, with a market cap around $4.6 trillion.

- At one point, it represented roughly 8.5% of the entire S&P 500’s market cap.

- The stock is still up more than 40% year-to-date, even after a pullback from its late-October highs.

Analysts expect: Earnings per share to be up roughly 50% year-over-year, revenue to grow more than 50% as AI demand stays strong

Beyond the numbers, the real focus will be:

- AI demand sustainability: Are hyperscalers still ordering at a breakneck pace?

- Customer behavior: Any signs of double-ordering, over-stocking or “dot-com-style” excess in AI infrastructure?

- Competition: How management talks about in-house chips from Alphabet (GOOGL), Amazon (AMZN), and Meta (META).

- 2026–2027 guidance: Nvidia’s multi-year demand story is what justifies current valuations. Any hint of normalisation could hit the entire AI complex.

Morningstar and other analysts still see strong secular growth, expecting high double-digit revenue expansion into 2027 as AI spreads across cloud, enterprise, and consumer applications. That’s the bull case.

The bear case is simple: too much optimism, too fast. After a 40–50% rally in major AI names, even a “good but not perfect” print could trigger profit-taking.

Whatever Nvidia says on Wednesday night will likely set the tone for tech and AI stocks for the rest of the year.

3. Walmart, Target, Home Depot & Lowe’s: How Strong Is the US Consumer?

This week’s earnings from Home Depot, Target, Lowe’s, Walmart, TJX, Gap, BJ’s Wholesale, Amer Sports, and several other major retailers will offer one of the clearest snapshots yet of the US consumer heading into the holiday season.

Investors will be watching three big themes.

First, holiday spending and overall consumer health. Markets want to know whether shoppers are still trading down or finally stabilizing after months of pressure. Lower-income households, in particular, have been squeezed by high prices, Trump-era tariffs, and slowing wage growth. Any signs of weaker basket sizes, a shift toward essentials over discretionary items, or heavier discounting will be key signals.

Second, margin pressure and pricing power. Retailers face a difficult balance between protecting margins and avoiding price hikes that push consumers away. With import tariffs, freight costs, and labor expenses still elevated, investors will be looking closely at how much of these pressures flow into earnings — and how much retailers can absorb.

Third, strategy shifts and leadership changes. Walmart’s results arrive just days after announcing that John Furner will replace Doug McMillon as CEO on February 1, putting added focus on guidance and execution. Target, meanwhile, has been trying to reposition itself after several difficult quarters; investors want proof that the strategy is gaining traction. Home Depot and Lowe’s remain directly exposed to the housing market, so any positive commentary on renovation demand or project pipelines would offer relief to a sector that has been weighed down by rates and low turnover.

Overall, this week’s retail earnings will shape the market narrative around consumer resilience, pricing power, and the holiday outlook — key drivers for the final stretch of 2025.

| Day | Key Earnings (Bold) | Other Earnings |

|---|---|---|

| Tue, Nov 18 | Home Depot (HD) | Medtronic (MDT), Baidu (BIDU), PDD (PDD), Amer Sports (AS), Klarna (KLAR), Dolby (DLB) |

| Wed, Nov 19 | Nvidia (NVDA), Target (TGT), Lowe’s (LOW) | TJX (TJX), Palo Alto (PANW), Williams-Sonoma (WSM), Viking (VIK), Jack in the Box (JACK), Bullish (BLSH) |

| Thu, Nov 20 | Walmart (WMT) | Ross Stores (ROST), Intuit (INTU), Gap (GAP), Warner Music (WMG), Bath & Body Works (BBWI), Post (POST), WeBull (BULL) |

| Fri, Nov 21 | BJ’s Wholesale (BJ) | — |

If the AI trade looks stretched, the question is: Can the US consumer keep carrying the earnings cycle into 2026?

This week’s retail reports will give the clearest answer yet.

4. The Government Is Back – But the Data Still Isn’t

The 43-day government shutdown finally ended on Wednesday, clearing the way for federal agencies to restart the flow of economic data.

But the timeline will be messy.

| Theme | What’s Coming This Week | Why It Matters |

|---|---|---|

| Jobs data & rate cuts | Thu: Long-delayed September nonfarm payrolls & unemployment rate, plus initial jobless claims | Markets were almost fully pricing in a December rate cut, but odds have now slipped to about 50/50. Stronger-than-expected jobs data would undermine the case for an immediate cut; clear labour softening would re-ignite the dovish narrative. |

| Housing as a pressure gauge | Thu: Existing home sales (October) | Existing home sales are stuck near multi-decade lows as high rates and tight supply freeze activity. Any turn higher, even small, would matter for construction, home improvement retailers, and banks. |

| Sentiment & shutdown scars | Fri: S&P Global US manufacturing & services PMIs (flash November); University of Michigan consumer sentiment (final November) | Earlier surveys already showed the shutdown weighing on confidence. Investors will watch whether relief from reopening shows up quickly – or whether worries about tariffs, inflation, and politics stay entrenched. |

| Day | Date | Economic Data | Notes / Focus |

|---|---|---|---|

| Mon | Nov 17 | New York Fed Empire Manufacturing (November) | Activity in New York manufacturing; good early read on goods demand and business conditions. |

