Amazon delivered a clean beat in Q3 2025, exactly as previewed, powered by an AWS growth re-acceleration to 20% and a stronger-than-expected retail/ads engine.

Shares jumped ~10% after the print as investors embraced a bigger AI build-out and a stronger 4Q guide.

Referenced article: Amazon Q3 2025 Earnings Preview and Prediction: What to Expect

From Forecasts to Facts

| Metric | Consensus Range (Preview) | Actual (Q3 2025) | What It Means |

|---|---|---|---|

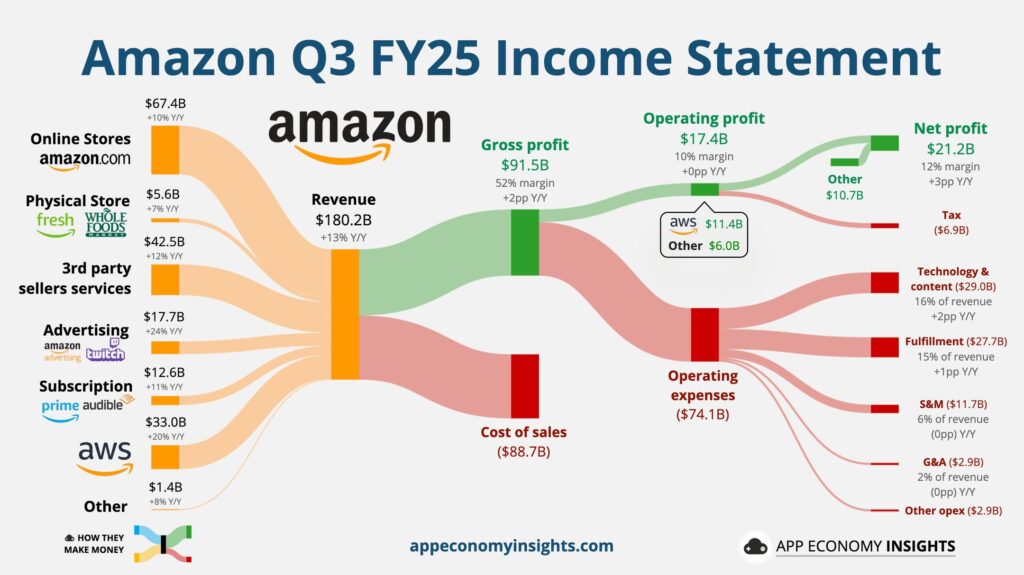

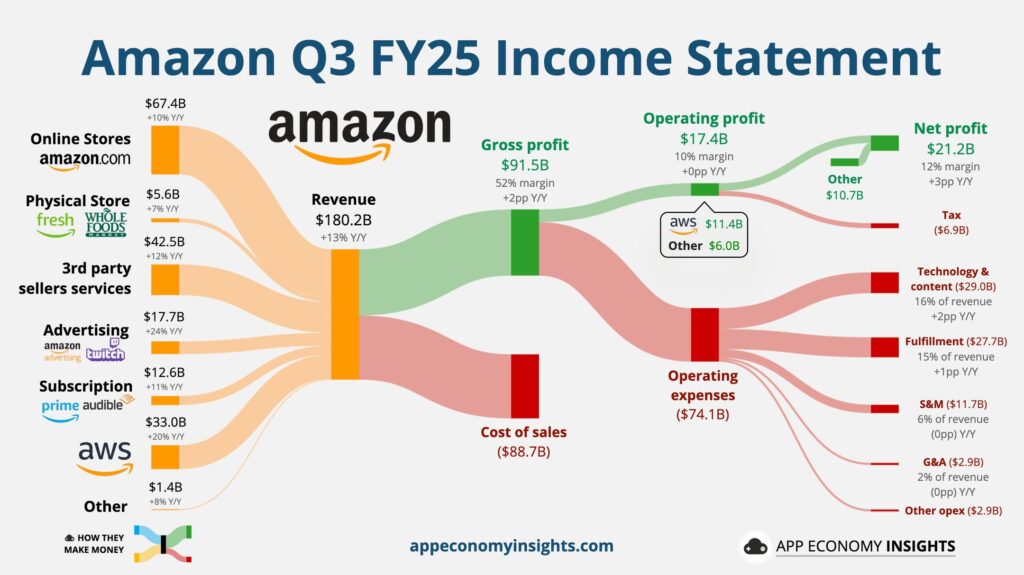

| Net Sales | ~$177–179B | $180.2B (+13% YoY) | Broad beat; record Q3 scale. |

| Diluted EPS | ~$1.57–1.65 | $1.95 | Solid upside; N/O gains from Anthropic also helped NI. |

| Operating Income | ~$17–18B | $17.4B ($21.7B ex. FTC & severance) | Core ops stronger than GAAP optics. |

| AWS Revenue | High-teens % | $33.0B (+20% YoY) | The long-awaited re-accel is here. |

| Advertising | Low-20s % | +24% YoY ($17.7B) | Prime Video & DSP momentum. |

| Q4 Sales Guide | ~$208B mid | $206–$213B | Healthy holiday setup. |

Why shares ripped: Results cleared a high bar and management leaned into capacity adds and AI demand translating to backlog/revenue—flipping the narrative from “capex fear” to “growth following spend.”

