BigBear.ai (BBAI) is set to report Q3 2025 earnings after market close today, riding the momentum of a staggering 160% stock gain over the past six months. The surge has been fueled by growing investor enthusiasm for US defense tech, homeland security modernization, and BigBear’s pure-play positioning in AI-driven autonomy and edge intelligence. But after a disappointing Q2 marked by contract timing delays and widened losses, Q3 will be a critical test: can BigBear demonstrate that its government pipeline and AI platform strategy are on track?

With the company’s cash war chest at all-time highs and AI/defence funding reaching historic levels under the recent $300 billion “One Big Beautiful Bill,” expectations are mounting for backlog execution and traction in both federal and commercial AI verticals.

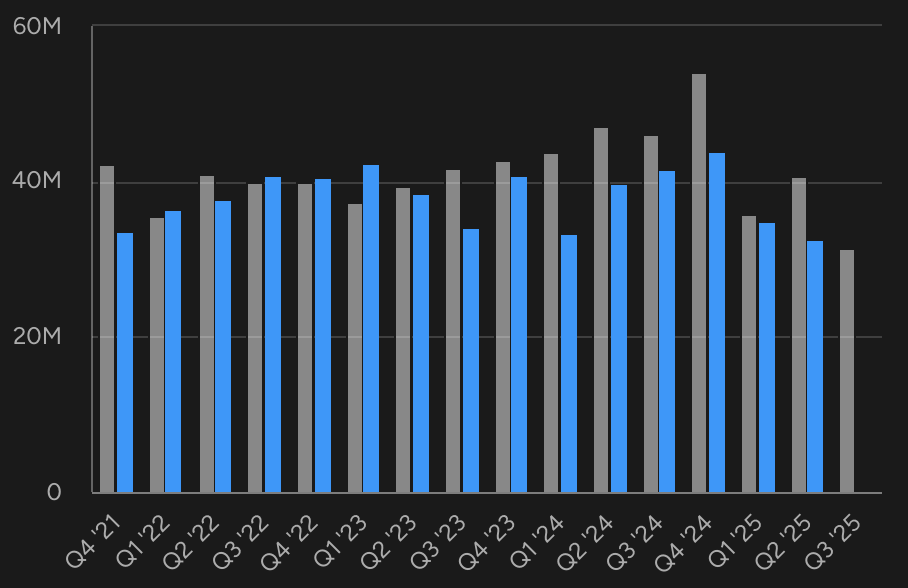

Street Forecast: Revenue Dip, Loss Widens

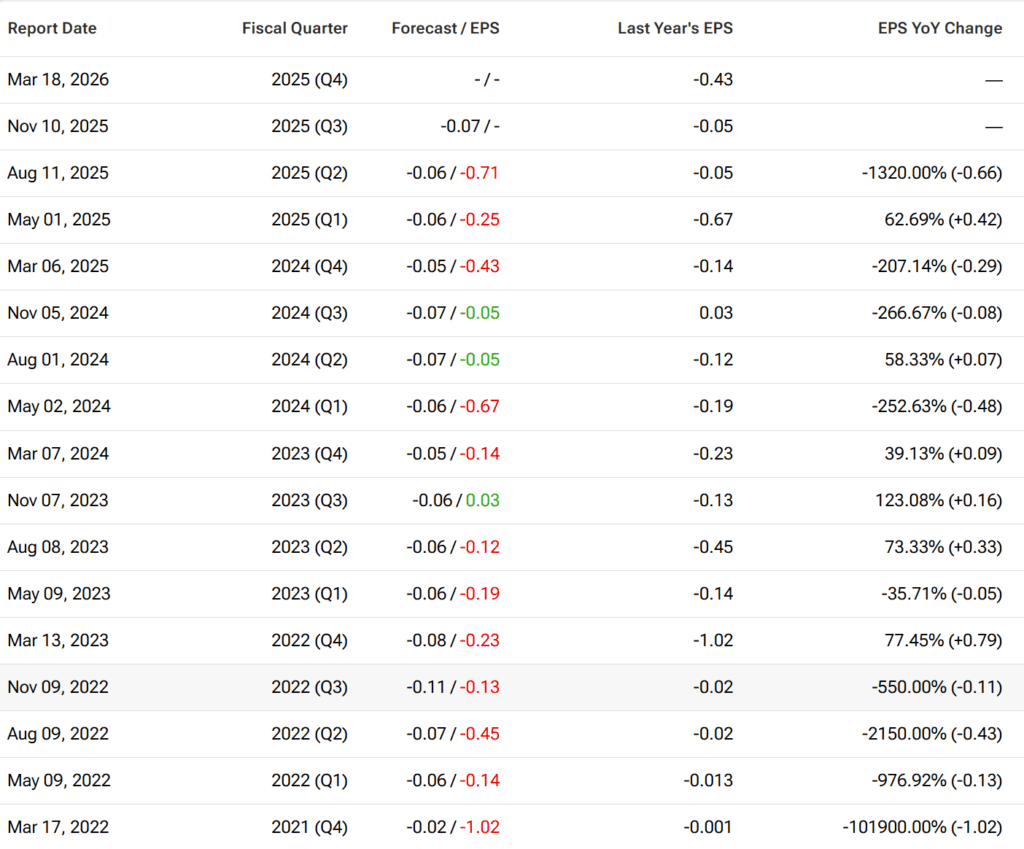

| Metric | Q3 2024 Actual | Q3 2025 Consensus | YoY Change |

|---|---|---|---|

| Revenue | $41.5M | ~$31.8M | –23% |

| EPS (GAAP) | –$0.05 | –$0.07 | (Wider loss) |

| Backlog | $437M | ~$380M (Q2 actual) | –13% |

| Adj. EBITDA (non-GAAP) | $0.9M | Not guided | N/A |

Sources: Company filings, Zacks, analyst estimates

Prediction: BigBear reports near the lower end of expectations with revenue ~–23% YoY and EPS loss slightly wider. Key to stock reaction will be backlog updates and outlook on Army contract timelines.

Federal AI & Defense Intelligence: Will Backlog Convert?

Federal government contracts account for ~87% of BigBear’s revenue base, making contract timing and DoD execution critical. The company holds multi-year contracts with the Army, Navy, DHS, CBP, and other national security entities. Recent activity includes:

- A new $13.2M U.S. Army contract for ORION modernization

