Wall Street opened on a burst of AI euphoria and notched fresh intraday records Friday, but gains faded after a weak read on the services economy undercut the rally. The Nasdaq 100 briefly hit an all-time high before slipping as the ISM services report showed business activity contracting for the first time since the pandemic and employment at 47.2—a fourth straight month of contraction. With the government shutdown in Day 3 and the September payrolls report shelved, traders leaned harder on ISM’s labor gauge—hardly comforting.

What moved markets

- AI deal spree vs. data shock: Big-ticket AI partnerships and chip headlines lifted semis early, but ISM’s soft print blunted momentum and narrowed tech’s lead.

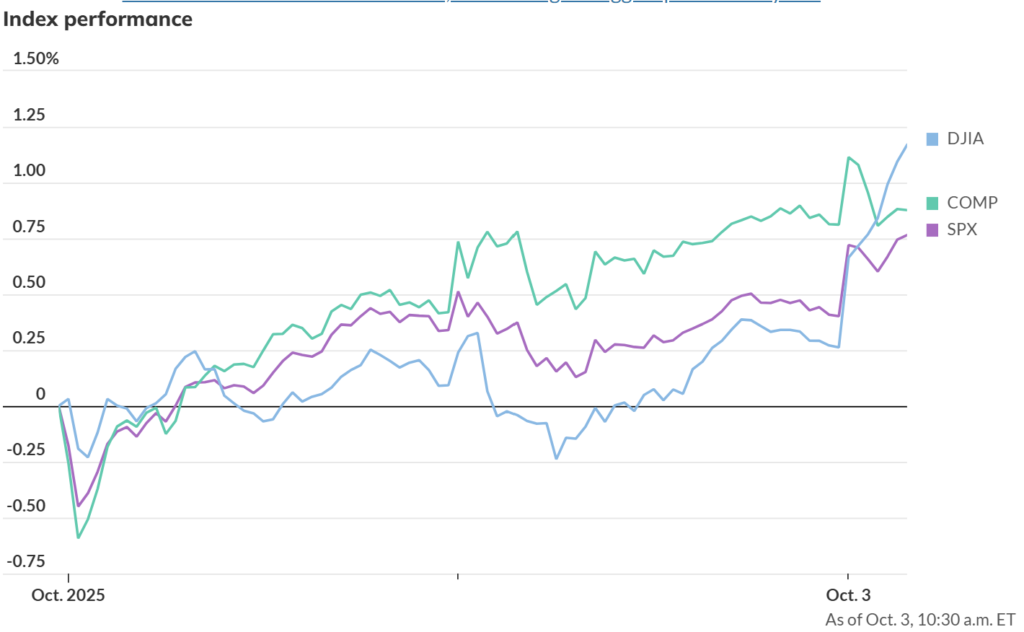

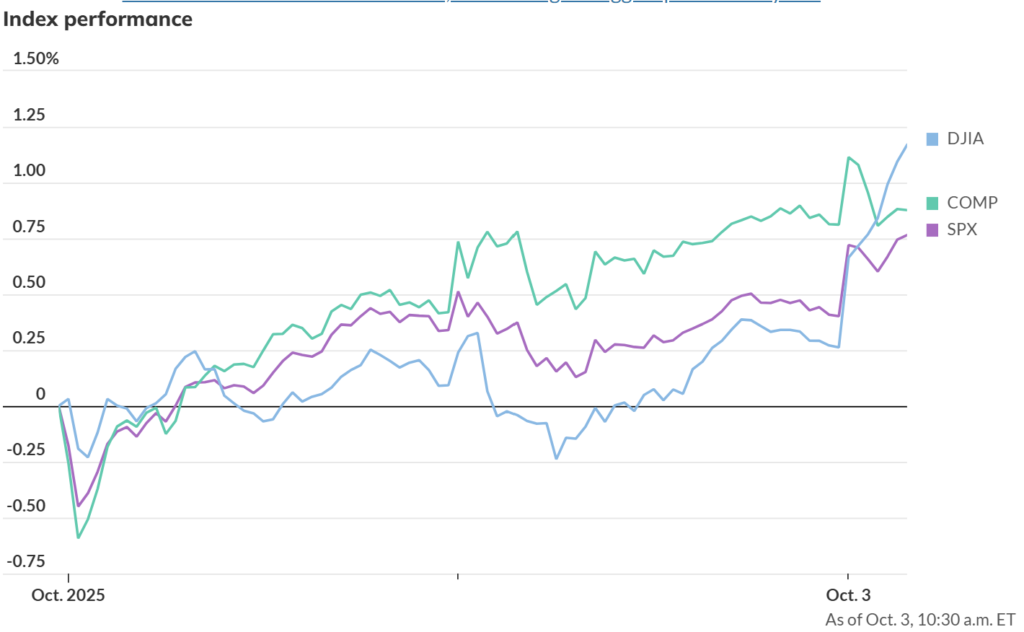

- Records, with asterisks: The Dow jumped roughly +400 pts (~+1%) to a record; the S&P 500 also hit a new high; the Nasdaq eked out a gain but lagged as services softness clipped enthusiasm.

- Shutdown = data drought: With NFP and other releases on ice, the Fed is “flying with fewer instruments.” Markets still price more easing, but tone is tentative.

- Fed speak: Chicago Fed’s Goolsbee cautioned against front-loading too many cuts, noting pressure on both inflation and jobs.

- CEO check: Goldman’s David Solomon said he “sleeps very well” about the bull market but expects a drawdown in 12–24 months, adding AI cycles create clear winners and losers.

- Oil supply signal: “Oil at sea” jumped to the highest since 2023, a sign of rising global supply and potential near-term headwinds for crude.

- Havens sticky: Gold hovered near this week’s records as shutdown angst and weaker services data kept safe-haven demand in play.

Why it matters now: With the jobs report delayed, ISM’s contracting services employment (47.2) takes on outsized importance, reinforcing evidence of a cooling labor market just as the Fed debates how fast to ease.

The AI capex wave is still powering risk appetite and new highs, but cyclical signals (services, oil supply, data blackout) are injecting two-way risk.

The setup into next week: Watch for shutdown duration (longer = deeper data gap and rising policy uncertainty), private-sector trackers (for labor and prices), and any Fed guidance shifts as officials weigh soft services against AI-led market exuberance.

Wall Street is still climbing on the AI boom, but weak ISM services data, a government shutdown, and a murky jobs picture are tempering euphoria. With economic releases delayed, the Fed is navigating without key signals — meaning rate cuts remain in play, but uncertainty is rising. Investors are enjoying record highs, yet the foundation is shaky: labor softness, political gridlock, and oversupply signs in oil could turn sentiment quickly.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

OpenAI Surges to $500 Billion Valuation, Overtakes Musk’s SpaceX

Trump’s $100,000 H-1B Visa Fee: What It Means for Tech, Talent, and Markets

Fed Divide Widens as Policymakers Clash Over Pace of Rate Cut

US Confirms EU Trade Deal, 15% Auto Tariffs Now in Force