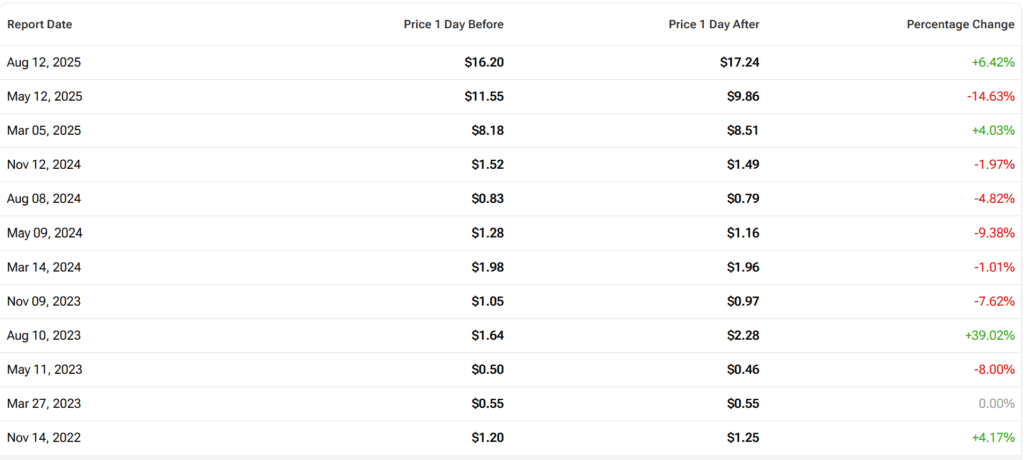

Rigetti Computing (RGTI) is set to report Q3 2025 earnings after the bell today, following a staggering 2,200% rally over the past 12 months. Once seen as a long-shot quantum bet, Rigetti has captured Wall Street’s imagination with rapid technical advancement, a fortified balance sheet, and a steady stream of government contract wins. The question now: can all this quantum progress begin translating into commercial traction and revenue momentum?

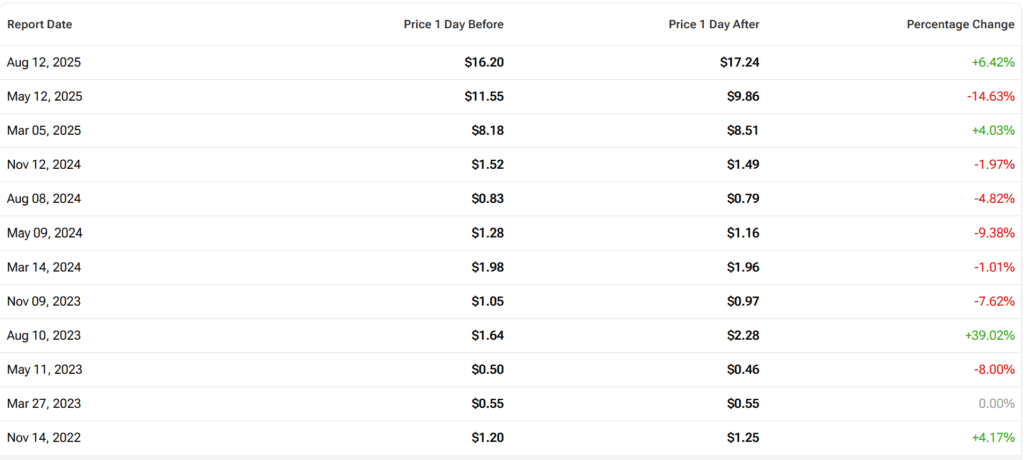

With expectations running high and volatility baked into the name (options pricing implies a ±14% move), this earnings report will test whether Rigetti’s recent rally is fueled by fundamentals—or froth.

