A high-stakes week awaits investors, with Big Tech earnings, a Federal Reserve rate decision, and a Trump–Xi summit all set to collide — a trio of events that could shake global markets.

Stocks ended last week at record highs after September’s CPI report showed inflation cooling to 3%, bolstering expectations that the Fed will cut rates again on Wednesday. The move would mark the central bank’s second rate cut of 2025, lowering borrowing costs to a target range of 3.75%–4%. (More about: US Inflation Cools, but Shutdown Threatens Next Report)

Fed Chair Jerome Powell will speak after the decision, with traders watching closely for hints of further easing in December amid ongoing government shutdown data delays. “It’s a done deal,” analysts at Bank of America said, noting that the soft labor market and mild inflation make a cut almost certain.

Big Tech Takes Center Stage

The week’s biggest spotlight belongs to the Magnificent Seven.

- Microsoft (MSFT) reports Wednesday after unveiling a $40B AI data center deal with Nvidia (NVDA).

- Alphabet (GOOGL) will update investors on its potential partnership with Anthropic.

- Meta (META) is expected to discuss its new AI-powered smart glasses.

- Apple (AAPL) and Amazon (AMZN) headline Thursday’s reports, with Apple buoyed by record iPhone 17 sales and Amazon facing scrutiny over recent AWS outages.

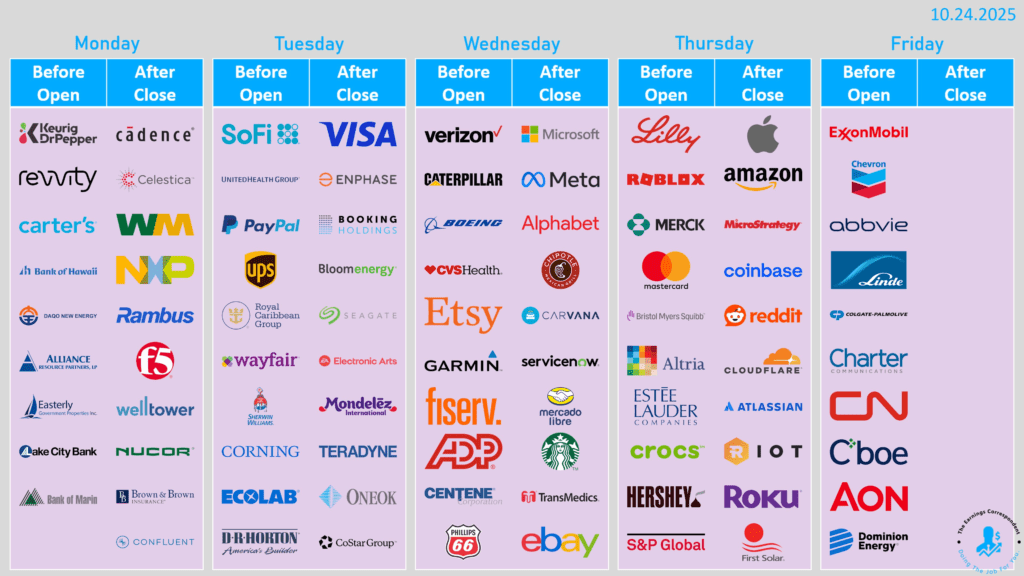

Other key earnings include Exxon Mobil (XOM), Chevron (CVX), UnitedHealth (UNH), Visa (V), and Eli Lilly (LLY) — offering a broad read on industrial, energy, and healthcare strength.

Geopolitics in Focus

Markets are also bracing for Thursday’s Trump–Xi Jinping meeting at the APEC summit in South Korea. The talks come amid escalating trade tensions after China restricted rare earth exports and Washington sanctioned Russian oil giants Rosneft and Lukoil.

More about: US and China Reach “Very Successful Framework” Ahead of Trump–Xi Meeting

Analysts say any sign of thawing US–China relations could boost risk appetite, though expectations remain muted. “We’re far from convinced there will be an important enough deal to relieve market uncertainty,” said Thierry Wizman of Macquarie.

Market Watch: Bullish Momentum Meets Critical Turning Point

Goldman Sachs estimates that companies are passing 70% of tariff costs to consumers, fueling inflation risk even as growth cools. But with S&P 500 earnings up 13.2% YoY and investors betting on easier Fed policy, bulls still have momentum.

| Date | Economic Data / Events | Key Earnings Releases |

|---|---|---|

| Monday, Oct. 27 | Data delayed by shutdown: Durable goods orders (Sep) Dallas Fed manufacturing activity (Oct) | Welltower (WELL), Southern Copper (SCCO), Cadence Design Systems (CDNS), Waste Management (WM), NXP Semiconductors (NXPI), Keurig Dr Pepper (KDP), Hartford Insurance (HIG) |

| Tuesday, Oct. 28 | Consumer confidence (Oct) S&P Case-Shiller home price index (Aug) FHFA home price index (Aug) Richmond Fed manufacturing index (Oct) | Visa (V), UnitedHealth Group (UNH), HSBC (HSBC), NextEra Energy (NEE), Booking Holdings (BKNG), Royal Caribbean (RCL), Sherwin-Williams (SHW), Mondelez (MDLZ), UPS (UPS), PayPal (PYPL), MSCI (MSCI), Sysco (SYY), Bloom Energy (BE) |

| Wednesday, Oct. 29 | FOMC rate decision Fed Chair Jerome Powell press conference Pending home sales (Sep) Data delayed: Advanced trade balance, retail & wholesale inventories (Sep) | Microsoft (MSFT), Alphabet (GOOG), Meta (META), Caterpillar (CAT), ServiceNow (NOW), Boeing (BA), Verizon (VZ), CVS (CVS), Starbucks (SBUX), Carvana (CVNA), KLA (KLAC), UBS (UBS), Chipotle (CMG), Phillips 66 (PSX), Kraft Heinz (KHC) |

| Thursday, Oct. 30 | Data delayed: Initial jobless claims (week ended Oct. 25), GDP (Q3) Personal consumption (Q3) | Apple (AAPL), Amazon (AMZN), Eli Lilly (LLY), Mastercard (MA), Merck (MRK), Shell (SHEL), Gilead (GILD), S&P Global (SPGI), TotalEnergies (TTE), Anheuser-Busch (BUD), Comcast (CMCSA), Coinbase (COIN), Cloudflare (NET), Reddit (RDDT), Restaurant Brands (QSR) |

| Friday, Oct. 31 | Chicago Business Barometer (PMI, Oct) Data delayed: PCE index (Sep), Employment cost index (Q3) | Exxon Mobil (XOM), Chevron (CVX), AbbVie (ABBV), Linde (LIN), Colgate-Palmolive (CL), Dominion Energy (D), Charter (CHTR), Cenovus (CVE), Cboe (CBOE), T. Rowe Price (TROW) |

As Wall Street enters its busiest week of the season, traders face a volatile mix of AI earnings, monetary policy shifts, and geopolitical theater, a combination that could define the final quarter of 2025.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Asian Markets Soar to Record Highs on Renewed US-China Trade Deal Optimism