Hedge funds are closing 2025 on a strong note, but October reminded them that even in a bull run, volatility still bites.

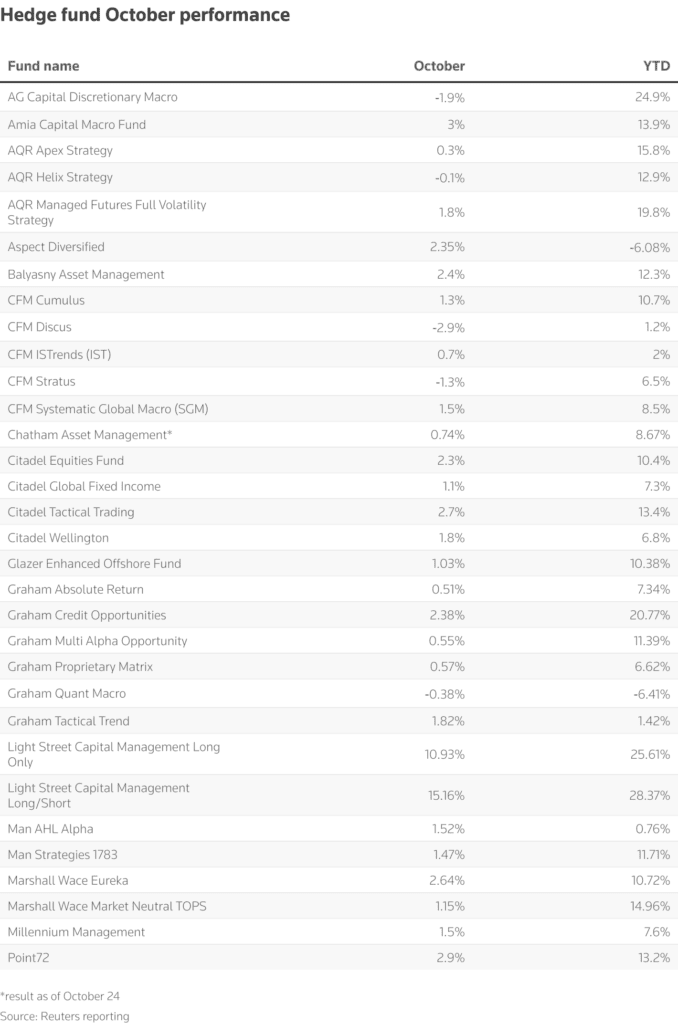

According to a Goldman Sachs client report reviewed by Reuters, hedge funds have gained more than 13% year-to-date through October, outperforming many of the biggest multi-strategy peers like Citadel and Millennium. Still, October was a mixed month: equity long/short funds returned 1.75%, lagging the S&P 500’s 2.3% rise.

Tech and healthcare drove the gains, TMT-focused funds rose 2.1%, while healthcare specialists surged 8.4%, marking their fifth consecutive positive month. Yet cracks appeared as AI stocks and high-valuation tech names stumbled heading into November, pushing the Nasdaq toward its worst week since April.

Meanwhile, systematic and quant funds struggled with short positions, and macro funds performed slightly better, aided by global rate and currency plays. According to Goldman, larger, concentrated trades, especially in the US and China, backfired for both discretionary and systematic managers.

Despite those headwinds, hedge fund sentiment remains bullish on single stocks, with net long exposure climbing for a second month. The optimism, however, may be tested further if the market’s tech-led correction deepens into year-end.

Multi-strategy titans like Citadel, Millennium, and Balyasny also reported modest gains in October, underscoring a steady but cautious environment: strong returns, but a sense that the easy money in 2025’s AI-fueled market may already be behind them.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.