Less than two weeks before her crucial Budget, Rachel Reeves has executed one of the most dramatic U-turns of her chancellorship, and financial markets immediately made her feel the consequences.

In a move that surprised MPs, investors, and even some inside government, the chancellor has abandoned plans to raise income tax rates in the 26 November Budget, despite weeks of preparing the public for exactly that step. The reversal came after the UK’s fiscal watchdog delivered a more favourable forecast that sharply reduced the expected hole in the public finances.

But instead of calming nerves, the U-turn triggered a fast and brutal backlash in the markets, raising borrowing costs for the UK and sending the pound lower, a clear sign that investors are now demanding clarity, discipline and credibility from a government struggling to show consistency.

A Sudden Shift: From “Hard Choices” to a Full Retreat

For months, Reeves and Prime Minister Keir Starmer had been signalling that tax rises were unavoidable.

Reeves even delivered a rare pre-Budget speech warning the country that “each of us must contribute” and hinting that the manifesto pledge not to raise income tax rates was likely to be broken.

Then, behind closed doors, something changed.

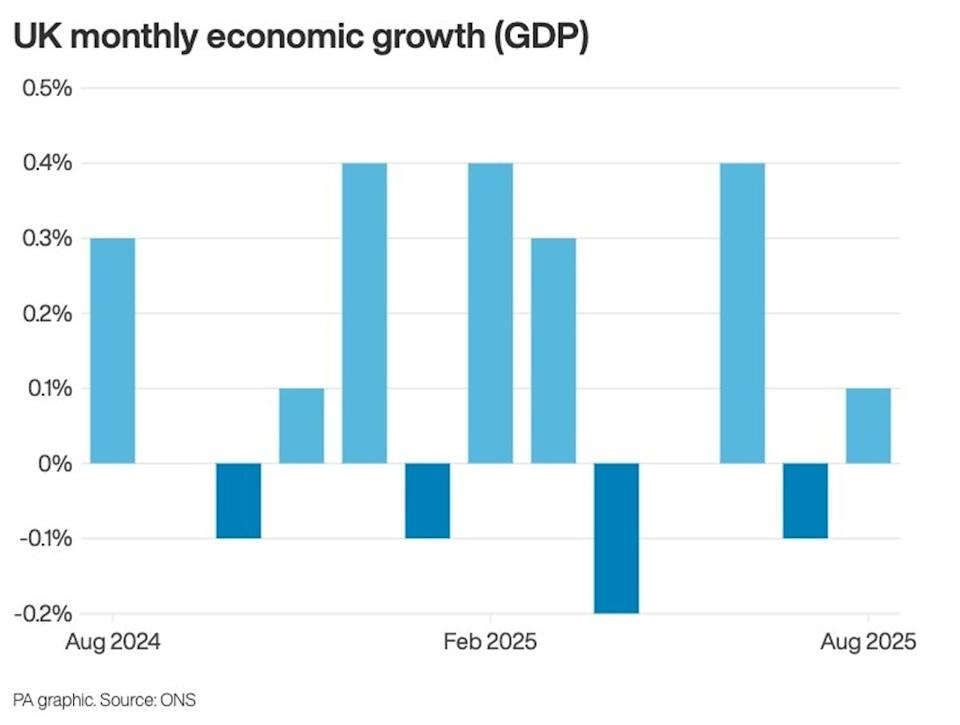

The OBR’s numbers came in, and they were better than feared.

- Economists had warned of a £35bn fiscal hole.

- New OBR projections suggested it was closer to £20bn.

- That smaller gap gave Reeves room to avoid the politically explosive income tax rise.

Downing Street was also facing a wave of internal anger from Labour MPs and a burst of leadership speculation around Starmer. The political mood darkened so quickly that officials privately warned No. 10 that the backlash could undermine the Budget before it even arrived.

The combination of political instability and an unexpectedly improved forecast pushed Reeves to reverse course.

But Markets Did Not Applaud, Panicked

The moment the Financial Times reported the U-turn, markets reacted instantly.

Gilts plunged. Borrowing costs soared.

- 10-year gilt yields jumped up to 12bp — the worst move since July.

- 30-year yields surged toward 5.3%.

- Prices fell sharply as investors demanded higher returns to lend to the UK.

Sterling dropped.

- The pound fell 0.3% against the dollar.

- It sank to a 2.5-year low versus the euro.

This may sound technical, but the message was simple: Markets had trusted Reeves’ willingness to take painful decisions. When she backed away, that trust faltered.

