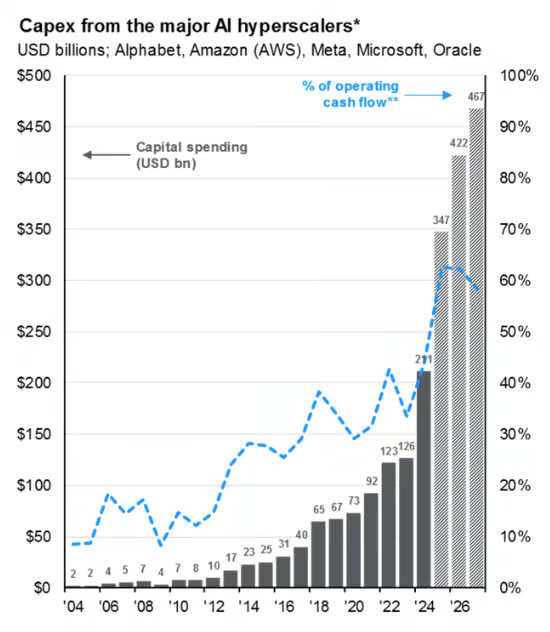

According to the new JPMorgan research note, the five giants will collectively pour more than $1.2 trillion into AI infrastructure, including data centers, chips, and cloud capacity. This staggering figure reflects how rapidly the AI arms race is escalating, as each company races to dominate foundation models, enterprise cloud AI, and next-generation computing ecosystems.

The Scale of the AI Infrastructure Boom

The investment pace — averaging over $400 billion per year — dwarfs past technology buildouts, even those of the early internet and mobile eras.

Much of the capital is expected to go into hyperscale data centers, custom silicon, and energy infrastructure needed to power large language models and inference engines.

- Google ($GOOGL) and Microsoft ($MSFT) are forecast to lead the charge, expanding global data center footprints and securing chip supply through exclusive deals with Nvidia, AMD, and custom AI accelerator designs.

- Amazon ($AMZN) is set to boost AWS investments into its Bedrock and Trainium platforms, extending its dominance in cloud AI.

- Meta ($META) continues to scale its data centers to host open-source models like Llama and enhance generative AI experiences across Instagram, Facebook, and Threads.

- Oracle ($ORCL), a relative newcomer among hyperscalers, is expected to leverage its partnership with OpenAI’s Stargate project and aggressive expansion in sovereign cloud and GPU clusters.

Why It Matters: The New “AI Industrial Revolution”

JPMorgan analysts called this the start of a new infrastructure supercycle, comparing it to the railroad and electricity buildouts of the 19th and 20th centuries — only faster and more concentrated.

The spending spree could add up to 1.5% to global GDP growth over the next three years, largely driven by capital-intensive AI infrastructure projects that boost semiconductor demand, energy investment, and software innovation.

However, analysts warned that profit visibility remains uneven, as most hyperscalers will face declining short-term margins due to heavy upfront costs.

“The near-term effect will be margin compression, but the long-term outcome could be exponential productivity gains across the tech sector,” JPMorgan wrote.

Impact on the Broader Tech Ecosystem

The ripple effects of this $1.2 trillion investment will reshape the entire tech landscape:

- Semiconductors: Nvidia, AMD, Broadcom, and TSMC are projected to see record revenues, with AI chip demand growing 60% annually through 2027.

- Energy & Power Infrastructure: AI data centers could consume over 5% of global electricity by 2027, fueling demand for renewable projects and grid modernization.

- Software & Cloud: SaaS and enterprise AI companies stand to benefit as hyperscalers build massive cloud capacity for resale and API monetization.

- Cybersecurity: With data volumes exploding, AI-driven security and encryption tools will see accelerated adoption across hyperscale networks.

The AI race is no longer just about innovation — it’s a capital war.

With over $1.2 trillion in collective investment through 2027, Big Tech is effectively building the digital infrastructure of the next century.

JPMorgan’s forecast highlights how this historic spending cycle could cement the dominance of the AI hyperscalers while ushering in a new era of cloud, chip, and energy convergence that redefines global technology growth.

In essence: the AI revolution is no longer about startups — it’s powered by trillion-dollar titans building a new industrial backbone for the digital age.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

OpenAI Surges to $500 Billion Valuation, Overtakes Musk’s SpaceX

Trump’s $100,000 H-1B Visa Fee: What It Means for Tech, Talent, and Markets

Fed Divide Widens as Policymakers Clash Over Pace of Rate Cut