Every handshake, every clash between Trump and Zelensky in 2025 shook the markets. Defense stocks soared, energy whipsawed, and investors learned one clear rule: war premium trades live and die on headlines.

Here’s a full breakdown of what happened before, during, and after each meeting, and what today’s summit could mean for your portfolio.

February: The Oval Office Showdown

he year’s first Zelensky–Trump sit-down ended in chaos. Instead of a peace roadmap, the world got a public shouting match.

- Before the meeting: Markets sniffed peace. Russian equities rallied +30% since December, European gas prices eased, and oil cooled near $75.

- During the clash: Headlines hit, and panic set in. Euro futures –1.4% intraday, Treasuries caught a bid, and the euro sank to a 2-week low.

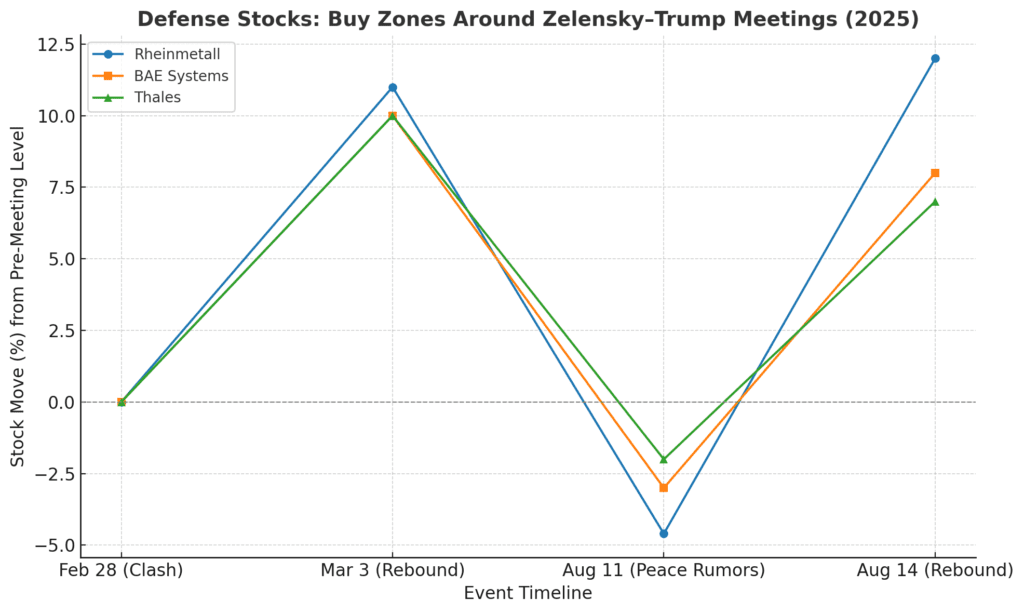

- After the dust settled: Wall Street staged a whiplash rally. The S&P 500 closed +1.6% as traders bought the dip, while European defense stocks exploded higher in the days after: Rheinmetall +11%, BAE +10%.

Takeaway: Markets learned fast: no peace = buy defense, brace for higher energy costs.

August: The Alaska Rollercoaster

Fast forward to August, and Trump’s summit with Putin in Alaska teased the possibility of a breakthrough. Markets priced in peace — and defense names cracked. Rheinmetall tumbled nearly 5%, Renk fell 3%, Hensoldt 1.3%.

But the optimism didn’t last. The talks ended with vague promises, no ceasefire, and Trump insisting on a “rapid” deal largely on his terms. Markets snapped back. By August 14, the STOXX 600 closed at a two-month high, driven by a 2.2% surge in aerospace and defense stocks.

Oil told a different story. Brent crude slid to $65.8 per barrel, down 1% for the week, as Trump signaled he wouldn’t punish China for buying Russian oil. Analysts at Bank of America warned crude was already “priced for a peace deal.” And if Trump really struck an Arctic drilling pact with Putin — unlocking an estimated 15% of the world’s undiscovered oil and 30% of its untapped gas — oil could plunge into a bear market.

Takeaway: Defence dips on peace rumours are buying opportunities. Energy, meanwhile, trades on Trump’s political calculus more than battlefield news.

