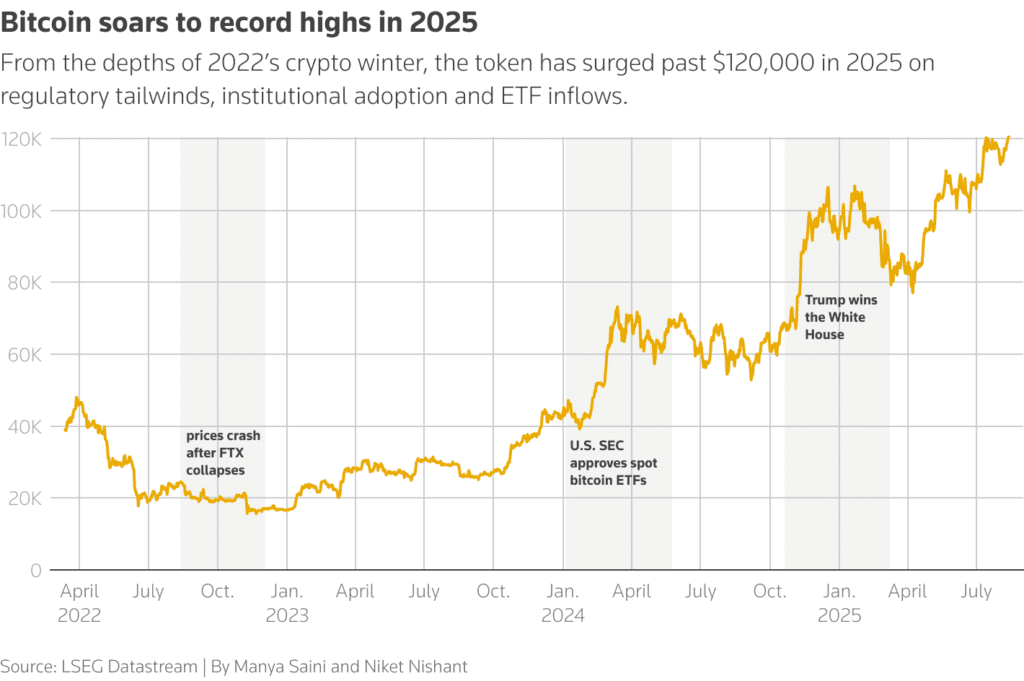

Global markets are riding a wave of rate cut optimism, with Wall Street’s momentum spilling into Asia and Europe. The S&P 500 and Nasdaq closed at fresh record highs for the second consecutive session, and the Dow is now just ~100 points away from its December 2024 all-time high. Bitcoin joined the risk-on rally, smashing past $124,000 for a new record, while the dollar slid to a two-week low as Treasury Secretary Scott Bessent called for up to 150 basis points of Fed rate cuts in September.

Market Sentiment

- Risk-on tone dominates: Investors are piling into equities, crypto, and commodities as September rate cut bets grow. Fed funds futures price in a near-certainty of a cut, with a 7% probability of an aggressive 50 bps move (up from 0% a week ago).

- Futures ease ahead of data: S&P 500 futures -0.17%, Nasdaq 100 -0.19%, Dow futures -0.12% after Wednesday’s rally (+0.32% S&P, +0.14% Nasdaq, +1.04% Dow).

- Dollar weakens, gold holds gains: The dollar is at a two-week low; gold trades near $3,370/oz for a third straight daily gain as lower yields and easing bets lift demand.

- Crypto surge: Bitcoin up 32% YTD, Ether up 41%, both approaching or hitting record highs. Institutional inflows and Trump-era crypto-friendly sentiment fuel the rally.

- Asia & Europe: Asia ex-Japan equities hover near 2021 highs. Japanese yen rallies to a 3-week high after Bessent says BoJ is behind on inflation. UK GDP surprised at +0.3% in Q2, beating 0.1% expectations.

Key Drivers & Events

- Bessent’s Rate-Cut Call — Urging the Fed to slash rates by 150 bps in September, citing slower jobs growth and the need to ease financial conditions. Goldman Sachs sees three 25-bp cuts this year and two more in 2026.

- Fed Voices Split — Chicago Fed’s Goolsbee and Atlanta Fed’s Bostic urged patience, pointing to tariff-driven inflation uncertainty and still-strong labor markets.

- Trump & Powell Watch — Trump says Powell’s replacement shortlist is down to “three or four” names, possibly announced early. Bessent is leading the search.

- Geopolitical Risk — Trump warns “severe consequences” if Putin refuses peace in Ukraine ahead of Friday’s summit, but says talks with Zelenskiy could follow. Oil remains near 2-month lows.

- IPO Heat — Peter Thiel-backed crypto exchange Bullish debuted at $37, opened at $90 (+143%), and closed at $68 (+84%). Shares gained another 12% in after-hours trading. (Bullish IPO raises $1.1B in oversubscribed debut at $5.4B valuation)

- Gold Miners Rebound — UBS says gold mining stocks are “starting to rebuild investor confidence,” noting balance sheet strength, higher buyback potential, and possible M&A activity. The VanEck Gold Miners ETF is up 40% YTD, outperforming gold by a wide margin.

Market Impact Watch

- Soft data (higher claims, lower PPI) could reinforce dovish bets, weaken the dollar further, and lift gold/crypto.

- Stronger data might challenge aggressive cut expectations, but markets may still lean bullish given momentum and positioning.

- Earnings from AMAT will be key for the semiconductor sector sentiment.

- Fed balance sheet changes will be watched for signs of liquidity shifts.

| Time (US ET) | Event Type | Details |

|---|---|---|

| 8:30 AM | Economic Data | Initial Jobless Claims, Producer Price Index (PPI) |

| Pre-Market | Earnings | JD.com ($JD), 22nd Century Group ($XXII), Canaan ($CAN), First Majestic Silver ($AG) |

| 4:30 PM | Economic Data | Fed’s Balance Sheet Update |

| After Hours | Earnings | Bionano Genomics ($BNGO), Cineverse ($CNVS), Co-Diagnostics ($CODX), Applied Materials ($AMAT), Comstock ($LODE) |

Markets are in full “bad news is good news” mode. Rate cut hopes, a weaker dollar, and record highs in both equities and crypto paint a risk-on picture. But tariff-driven inflation uncertainty and split Fed commentary suggest September’s meeting could be contentious. Today’s PPI and jobless claims will be the first real test of whether the rally’s footing is data-proof or data-dependent.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.