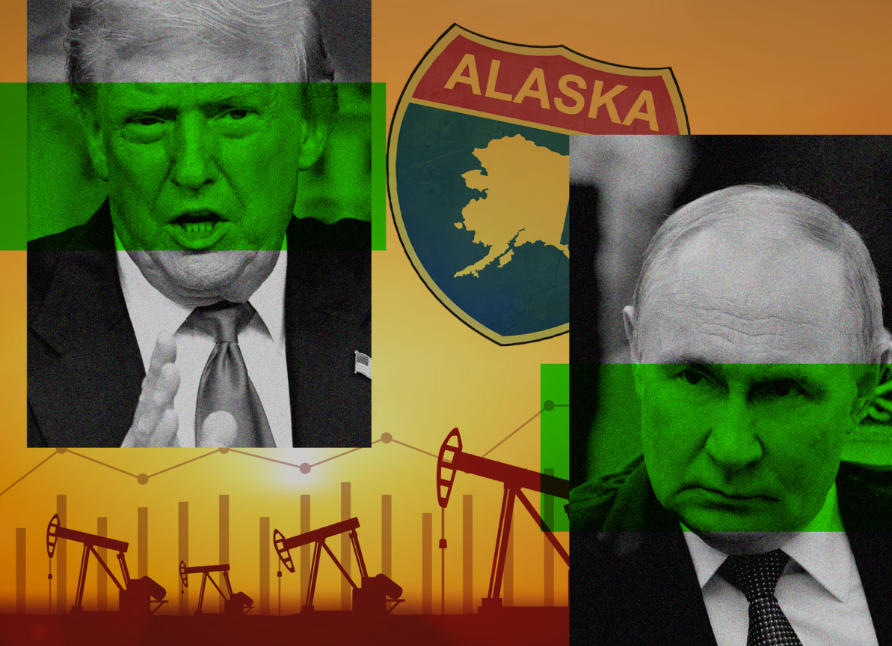

The global oil markets are showing renewed weakness following the high-profile Trump–Putin summit in Alaska, as the absence of fresh sanctions on Russian energy supplies signals continued stability in flows, and consequently, downward pressure on prices.

Related: Trump–Putin Alaska Summit: What Really Happened

Oil Reaction: A Temporary Dip—and Then Stagnation

Brent crude futures closed Friday at $65.85 a barrel, while U.S. West Texas Intermediate settled at $62.80—each down roughly $1 in anticipation of the summit. Market participants are bracing for a muted reaction when trading resumes, with analysts expecting prices to hover within a tight band unless new developments emerge.

ICIS analyst Ajay Parmar noted that “Russian oil will continue to flow undisturbed,” a factor inherently bearish for prices. However, he added that the likely impact is marginal—limited to a mild short-term dip unless accompanied by stronger catalysts.

UBS analyst Giovanni Staunovo underscored that, for now, risks related to disruptions in Russian supply remain well-contained.

Phil Flynn of Price Futures Group echoed this outlook, suggesting that without substantive breakthroughs from the summit, oil prices are poised to remain range-bound.

Summit Outcome: Symbolic Gains, No Concrete Deal

Despite the fanfare, the August 15 summit yielded no formal agreements. President Trump refrained from implementing new tariffs on China or India for their continued purchases of Russian oil, effectively assuring a continuation of flows.

The summit raised hopes but delivered few results—the meeting was largely symbolic. Analysts described it as more of a stepping stone toward future diplomacy, with no immediate market-moving impact.

Putin’s Overture: Conditional Peace Amidst Pushback

Details emerging from Moscow outline a controversial peace proposal: Russia would withdraw from select occupied areas, while Ukraine would relinquish control over Donetsk and Luhansk in exchange for a freeze elsewhere. Ukraine immediately rejected this offer.

European and U.S. voices criticized the optics of the summit. Putin gained diplomatic traction without making meaningful concessions, while Trump attracted scrutiny for echoing Russia’s framing of peace.

Experts warn that the summit has granted Putin—already pursued by the International Criminal Court—renewed legitimacy on the world stage, while sidelining Ukraine and European partners.

Market Context: Oversupply Meets Geopolitical Uncertainty

The modest oil price drop follows acknowledged oversupply signals. Earlier in the week, bearish supply forecasts from the U.S. Energy Information Administration and the International Energy Agency, coupled with a glut outlook, drove Brent to two-month lows around $65.63, with U.S. crude dipping below $62.

Outlook: Waiting for Washington Summit and Market Relief

Markets are now looking ahead to Monday’s gathering in Washington, where Trump is expected to meet Ukrainian President Zelenskiy. The outcome—and potential involvement of European leaders—could serve as the next spark for market movement.

Analysts like those at UBS and Price Futures Group caution that unless there’s substantial movement toward a peace framework or a shift in sanctions policy, oil price momentum will remain subdued.

Summary Table: Key Developments & Market Impacts

| Factor | Key Insight |

|---|---|

| Peace vs. Ceasefire | Shift toward “full peace” favored—not an immediate halt—aligns closer with Putin’s narrative. |

| Russian Oil Flow | No sanctions on buyers; energy flows likely uninterrupted—bearish signal. |

| Short-Term Market Reaction | Slight dip expected; more significant moves await future summit outcomes. |

| Geopolitical Positioning | Putin garners prestige; Ukraine and Europe feel sidelined. |

| Market Drivers | Supply gluts, weak demand signals, and dovish policy tone weigh on prices. |

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.