Defense: The Win-Win Sector

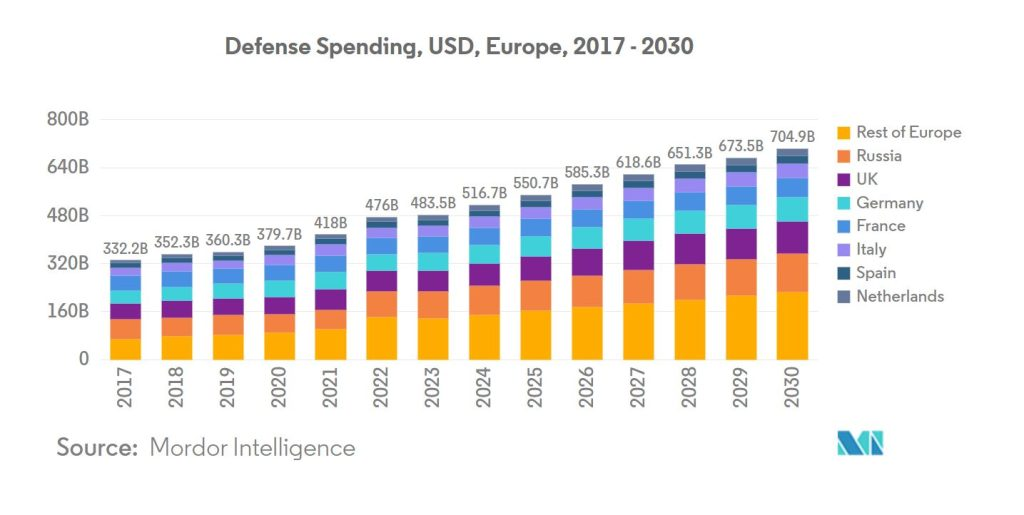

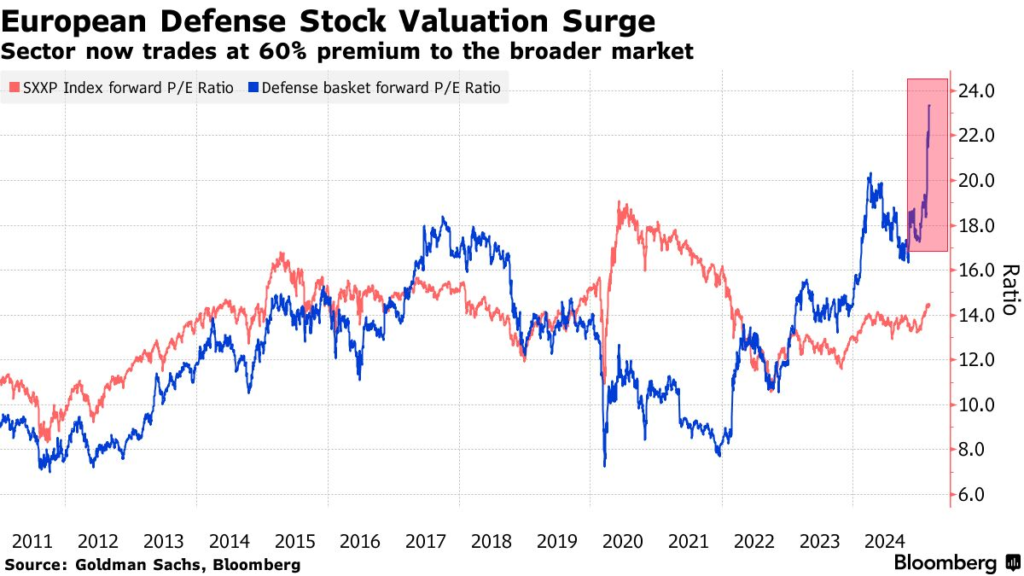

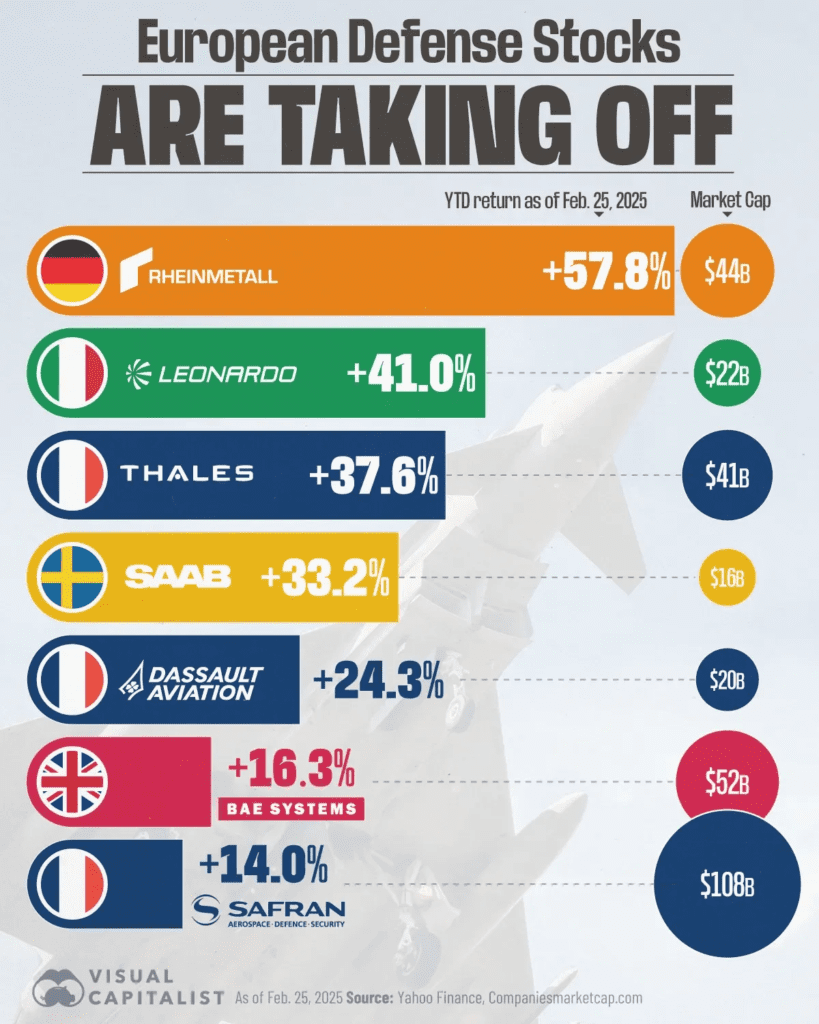

The pattern is clear: defense sells off on peace whispers, then rallies hard when talks collapse. European names dominate the field: Rheinmetall up 1,500% since 2022, Leonardo +600%, BAE Systems at record highs. U.S. contractors like Lockheed and Raytheon have lagged, cushioned by Pentagon budgets but missing Europe’s “rearmament supercycle.”

Analysts call it a “win-win trade.” If the war drags on, demand soars. If peace comes, Europe still needs to rearm. As one strategist put it: “Buy European defense stocks on any weakness. Peace or war, they win.”

For investors, the best entry point has been during pre-summit peace rumors, when stocks like Rheinmetall or BAE dip 3–5%. Those moments, like August 11, have turned out to be the golden buy-the-dip opportunities.

Energy: War Premium vs. Trump’s Oil Politics

Energy’s story is more complicated. When peace hopes evaporated in February, gas prices spiked 4% and oil steadied higher. But in August, oil slipped despite the lack of a ceasefire, as Trump signaled no new sanctions.

Here’s the catch: a peace deal is bearish for oil. Sanctions could be eased, Arctic drilling unlocked, and Russian flows return — flooding supply. That’s why European energy equities have been sluggish recently.

On the other hand, if today’s meeting collapses, traders may pile back into oil and gas. But Trump’s obsession with cheap fuel keeps a cap on prices — meaning energy’s upside looks more limited than defense’s.

US vs. Europe: Who Feels It More?

- Wall Street shrugs. The February clash saw U.S. indices close higher despite the chaos, with Big Tech powering ahead. The war is just one variable among many — Fed policy, AI earnings, and tariffs often matter more.

- Europe lives it. The DAX dipped 0.4% on August 11 when peace looked possible, then the STOXX 600 surged after defense rebounded. The euro, too, swings with sentiment: $1.03 after the Oval Office spat, $1.17 by mid-August as Europe showed unity.