AWS: The AI Unlock Quarter

AWS posted +20% YoY to $33.0B, its fastest growth in ~3 years, with management tying the re-acceleration to AI workloads, capacity expansions, and custom silicon adoption. With AWS contributing roughly two-thirds of operating profit, the cloud arm re-assumed the role of profit engine.

Retail & Ads: Quietly Exceptional

- Retail: North America +11% YoY; International +14% (+10% ex-FX). Network efficiency, faster delivery, and grocery expansion kept volumes sturdy.

- Advertising: +24% YoY to $17.7B, driven by Prime Video ads and a resilient DSP—another quarter of double-digit outperformance.

Profit Quality: Charges Mask Core Strength

Operating income printed $17.4B, flat YoY, but would have been $21.7B without a $2.5B FTC settlement and $1.8B severance tied to planned role eliminations. Net income also reflected a $9.5B pre-tax gain from the Anthropic investment. Under the hood, the P&L was stronger than the headline.

Capex: Spend More, Grow Faster

Amazon lifted 2025 capex to ~$125B (from ~$118B) and indicated higher again in 2026, out-spending peers to meet compute demand (data centers, power, networking, chips). The market embraced the step-up because growth is following capacity (AWS +20%).

What Analysts Said After the Report

- Evercore ISI – Mark Mahaney (Outperform; PT $335): “AWS Unlock Quarter—20% Y/Y; backlog $200B; Trainium2 +150% q/q; Retail/OM up; Ads +22%.”

- Morgan Stanley – Brian Nowak (Overweight; PT $315): “Capacity doubling by ’27; October new business > entire Q3; Trainium3 coming; ’26/’27 EPS +5%/+6%.”

- Oppenheimer – Jason Helfstein (Outperform; PT $290): “AWS +20%—fastest in 11 quarters; added 3.8 GW; Project Rainier 23% online; EBIT > Street.”

- BofA – Justin Post (Buy; PT $303): “Capacity ramp underpins growth; re:Invent to showcase Trainium, Nova, new partners; raise PT on 2027 SOTP.”

- Canaccord – Maria Ripps (Buy; PT $300): “Backlog $200B; Trainium3 ~40% more cost-efficient by YE; ads +22% ex-FX.”

- Truist / Raymond James (Buy/Outperform; PT $290 / $275): “AWS cleared 20% early; ~500k Trainium2 chips now, 1M by YE—multi-billion AI Cloud ARR thesis intact.”

- Goldman Sachs – Eric Sheridan (Buy; PT $290): “Debates shift to consumer backdrop; long-term case: compounded revenue + margin expansion while investing.”

Overall Forecast Accuracy (Finblog Preview vs. Actuals)

| Focus Area | Result |

|---|---|

| Clean headline beat on sales/EPS | ✅ |

| AWS re-acceleration toward 20% | ✅ (printed 20%) |

| Advertising low-20s% growth | ✅ (24%) |

| Capex step-up and investor acceptance | ✅ |

| Positive stock reaction post-print | ✅ (~10%) |

| Score | A (≈90%) |

Key Takeaways

- Scale milestone: $180.2B sales; broad strength across AWS, Retail, and Ads.

- Cloud inflection: AWS +20% eases share/growth fears and validates the AI demand thesis.

- Quality of earnings: Core operating profit stronger than GAAP after one-offs.

- Capex with purpose: $125B in 2025, likely higher in 2026—and the market rewarded it as growth follows capacity.

- Holiday runway: Q4 guide $206–$213B sets a constructive tone into peak season.

Amazon Share Price Has Never Been Higher, Here’s Why It Still May Be Cheap

Amazon stock recently hit a new all-time high, marking a staggering long-term performance in which $1 invested at IPO in 1997 is now worth over $2,800. Despite the rally, some analysts argue the shares remain attractively priced given AWS’s dominance, the company’s massive scale, and its willingness to reinvest aggressively instead of paying dividends.

AWS alone contributed roughly two-thirds of Amazon’s $17.4B quarterly operating income, fueled by AI-related hosting demand. This surge in profitability explains why investors see Amazon’s long-term AI strategy as the foundation for continued compounding growth.

Even with uncertainties around tariffs and competitive pricing, many believe Amazon’s expanding moat—spanning cloud, retail, and advertising ecosystems, means the record-high stock could still be undervalued on a multi-year horizon.

In bottom

This was the AWS unlock quarter. Capacity, backlog, and custom silicon are now showing up in revenue and operating profit, while retail and ads keep compounding in the background. With a firm holiday guide and the will to out-invest rivals in AI infrastructure, Amazon just re-asserted leadership across all three pillars: AWS, Retail, and Ads.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.