Quantum computing & AI will be key themes of 2026: Rigetti CEO

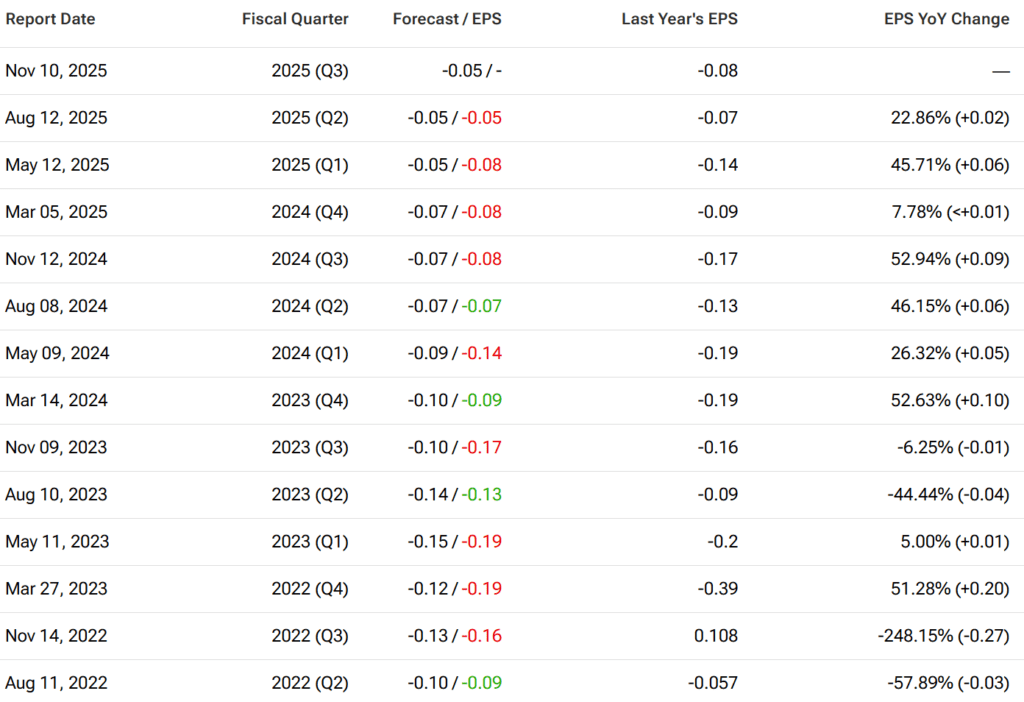

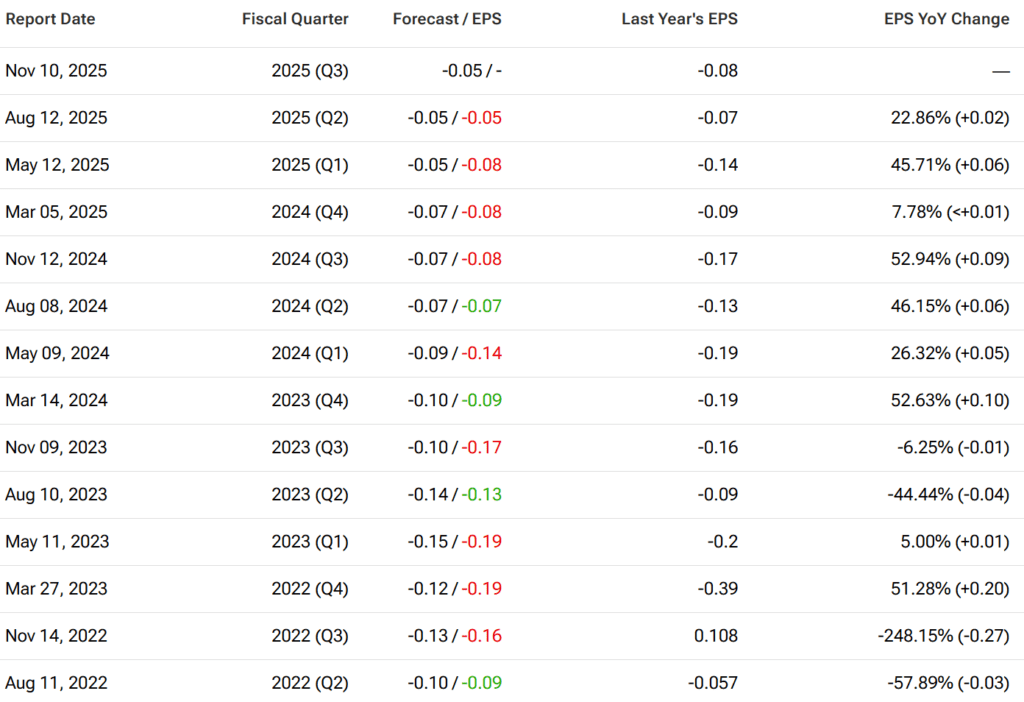

Street Forecast: Shrinking Losses, Revenue Dips

| Metric | Q3 2024 Actual | Q3 2025 Consensus | YoY Change |

|---|---|---|---|

| Revenue | $2.40M | ~$2.17M | –9.4% |

| GAAP EPS | –$0.08 | –$0.05 | +37.5% (narrower loss) |

| Operating Cash Burn | ~$15M (est.) | ~$30M (est.) | N/A |

Sources: Rigetti IR, Zacks, TradingView, SEC Filings

Prediction: Rigetti will report revenue slightly below expectations but show a narrower-than-expected loss. Unless it unveils a major commercial win or breakthrough roadmap update, shares may face a near-term cooldown.

