Vlad Tenev says Robinhood is “just getting started” as competition with Kalshi and Polymarket heats up.

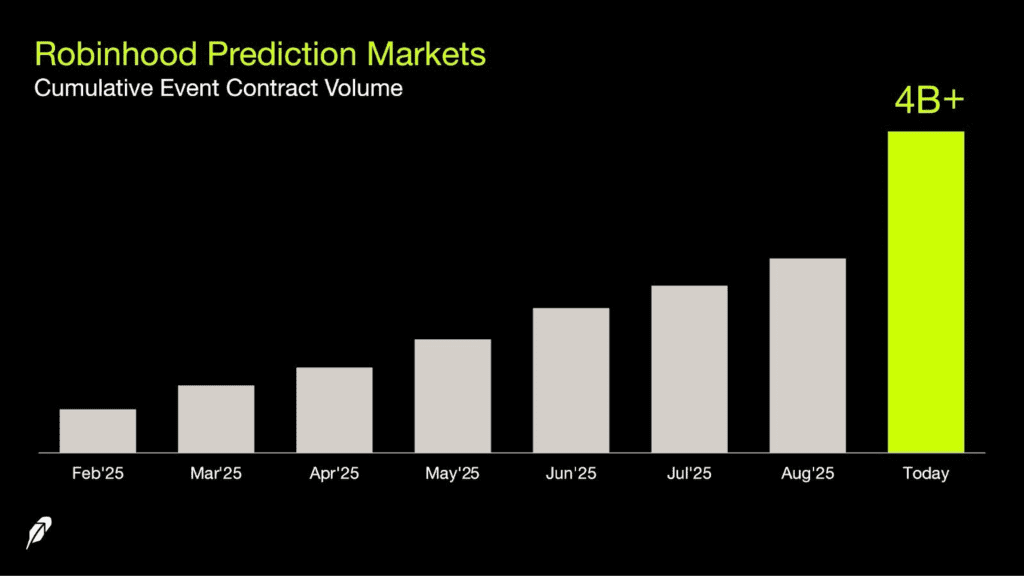

Robinhood has reached a major milestone in the fast-growing world of prediction markets, with more than 4 billion event contracts traded all-time, according to CEO Vlad Tenev. The company logged over $2 billion in contracts during the third quarter alone, underscoring the surge in retail and institutional interest in event-based trading.

The milestone comes as competition intensifies. Kalshi recently overtook Polymarket, now controlling nearly two-thirds of the market’s trading volume, thanks to its US-regulated model. According to Dune Analytics, Kalshi processed over $500 million in weekly trading between September 11–17, maintaining $189 million in open interest. Polymarket, by comparison, generated $430 million with $164 million in open interest.

The shift marks a dramatic reversal from late 2024, when Polymarket held 95% of market share, highlighting how quickly regulated platforms are gaining traction.

Industry voices argue prediction markets are drawing users because they offer a direct way to bet on real-world events — from elections to economic data releases — while also generating some of the most accurate signals on probabilities.

Robinhood’s 4-billion milestone reinforces its push to expand beyond stocks and crypto, positioning event contracts as a mainstream product. But with Kalshi tightening its grip on market share, the next stage of competition will test whether Robinhood can keep pace.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump’s $100,000 H-1B Visa Fee: What It Means for Tech, Talent, and Markets

Fed Divide Widens as Policymakers Clash Over Pace of Rate Cut