| Tue | Nov 18 | ADP weekly employment | High-frequency look at labour market, not as important as nonfarm payrolls but still watched. |

| Homebuilder sentiment (NAHB, November) | Key gauge of housing sector confidence; sensitive to mortgage rates and demand. | ||

| Import price index (October) (shutdown-delay risk) | Tracks imported inflation; may still be delayed due to the shutdown backlog. | ||

| Industrial production & capacity utilization (October) | Shows how strong overall production is and how “tight” industrial capacity is running. | ||

| Wed | Nov 19 | MBA Mortgage Applications | Weekly read on housing/credit demand; very rate-sensitive. |

| Housing starts (October) (shutdown-delay risk) | New construction – crucial for builders and materials; may be delayed by shutdown disruptions. | ||

| Building permits (October) | Forward-looking indicator for future construction and housing supply. | ||

| FOMC minutes – October meeting | Deeper insight into Fed debate on future rate cuts and how worried they are about growth vs. inflation. | ||

| Thu | Nov 20 | Philly Fed business outlook (November) | Regional manufacturing survey; often used as an early proxy for broader factory activity. |

| Existing home sales (October) | Key housing activity metric; stuck near multi-decade lows – any change matters for housing-linked stocks. | ||

| Initial jobless claims (shutdown-delay risk) | Timely labour-market stress indicator; may still be noisy or delayed post-shutdown. | ||

| Nonfarm payrolls (September, restored) (shutdown-affected) | First official jobs update since September; critical for December Fed cut expectations. | ||

| Unemployment rate (September, restored) (shutdown-affected) | Together with payrolls, will drive the narrative on whether the labour market is cooling or still tight. | ||

| Fri | Nov 21 | S&P Global US manufacturing PMI (flash November) | Early read on factory activity and supply chains. |

| S&P Global US services PMI (flash November) | Tracks the much larger services side of the economy – crucial for growth outlook. | ||

| University of Michigan consumer sentiment (final November) | Updated look at consumer mood, including lingering effects from the shutdown and tariff worries. |

The data calendar is still “spotty,” but this week is the first real chance for markets and the Fed to re-anchor their view of the economy after six weeks of statistical blackout.

5. Crypto’s Slide: Contained Shock or Broader Risk?

Despite JPMorgan CEO Jamie Dimon’s long-running skepticism toward crypto, the bank is quietly accelerating its blockchain push. On Wednesday, JPMorgan announced it has completed the proof-of-concept for its USD-denominated deposit token, JPM Coin (JPMD), designed for institutional clients. The token enables 24/7, near-instant settlement and can now be transferred on Base, Coinbase’s Ethereum Layer-2 network. Major players including Coinbase and Mastercard have already executed test transactions using JPMD — a clear sign that traditional finance is moving deeper into on-chain settlement despite the broader crypto downturn.

Meanwhile, the crypto market itself is going through one of its sharpest shakeouts of 2025.

- Bitcoin (BTC) is down roughly 14% this month and almost 24% below its October peak.

- Coinbase (COIN) and Robinhood (HOOD) have both fallen by high-teens percentages in November after massive rallies earlier this year.

- MicroStrategy (now rebranded “Strategy”), one of the most aggressive corporate BTC buyers, has collapsed from $455+ in July to below $200, wiping out more than half of its market cap.

So far, the pain is mostly confined to crypto assets, crypto-heavy brokerages, a few high-beta tech names, and speculative “AI + crypto” crossover trades.

But with markets increasingly concentrated in megacap AI stocks, crypto, and high-growth tech, any deeper unwinding in one of these pockets risks spilling over into the others through risk-off sentiment and forced de-leveraging.

Equity bulls argue this is simply a much-needed reset in the most speculative corner of the market. Bears counter that this could be the first crack in the liquidity-driven rally that has powered markets since April.

6. A Bull Market That Needs Proof, Not Promises

Underneath all the noise, the fundamental backdrop is still surprisingly strong:

S&P 500 earnings are on track for about 13% year-over-year growth in Q3. If that holds, it will be the fourth straight quarter of double-digit earnings growth.

Tech and AI earnings in particular have more than justified much of the rally so far.

But that strength cuts both ways: With stocks up so much since April, expectations are sky-high. There hasn’t been a normal 5–10% correction in months. Sentiment indicators like AAII show bearishness rising again, as investors get whipsawed between euphoria and panic.

This week, markets don’t just need good headlines – they need credible signals that:

- AI demand is strong and sustainable (Nvidia)

- The US consumer is slowing, but not breaking (Walmart, Target, Home Depot, Lowe’s)

- The macro data are cooling without collapsing (jobs, housing, sentiment)

- The Fed can move toward cuts without losing inflation control or market confidence.

If those pieces line up, the bull market probably keeps the benefit of the doubt into year-end. If they don’t, this could be the week where “volatility risk” turns into a real correction.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

The United States, Switzerland, and Liechtenstein Reach a Historic Trade Deal

Warren Buffett Reveals New $4.3B Alphabet Stake, And Sells More Apple Ahead of Buffett’s Exit