Government Contracts: Steady Support from Washington

Rigetti has quietly become a go-to vendor in U.S. quantum R&D funding:

- In September, it was awarded a $5.8 million three-year contract from the U.S. Air Force Research Lab to develop superconducting quantum networking prototypes.

- It leads a $3.1M Department of Energy fusion simulation initiative.

- It remains active in DARPA’s Quantum Benchmarking and IMPAQT optimization programs.

These projects give Rigetti a steady funding stream and technical validation—but the key question is whether that foundation will convert into scaled commercial deployments.

Commercial Cloud and Partnerships: Azure, NVIDIA, Quanta in Focus

Rigetti has made progress on the enterprise and cloud fronts:

- It recently launched its 36-qubit “Cepheus-1” quantum computer on Rigetti QCS and Microsoft Azure Quantum, giving developers easier access to its hardware.

- It’s collaborating with NVIDIA to integrate with its DGX Quantum platform and NVQLink, bridging quantum and GPU-based AI workloads.

- In a major commercial win, Quanta Computer (Taiwan) agreed to purchase two Novera systems (~$5.7M) and invest $35M as part of a broader $100M+ development pact.

These integrations are crucial as Rigetti seeks to embed itself in hybrid classical–quantum enterprise infrastructure. Revenue recognition from those deals, however, may lag execution.

Technology Roadmap: 84 to 336 Qubits and Beyond

Rigetti’s superconducting qubits remain some of the fastest in the market (~60–80ns gate speeds), and its modular chip architecture is gaining attention. Key milestones:

- The company launched general availability of Cepheus-1 (36 qubits) on QCS in Q3.

- It aims to debut Ankaa-3 (84 qubits) by end of 2024.

- Its long-term plan includes a 336-qubit “Lyra” system in 2025, targeting 99.5% gate fidelity.

While larger quantum competitors like IBM and Google boast higher qubit counts, Rigetti argues its approach enables faster hybrid computation—ideal for use cases like finance, defense modeling, and optimization.

Prediction: Technical updates reaffirm roadmap execution, but enterprise revenue scale remains elusive.

