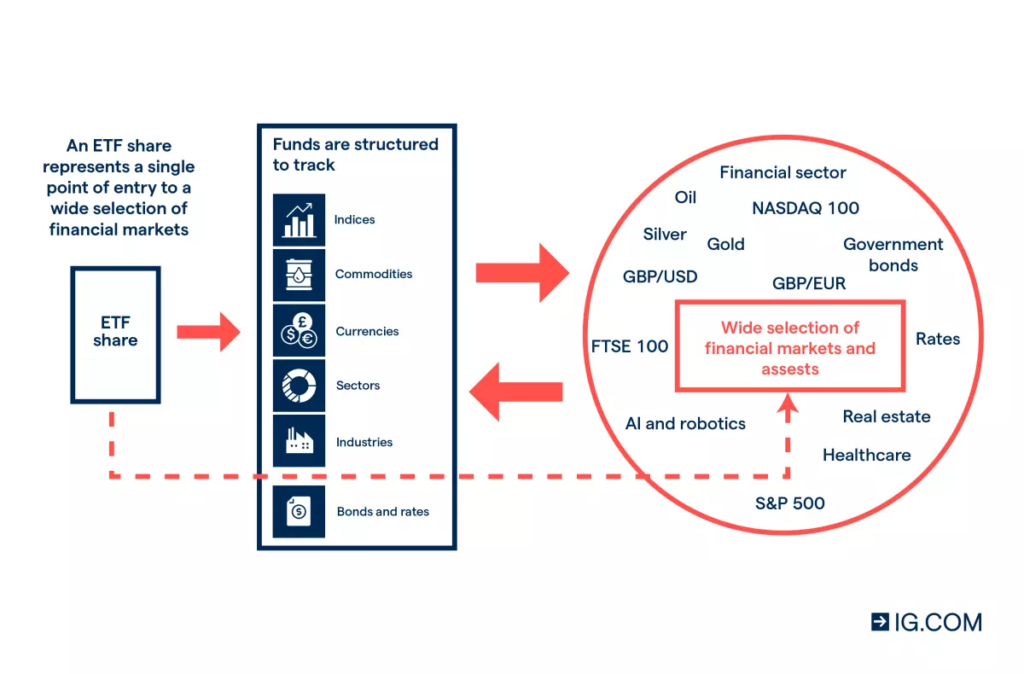

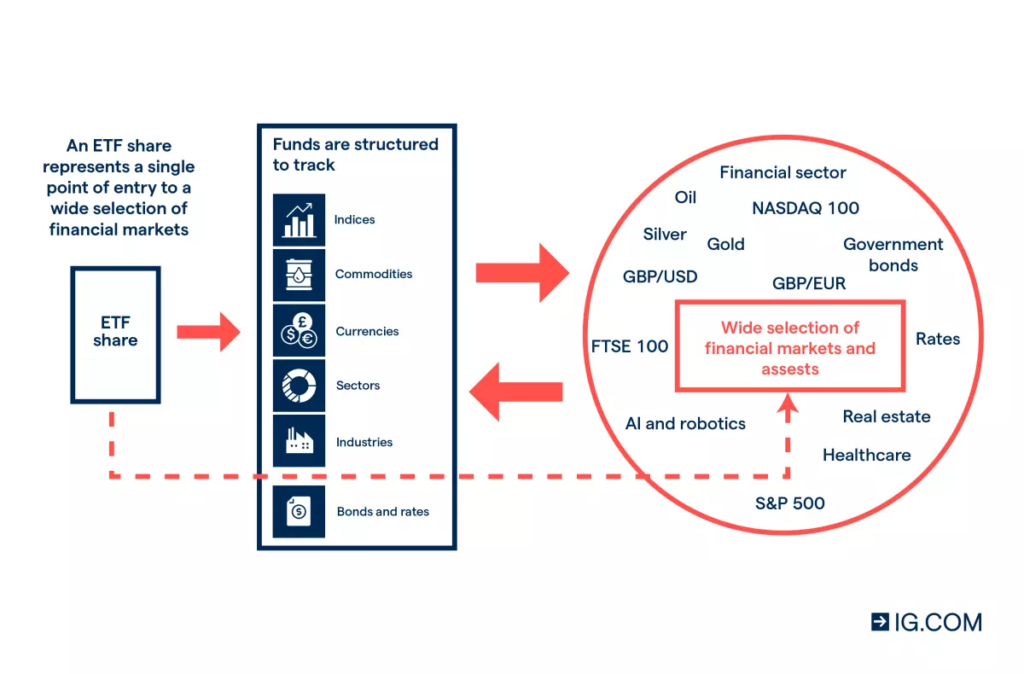

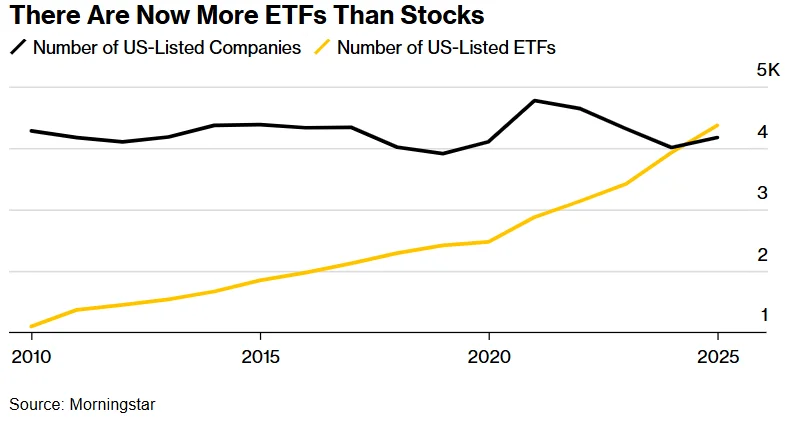

ETFs just crossed a psychological (and structural) milestone in the U.S.: there are now more ETFs than individual stocks listed. Think about that for a second—picking “the market” via funds has become more common than picking companies themselves. Here’s a deep, plain-English walkthrough of what changed, why it happened, how it affects trading, and what to watch next.

What’s new

- ETF count > stock count. By late August, the U.S. had roughly 4,300 ETFs vs. ~4,200 stocks listed—an inversion driven by a flood of new launches this year.

- Record launch pace. 2024–2025 has been a launch machine (hundreds of new funds), with issuers racing to capture investor flows and exchange shelf space.

