Investors face a tense week as the September jobs report, a looming government shutdown, and the close of Q3 collide with corporate updates from Nike and Carnival.

Markets ended last week relatively calm despite President Trump’s latest tariff announcements, but the coming days could bring fresh turbulence. Tuesday marks the final session of the third quarter, a period in which the S&P 500, Dow, and Nasdaq all touched record highs. Yet, political gridlock in Washington and key labour data are set to dominate investor focus.

Nonfarm Payrolls in Focus

The September employment report, due Friday, is the marquee event of the week. Economists forecast 43,000–51,000 new jobs, with unemployment holding steady at 4.3%. A stronger print could give the Federal Reserve reason to slow its pace of rate cuts, while a weaker number may reinforce the case for easing at the October 29 meeting.

- Consensus forecast: +43,000 to +51,000 jobs

- Unemployment rate: 4.3% (flat)

- Key Fed angle: A sub-75K number supports another cut; over 115K risks a pause

With inflation pressures still sticky, markets are preparing for heightened sensitivity to this release — assuming it isn’t delayed by a government shutdown.

Government Shutdown Threat

Congress faces a midnight Tuesday deadline to fund the government. Without action, the US would enter its 15th partial shutdown since 1981.

- Risk: Delayed jobs data and other key reports (CPI, PPI, JOLTS), complicating Fed policy decisions

- Politics: Republicans hold both chambers, but Democrats are blocking short-term bills over healthcare cuts

- Next step: Trump meets congressional leaders Monday in a last-ditch effort to strike a deal

Past shutdowns have often had limited lasting market impact, but uncertainty could fuel short-term volatility, especially in safe-haven assets like Treasuries and gold.

More about: US Government shutdown watch: what it means for markets — and your wallet

ISM Manufacturing and Services Data

Unlike government releases, ISM’s September activity surveys will be published on schedule.

- Manufacturing PMI: Expected 49.1 (August: 48.7), still below expansion threshold

- Services PMI: Expected 52.0 (flat vs. August), keeping two-thirds of the economy in growth mode

Investors will watch employment components closely, though historically these have not strongly predicted nonfarm payrolls.

Nike Earnings: A Crucial Turnaround Test

Nike reports Tuesday after the bell, giving investors a read on its turnaround strategy under CEO Elliott Hill.

- Revenue: Seen falling mid-single digits YoY

- Challenges: Clearing older inventory via discounts; reducing reliance on Chinese production amid tariffs

- Green shoots: JD Sports praised Nike’s reset efforts last week; demand for running shoes and sneakers seen as early bright spots

Analysts caution it will take “several quarters” for Nike to regain momentum, but signs of operational reset are emerging.

Carnival Earnings: Riding the Cruise Wave

Carnival kicks off the week’s earnings Monday, with the cruise operator benefiting from surging demand for travel experiences.

- Q3 EPS forecast: $1.32 (Bloomberg consensus)

- Stock performance: +22% YTD

- Tailwinds: Cruise margins at 20-year highs; favorable FX boosting outlook

- Guidance: Annual profit outlook raised in June; resilience amid macro volatility noted

Carnival’s results will serve as a bellwether for discretionary spending in an uncertain consumer environment.

Wall Street’s Washington Worries and Bullish Bets

The Fed remains in the spotlight not only for data but also for political drama. Governor Lisa Cook’s position is tied up in a legal fight with the Trump administration, while rate cut expectations remain divided within the FOMC.

Meanwhile, optimism on equities is intact. BMO’s Brian Belski raised his S&P 500 target to 7,000, arguing 2025 could mirror the mid-1990s “Goldilocks” period. The VIX volatility index has steadily dropped to the mid-teens, signaling confidence even amid looming risks.