- Deployment of its edge-AI stack (ConductorOS) in joint-force exercises (Talisman Sabre, UNITAS)

- Continued integration of biometric screening systems in U.S. airports

However, delays in a large Army project pressured Q2 results, and investors will be watching whether that contract and other federal programs return to schedule in Q3. The newly passed AI-defense spending bill has sparked optimism about sustained funding. But execution remains the near-term catalyst.

Commercial AI & Analytics: Can the Modeling Suite Scale?

While still small, BigBear’s commercial segment shows promise across logistics, healthcare, and infrastructure sectors. Its flagship analytics platforms include:

- ProModel: predictive simulations for logistics and manufacturing

- Shipyard AI: planning tools for naval and defense yards

- FutureFlow Rx: hospital patient flow modeling

- Pangiam (acquired): biometric identity and travel analytics for airports

Notably, BigBear’s airport facial recognition systems are now live at locations like O’Hare and Nashville. Any signs of recurring commercial revenue or scaling contracts will be welcomed, especially as peers like Palantir lean into commercial expansion.

Edge AI & Cyber Platforms: ConductorOS at the Tactical Edge

BigBear has leaned heavily into real-time distributed AI. Its flagship defense solution, ConductorOS, enables AI model deployment on disconnected edge systems like drones, sensors, and ISR units. ConductorOS was recently used in joint-allied training exercises and is gaining visibility among NATO and Five Eyes partners.

In cyber, BigBear applies predictive modeling and anomaly detection to national-security-grade threats, positioning itself for contracts in network defense and tactical forensics. Expansion of these platforms and international deployments could be a significant revenue unlock if traction builds.