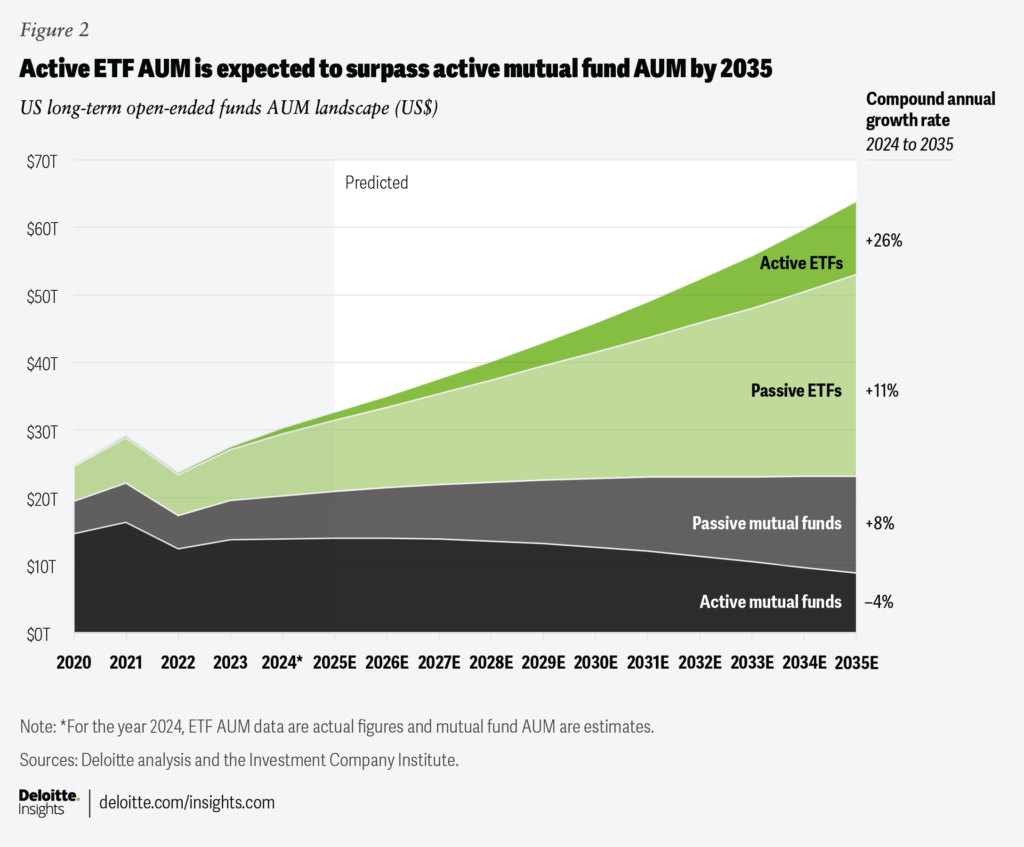

- AUM keeps climbing. Global ETF/ETP assets finished 2024 near $14T and have kept growing in 2025 as flows stay strong.

Why this happened

Lower cost + one-click diversification + tax efficiency became the default choice for many investors, and issuers answered with more niches, more actives, more wrappers. The SEC also modernized the plumbing in 2019 with the ETF Rule (6c-11), which made launching many ETFs faster and cheaper—think “fast pass” compared with the old, case-by-case approvals.

How this changes the market’s plumbing

Trading dynamics. ETFs are now a major share of daily U.S. equity trading by notional value. The biggest ETFs (e.g., S&P 500 trackers) regularly rank as the most-traded U.S. securities, shaping intraday liquidity and price discovery. Exchanges love ETFs because high turnover = more fees and quote activity. (See the NYSE’s own data on how active ETFs are taking share of listings and volumes.)

Bond market knock-on. Fixed-income ETFs have changed how bonds trade—promoting portfolio trading, tighter electronic markets, and new liquidity “shock absorbers.” That proved out in prior stress episodes and is now a $2T+ asset class globally.

Creation/redemption matters. Under the hood, ETFs rely on “APs” (authorized participants) to swap baskets of securities for shares of the ETF. This mechanism is why ETFs can stay close to NAV—but in stressed markets you can still see discounts/premiums. The SEC’s investor bulletin is a good primer on how this works.