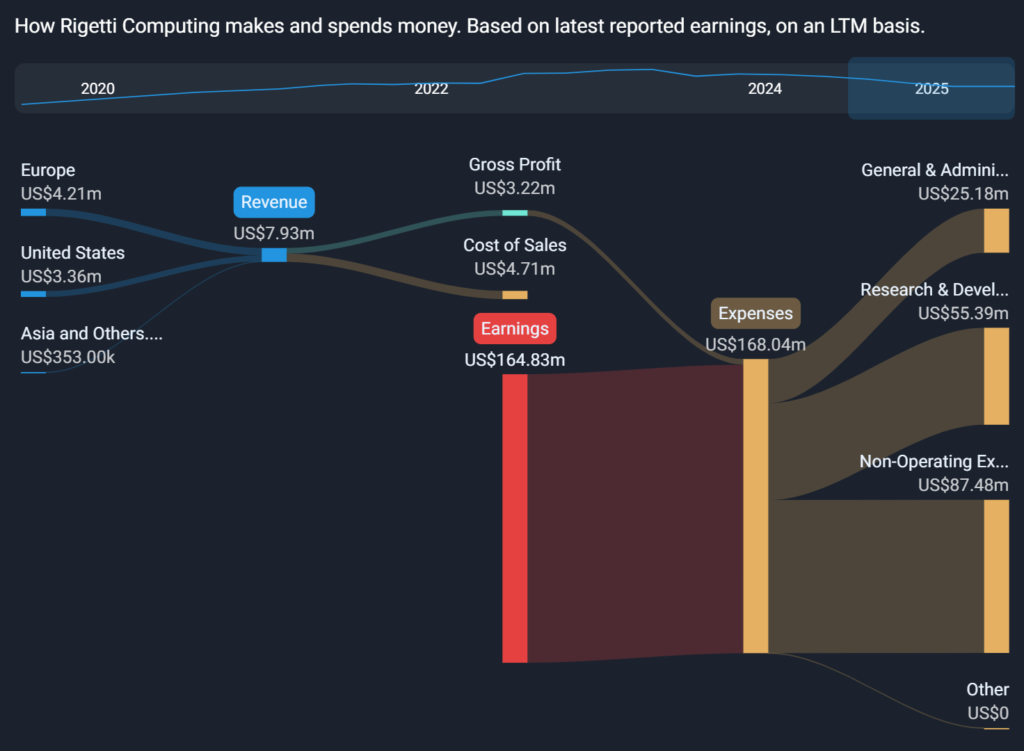

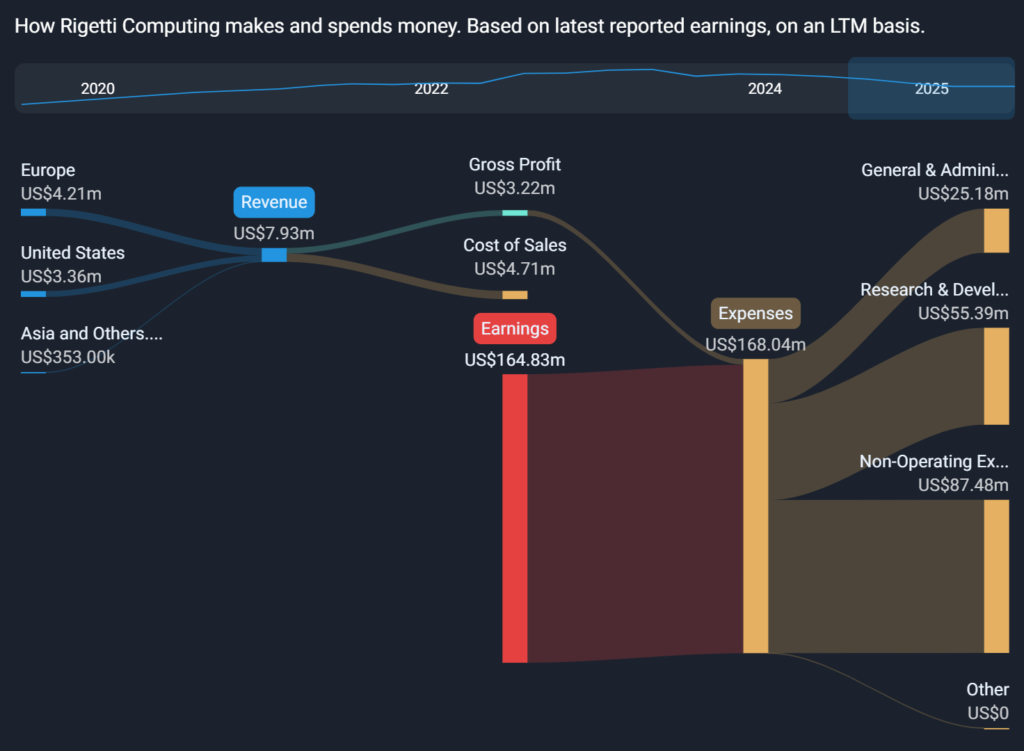

Cash Burn and Profitability: Long Runway, Short-Term Pain

Rigetti remains firmly pre-profit:

- R&D costs are >$13M/quarter, with total OpEx near $20M.

- Gross margins have shrunk (Q2: 31%), driven by low-volume production and high overhead.

The silver lining: Rigetti raised ~$350M earlier this year, ending Q2 with $571M in cash, giving it 9–10 years of liquidity even at current burn rates. That makes it one of the best-capitalized small-cap deep tech firms on the market.

Prediction: Margin pressure continues, but strong liquidity reassures investors on near-term funding risk.

Competitive Landscape: Speed vs. Coherence

Rigetti faces off against rivals including:

- IonQ (IONQ): Trapped-ion systems with higher coherence but slower gate speeds.

- D-Wave (QBTS): Quantum annealing for optimization problems, not general-purpose QPUs.

- IBM, Google, Amazon: Big Tech incumbents with massive R&D but slower commercialization timelines.

Rigetti’s niche lies in hybrid quantum-classical architectures and time-to-solution advantages. But its go-to-market strategy still lags larger enterprise cloud competitors.

Analyst Sentiment: Bullish, but Pricey

- TipRanks shows a Moderate Buy rating with a $32 average target (well below current ~$55 level).

- Needham and Compass Point remain bullish, citing commercial traction and roadmap execution.

- Raymond James recently downgraded the stock to Hold, citing valuation after its massive run.

Prediction: Sentiment remains constructive, but any earnings disappointment could prompt profit-taking.

Will Quantum Hype Deliver Quantum Returns?

Rigetti has delivered on many of its promises—technical milestones, government validation, and commercial pilots. But with the stock already up over 2,000%, the market will want to see more than just progress—it needs revenue acceleration and scalable commercial demand.

Our Call: Rigetti reports inline-to-slight-miss revenue and a narrower loss, but shares trade sideways or slightly lower unless new guidance or partnerships significantly exceed expectations.

Disclosure: All predictions and insights shared in this article are based on a comprehensive review of publicly available analyst reports, media coverage, and market consensus. These views are for informational purposes only and do not constitute investment advice. Please conduct your own research or consult a licensed financial advisor before making any investment decisions.