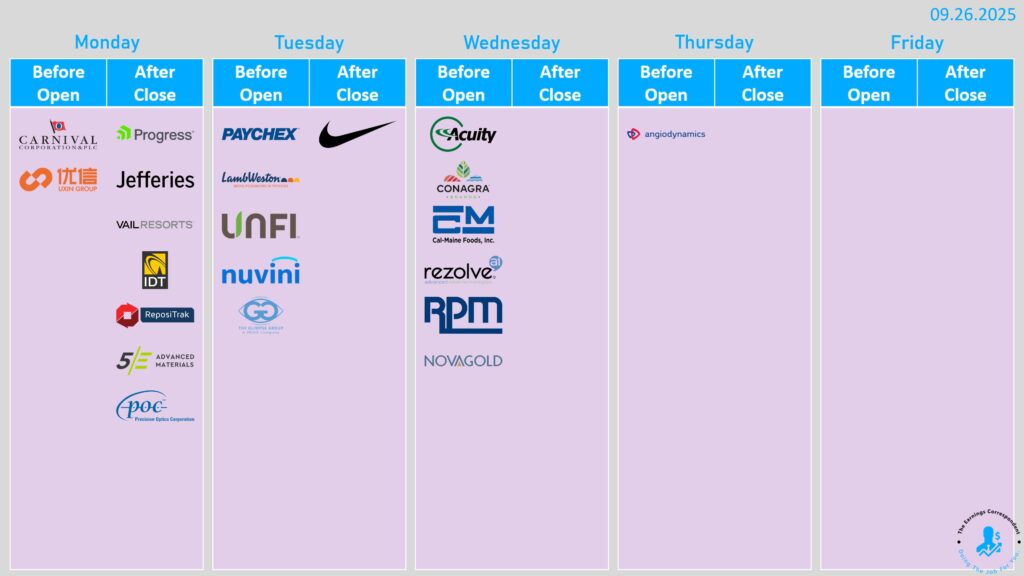

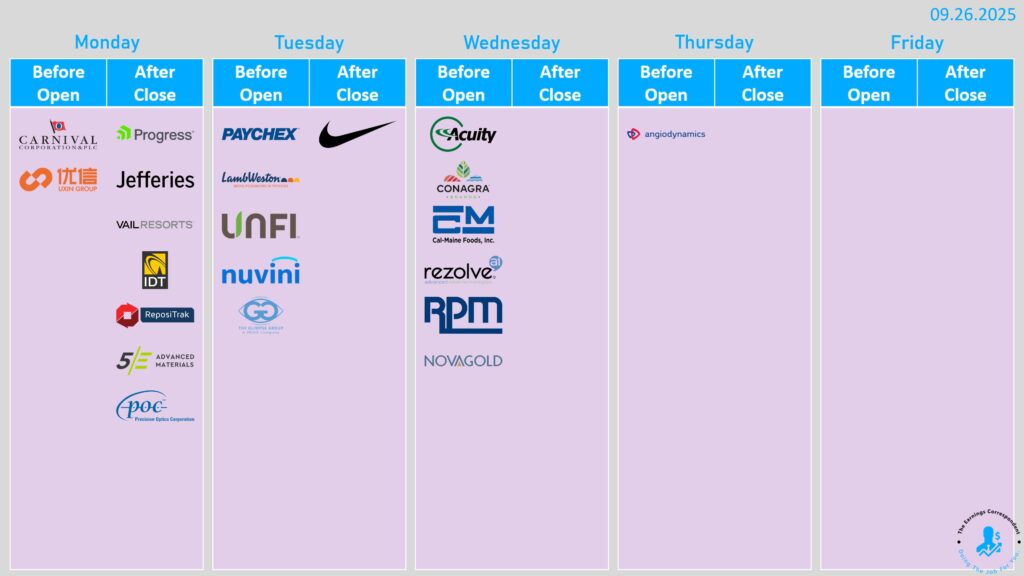

Economic & Earnings Calendar Highlights

Monday:

- Dallas Fed manufacturing activity

- Earnings: Carnival (CCL), Jefferies (JEF), Vail Resorts (MTN), Diginex (DGNX)

Tuesday:

- FHFA house price index (July), Chicago PMI (Sept), JOLTS job openings (Aug), Consumer Confidence (Sept)

- Earnings: Nike (NKE), Paychex (PAYX), Lamb Weston (LW)

Wednesday:

- ADP private payrolls (Sept), ISM manufacturing PMI (Sept), Construction spending (Aug)

- Earnings: RPM (RPM), Acuity (AYI), Levi Strauss (LEVI), Conagra (CAG)

Thursday:

- Jobless claims, Factory orders (Aug), Durable goods (final)

- No major earnings

Friday:

- Nonfarm payrolls (Sept), Unemployment (Sept), Average hourly earnings (MoM/YoY)

- ISM services index (Sept)

This week could prove pivotal for investors. A shutdown would cloud the data picture, just as the Fed weighs its next moves. Nike’s reset and Carnival’s cruise strength provide stock-specific tests, but all eyes remain on Friday’s jobs report. With the S&P 500 near record highs and bulls chasing momentum, the stakes couldn’t be higher heading into Q4.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump’s $100,000 H-1B Visa Fee: What It Means for Tech, Talent, and Markets

Fed Divide Widens as Policymakers Clash Over Pace of Rate Cut