The new frontier: active, themes, and crypto

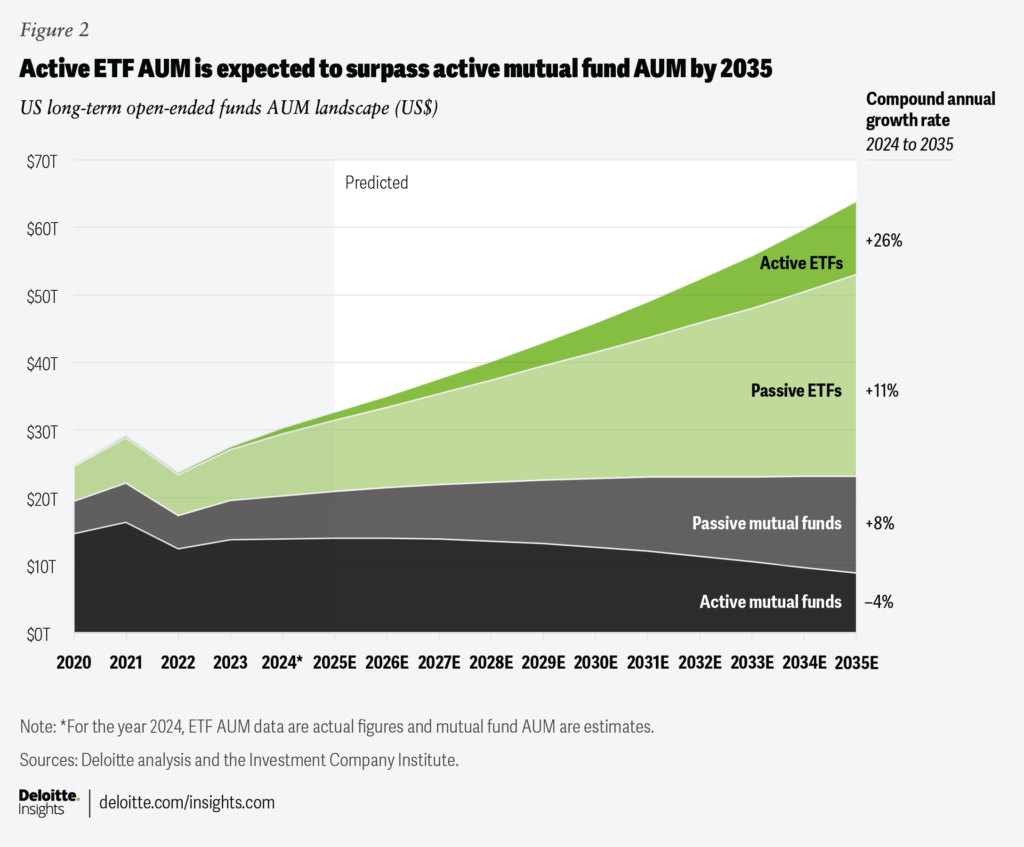

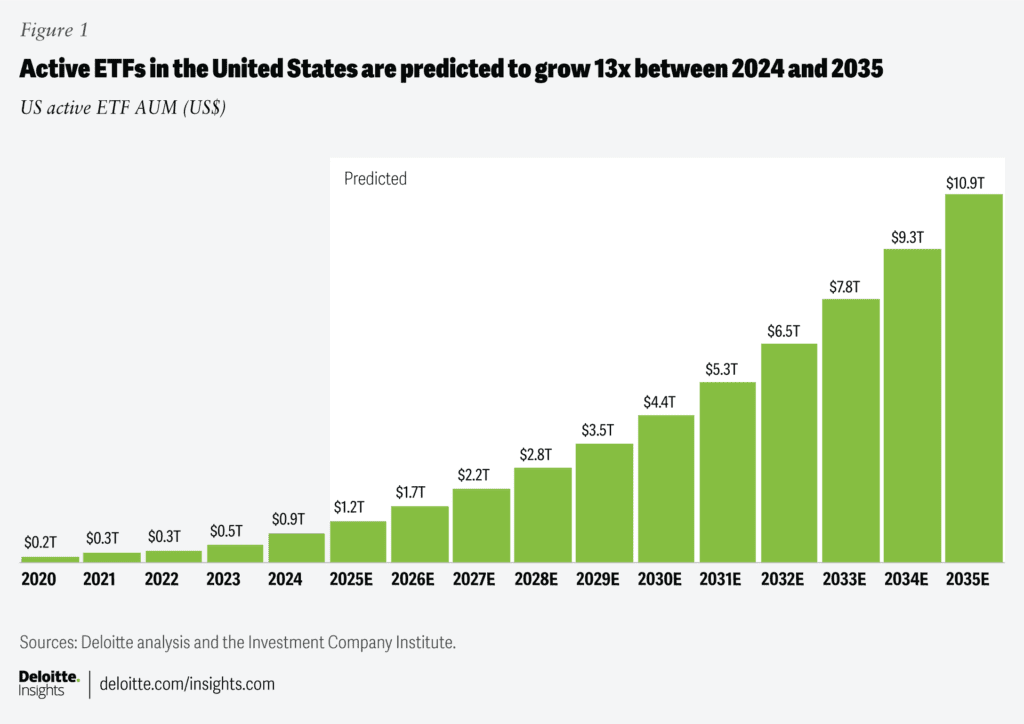

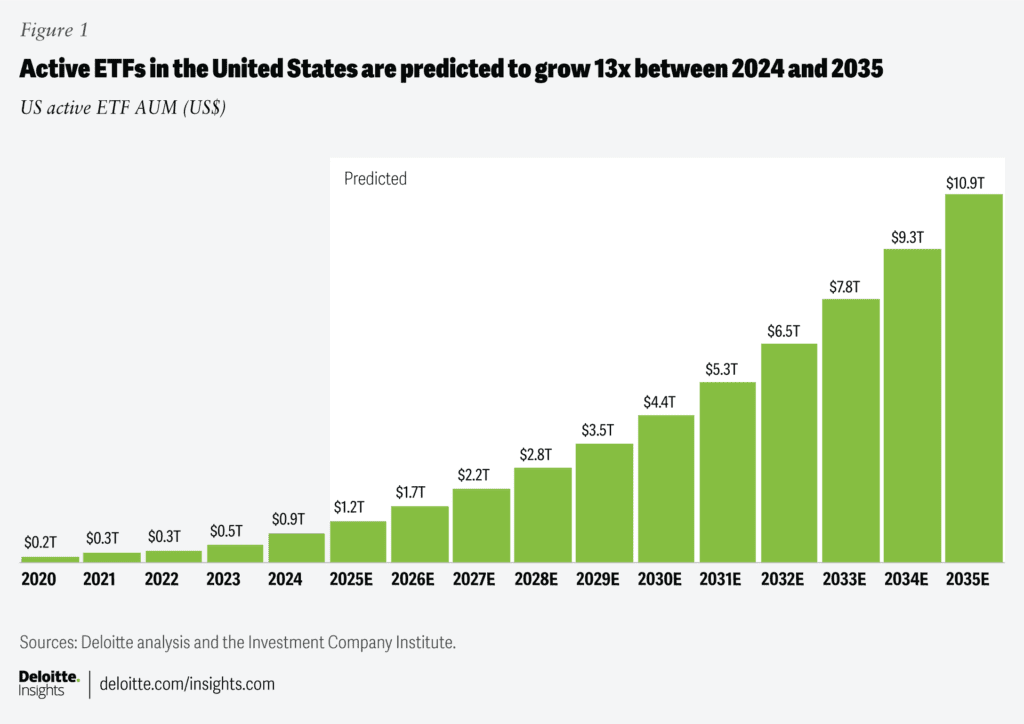

- Active ETF boom. After years of passive dominance, active ETFs are now the majority of new listings (even if they’re still a minority of assets). Issuers and exchanges are leaning into it.

- Themes & single-stock funds. There’s now “an ETF for almost everything” (AI, defense, option-income, carbon, you name it). It’s great for choice—but choice overload and near-duplicate funds raise due-diligence needs.

- Crypto ETFs next wave. After spot bitcoin ETFs, U.S. exchanges (Cboe, Nasdaq, NYSE Arca) filed generic listing standards in July to fast-track commodity/crypto ETPs. If the SEC approves, it could shorten the path for major altcoin funds (e.g., SOL, XRP) that already have futures on regulated venues. The proposal is on the SEC’s docket now.

Pros and cons (keep it real)

Upsides

- Lower fees than most mutual funds; tax-efficient in-kind redemptions.

- Instant diversification—in one trade you can own 500 stocks, or a basket of Treasuries.

- Liquidity at the wrapper level (you can enter/exit throughout the day).

Watch-outs

- Crowding & overlap: many funds own the same megacaps; two “different” ETFs can be 90% the same.

- Liquidity mirage: ETF trading can look deep even when the underlying is illiquid (long bonds, small caps, frontier markets). Discounts/premiums can appear in stress.

- Product proliferation: record launches mean record closures too; niche products can disappear or underperform once the fad fades.