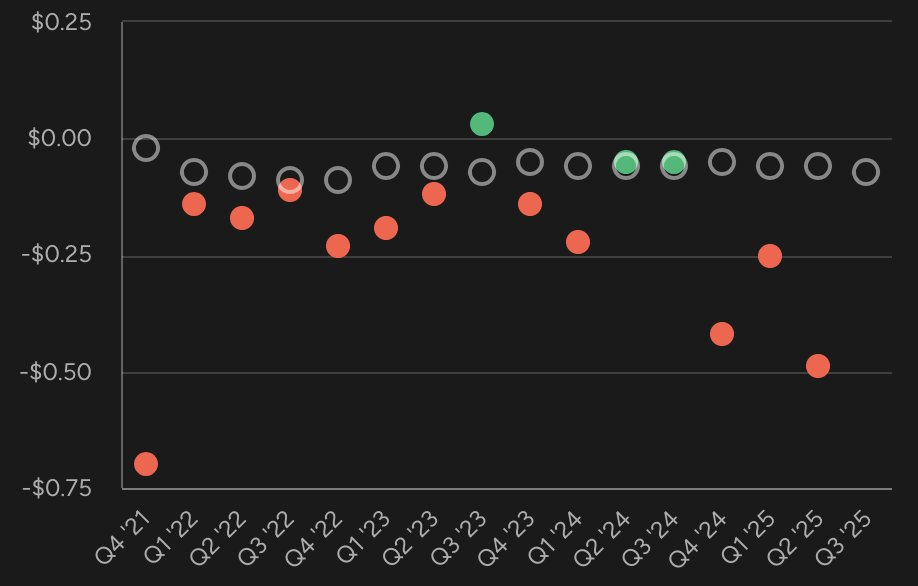

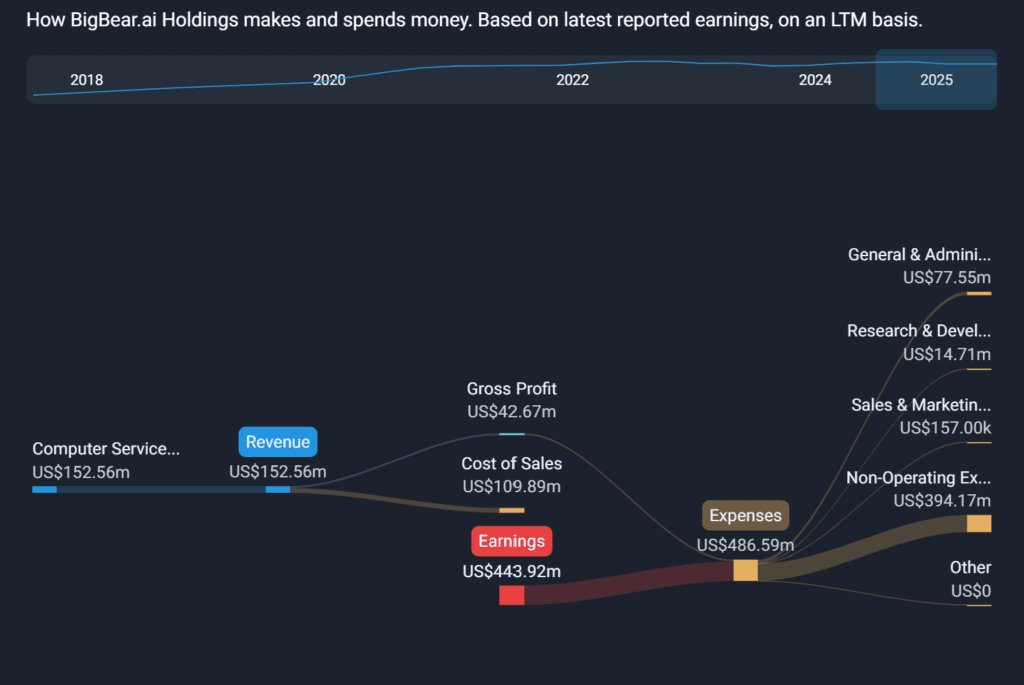

Financial Health: Ample Cash, But Profitability Elusive

Following a large equity raise earlier this year, BigBear now holds $391 million in cash – among the strongest balance sheets in the defense-tech small cap universe. Management has emphasized a “go on offense” strategy, investing in R&D, headcount, and platform growth.