What to Watch Today

If ceasefire breakthrough:

- Defense: sharp correction, Rheinmetall/BAE –5–10% in days.

- Energy: Brent slips to $62–64, oil majors drift lower.

- Europe: rally in banks, industrials, utilities.

- FX: euro strengthens, bonds sell off on optimism.

If talks collapse:

- Defense: another leg up, Rheinmetall/BAE +5–8%.

- Energy: Brent firms to $68–70, Shell/Exxon tick higher.

- Europe: volatility, but defense cushions indexes.

- U.S.: likely shrugs again; S&P steadies.

If middle ground:

- Range-bound. Defense choppy but supported, energy flat near $66, indices sideways until the next headline.

The Investor Playbook

- Defense = buy dips. Every peace rumor has been the entry point of the year.

- Energy = capped upside. Trump’s oil politics suppress big rallies; real risk is a peace-driven crash.

- Indices = divergence. S&P trades on Fed cuts; STOXX trades on war headlines.

- Defense dips of 3–5% tied to peace rumors have consistently flipped into 6–12% rallies once talks collapse.

- European names outperform U.S. peers — Rheinmetall, BAE, Leonardo are the prime targets.

- Best strategy: Buy during pre-summit optimism or on headlines suggesting a ceasefire. Sell partial positions after the rebound when reality resets.

2025 has taught investors one thing: Zelensky–Trump meetings are volatility machines. Defense stocks remain the surest “win-win” trade, while energy walks a knife edge. Today, whether it ends in handshakes or hostility, the market will react — and for defense bulls, every dip still looks like a gift.

Actionable Insight: If today’s Zelensky–Trump meeting produces even a hint of peace, watch for a short-term correction in defense stocks. That dip could again be the buy zone — just as Feb 28 and Aug 11 proved.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Main sources:

CNBC: Trump-Putin talks a ‘win-win’ for European defense stocks

CNBC: European defense giants could be about to get another big push higher