What this means for you

- Start with the core. Broad, low-cost index ETFs (total market, S&P 500, aggregate bond) remain the most reliable building blocks.

- Read the recipe, not just the label. Check the holdings and index method, not just the name—two “AI ETFs” can be totally different. (Fund sites show top holdings and sector weights.)

- Mind costs & spreads. Expense ratios and average bid/ask spreads both eat returns; bigger, older funds often win here.

- Don’t confuse trading with investing. The ease of tapping ETFs intraday is a feature—but it can tempt overtrading.

- If you venture into actives/thematics/crypto, size positions modestly and know the specific risks (manager risk, factor tilts, premium/discount behavior, regulatory risk for crypto).

ETFs have quietly rewired how markets work—to the point there are now more ETFs than stocks. For investors, that’s mostly a win: lower costs, cleaner access, and flexible building blocks. The trade-off is complexity. With thousands of look-alike tickers and ever-narrower themes, the edge now comes from good selection and discipline, not just choosing “an ETF.” Keep your core simple, kick the tires on anything flashy, and you’ll harness the ETF era without getting lost in it.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

The Big Question: Are Crypto ETFs About to Explode?

ETF Boom or Bubble? US Now Has More ETFs Than Stocks as Retail Piles In

Bitcoin ETFs Surge on Trump Election Prospects, Market Braces for Volatility