That said, operating losses remain heavy. Q2 saw a –$228.6M net loss (including noncash charges), with adjusted EBITDA at –$8.5M. Gross margin dipped to 25%, and SG&A spending remained elevated. Management withdrew full-year EBITDA guidance, citing contract delays and heavy reinvestment. Q3 is unlikely to show margin expansion, and investors will look to FY2026 commentary for the path to breakeven.

Competition: Palantir, C3.ai, and the Defense Primes

BigBear sits at the crossroads of AI software and defense analytics. Its core rivals include:

- Palantir: broader data-integration platform but targeting similar U.S. government agencies

- C3.ai: stronger in commercial AI, though expanding into federal

- Leidos, Raytheon, Lockheed Martin: defense primes embedding AI into traditional systems

What sets BigBear apart is its focused architecture – edge-native, tactical AI systems, biometric inference, and modeling-as-a-service platforms. Yet the firm’s small scale and lack of profitability remain pressure points compared to its larger, better-capitalized rivals.

Analyst Sentiment: Watchful Optimism

Wall Street sentiment is mixed. Analysts rate BigBear a Moderate Buy, but with muted upside:

- TipRanks consensus: $6 price target, ~6% upside

- Zacks Rank: #3 (Hold), no EPS beat expected

- Institutional ownership: ~34%, insider ownership: ~2%

- Short interest: ~17% of float – relatively high

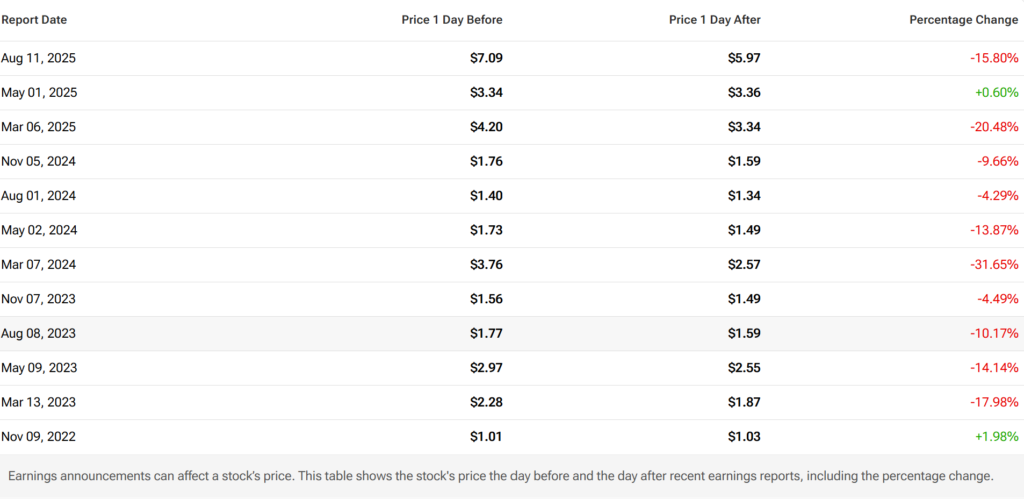

With the stock still up over 2x YTD, sentiment is cautious. A clean earnings beat or unexpected contract win could trigger another leg up. But a miss could invite a sharp pullback.

Can BigBear Deliver More Than Hype?

BigBear.ai’s story is compelling: a pure-play AI defense platform riding macro funding tailwinds with deep federal ties and a unique tech stack. But Q3 must deliver progress on revenue recovery, commercial traction, and margin stability to justify the rally.

Our Call: BigBear prints slightly below consensus on revenue, beats on cash positioning, but issues cautious commentary. Shares may consolidate unless management announces new wins or backlog conversion guidance. Watch for forward-looking language on FY2026 federal awards and ConductorOS deployments as key swing factors.

Disclosure: All predictions and insights shared in this article are based on a comprehensive review of publicly available analyst reports, media coverage, and market consensus. These views are for informational purposes only and do not constitute investment advice. Please conduct your own research or consult a licensed financial advisor before making any investment decisions.