Investors know one thing: Without income tax hikes, the UK still needs to find £20–30bn, fast. And the more uncertainty there is, the higher borrowing costs go.

The UK still relies heavily on foreign investors to buy its debt. When they sense uncertainty, yields rise, and the move in gilts shows that anxiety sharply increased after the U-turn.

What Reeves Must Do Now: Build a Budget from Scraps

With income tax off the table, Reeves now has to construct what one economist called “a patchwork Budget made from dozens of revenue stitches.” Here are the tools left in her box:

1. Freeze income tax thresholds again: This is a stealth tax, it raises bills without changing tax rates. Extending the freeze beyond 2028 could raise £8bn a year.

2. Lower thresholds entirely: This is politically toxic but mathematically effective.

3. New targeted taxes – Possibilities include: A new electric vehicle tax, higher gambling duties, tougher rules for landlords, possible changes to pension reliefs

4. Corporate tweaks: Small increases or loophole changes that raise revenue without headlines. But economists warn this approach risks being: Anti-growth, complicated, and uncertain, which is exactly what markets dislike.

The Political Fallout: Starmer Faces Questions, Again

Inside Labour, the mood is fragile. The U-turn came after days of bitter internal briefings, accusations of disloyalty, and a near-crisis around Starmer’s leadership. Many MPs privately worry that the prime minister looked weak and indecisive, especially after a week of speculation about coups and factional pressure.

Reeves’ reversal now gives her critics ammunition, who say the government is “lurching” rather than leading.

The Conservatives seized the moment immediately. Kemi Badenoch said:

“I’ve never seen this level of chaos before a Budget.”

Even Liberal Democrats called it “unprecedented confusion.”

Why This U-Turn Matters Far Beyond Politics

This is not just a Westminster drama. The stakes are bigger.

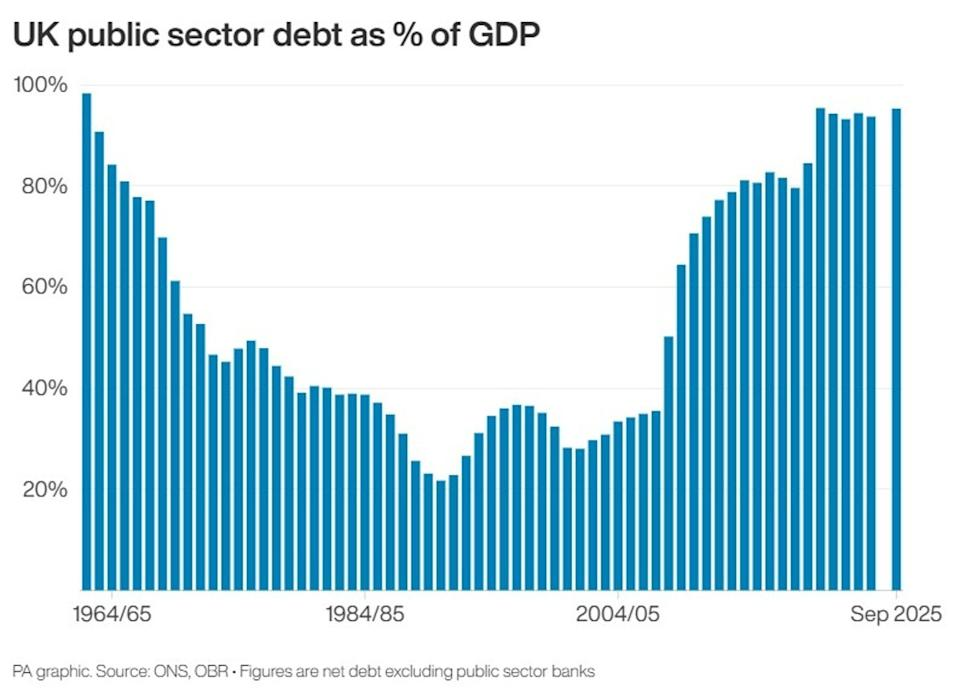

Reeves wants to borrow and spend tens of billions on infrastructure, the NHS, and growth initiatives, but she must obey fiscal rules that require debt to fall by 2029.

Markets believed the message until this week. Now, they are asking a harsher question: If Labour cannot make the hard choices now, will they be forced into even harder ones later?

The UK learned during the Truss mini-budget crisis that credibility evaporates quickly, and rebuilding it is expensive.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Europe Explores Pooling Dollar Reserves after Trump shocks