US markets pulled back on Tuesday, with the Dow, S&P 500, and Nasdaq all closing lower as investors questioned whether corporate earnings can justify the market’s lofty valuations.

The Nasdaq Composite fell about 1.2%, led by sharp losses in high-flying AI stocks. Palantir ($PLTR) dropped over 7% despite beating earnings expectations, as analysts flagged its stretched valuation, trading at nearly 700 times forward earnings. Uber ($UBER) also fell more than 7% after strong results failed to meet investor hopes. Super Micro Computer ($SMCI) and AMD ($AMD) slipped ahead of their results.

Analysts say markets are starting to cool from overextended highs, with the S&P 500’s forward P/E ratio near 23, close to levels seen during the 2000 tech bubble.

Related: Is Big Tech’s AI Spending Creating a Bubble?

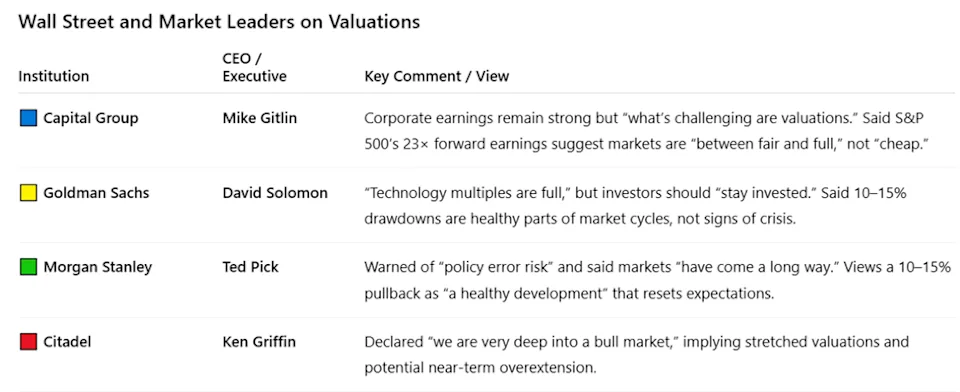

According to Bloomberg, several top Wall Street CEOs are warning of a 10–15% equity correction in the next 12–24 months. Goldman Sachs’ David Solomon said markets are “likely due for a healthy drawdown,” while Morgan Stanley’s Ted Pick pointed to “policy error risk” after this year’s relentless rally.

Capital Group CEO Mike Gitlin added that while earnings remain strong, valuations are stretched: “We’re somewhere between fair and full, but not between cheap and fair.” The S&P 500 now trades at 23x forward earnings, well above its five-year average of 20x.

Investor sentiment has turned sour, the CNN Fear & Greed Index has now sunk into “Extreme Fear” territory, signalling rising anxiety over high valuations and the potential for a correction.

The selloff comes amid rising caution over AI valuations and a prolonged US government shutdown, which has delayed key economic data including the October jobs report, leaving the Federal Reserve and investors flying blind on the economy’s direction.

Markets are facing a harsh mix of overvaluation fears, stalled economic data, and shaken confidence. As one trader put it, “The mood has flipped fast. Greed’s gone. Fear’s in charge.”

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.